How Golf is Evolving to Win New Fans and Revenues

Traditional sports such as golf are facing a dilemma of sustainability. Shifts in sports consumption, increased competition with the rise of challenger sports, and a younger fan demographic that is more likely to pick gaming over golfing and TikTok over television, reinforce the business case for adopting a new attitude by the sports’ organising bodies. Guaranteeing future relevance in a highly saturated media landscape that continues to fragment is easier said than done, but there are underlying strategic pillars that are being adhered to by golf’s governing bodies.

Driving athlete engagement

Over 2003-2020, the average age of a top 10 PGA Tour golfer dropped by almost eight years. As a result, the most highly ranked professionals tend to be younger, more tech-savvy and often fluent using social media. Rory McIlroy was the only 2021 Ryder Cup player with more than five million fans in total across social media platforms. The PGA Tour has formally recognised how important this attention is, creating the Player Impact Program, a system designed to compensate players that produce the most engagement from fans and sponsors, which sees 10 players set to share a USD40 million bonus pool each year. While this program is still in its infancy, initial signs show that there is increased engagement on the part of many players.

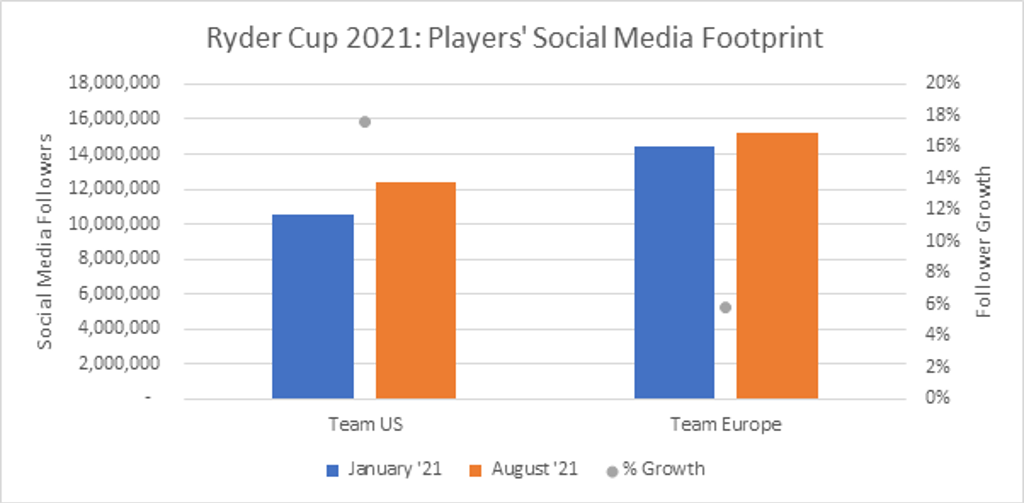

Players on the US Ryder Cup team collectively grew their social media following by 18% in the first eight months of 2021. Their European counterparts managed growth of just 6%, albeit from a larger base. However, it’s worth noting that the US team is relatively young, with an average age of 29.1 years compared to the European team which was comprised of more veterans and had an average age of 34.6 years.

Diversifying commercial revenues

Golf still relies heavily on finance and insurance when it comes to sponsorship, accounting for over 10% of golf sponsorship deals across top tours including the PGA, LPGA, European, Japan and Asian. Other categories that play a major role in golf sponsorship are luxury timepieces and cars, and while these categories undoubtedly contribute the bulk of essential sponsorship revenue, there is now space to build partnerships that target younger fans online, especially those that follow top golfers on social media. Activity is growing in emerging categories such as CBD products, energy drinks and consumer electronics brands. Golf apparel is another area rapidly changing, with a host of challenger brands including Eastside Golf, Vice Golf and hip-hop star Macklemore’s Bogey Boys all pulling golf fashion from the conservative fringes of sports and entertainment to the progressive main. From CBD to fashion, these categories represent a welcome opportunity to bolster commercial revenues following the pandemic.

In 2019 the European Tour announced a brand refresh that will broaden the appeal of the game and grow B2C revenues in parallel, further illustration that a proactive approach to sponsorship is warranted to maximise commercial revenues.

Will these strategies be enough to guarantee future success?

The US Golf Association has major tournaments already scheduled up to 2050, by which time sports will be radically different. For instance, esports will likely have been featuring within the Olympics for over two decades by that point. Any embers of debate as to whether esports should sit alongside what we today call ‘traditional’ sports will have long died out. These long-term schedules in golf encourage governing bodies to think about the big challenges facing golf in the fast-approaching future, such as growing participation at amateur levels and understanding shifts in consumption across younger generations. The key will be to translate this knowledge into insights that can drive short to medium term sponsorship revenues without losing sight of the mission of setting golf on a more sustainable long-term course.