This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

The success of professional sports properties hinge on the exposure they generate, i.e. the number of fans that attend events, watch them live on TV, or engage online. The disruption caused by Coronavirus (COVID-19) has resulted in a halt in live attendance, with an estimated nearly 40 million missing attendees globally a month. Broadcasting viewership and sponsorship revenues will also be impacted, with growing uncertainty for commercial partners that are heavily reliant on sports marketing to reach fans and consumers across the globe.

Looking at monthly matchday analysis, which takes into account average attendance and ticket prices, total ticket spend and volume of events, the estimated monthly impact on fan attendance across the most popular leagues worldwide differs greatly across different sports and geographical regions. Leagues that present a high density of events monthly will suffer the highest impact; leagues that present a high average ticket price are instead those expected to carry the highest ticket spend loss, even more so for those leagues that present a combination of the two factors.

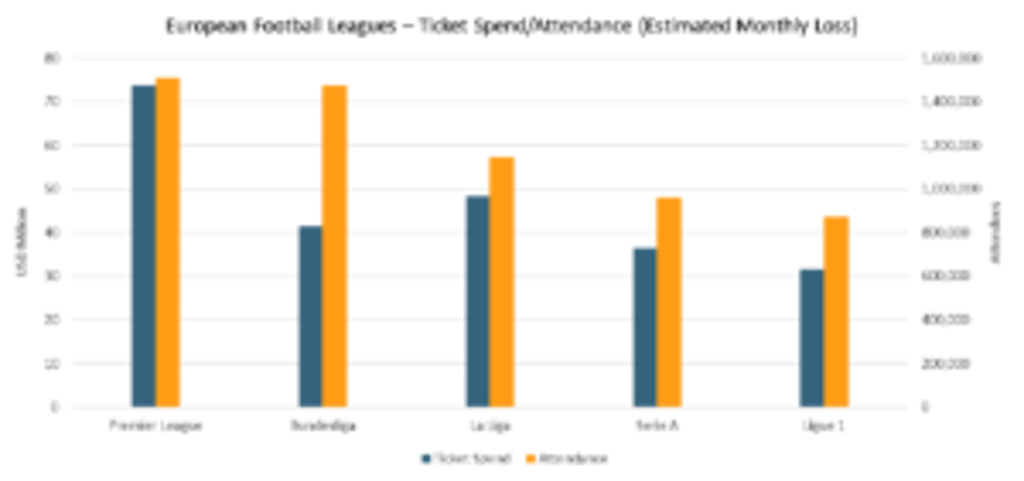

Premier League expected to incur most significant losses in Europe from COVID-19 outbreak

Among top European Football leagues, the Premier League is expected to incur the most significant losses, both due to usual high attendances and relatively costly tickets. The estimated number of fans that attend the UK’s top football competition monthly is over 1.4 million people, resulting in overall ticket revenue of over USD70 million a month. Bundesliga differs slightly. While its attendances are very similar to those of the Premier League, clubs charge less for match tickets, in order to protect local fanbases, resulting in lower ticket revenue losses, approximately USD40 million a month.

European Football Leagues: Ticket Spend/Attendance (Estimated 2020 Monthly Loss, based on 2015-2019 data)

Source: Euromonitor International

Major League Baseball will be hit hardest in North America

In North America, Major League Baseball (MLB) is set to face the greatest monthly impact overall, considering the higher number of matches played monthly (on average 397 games), as well as the impressive average attendance that the average MLB game enjoys. One month of halted events translates to a loss of 10.2 million attendees and over USD335 million in ticket spend loss.

The National Football League is expected to face a similar loss in ticketing spend, almost USD345 million a month, but with far fewer games per month (on average 64), it faces a much lower attendance loss, at just above 3.6 million people monthly.

North American Leagues: Ticket Spend/Attendance (Estimated 2020 Monthly Loss, based on 2015-2019 data)

Source: Euromonitor International

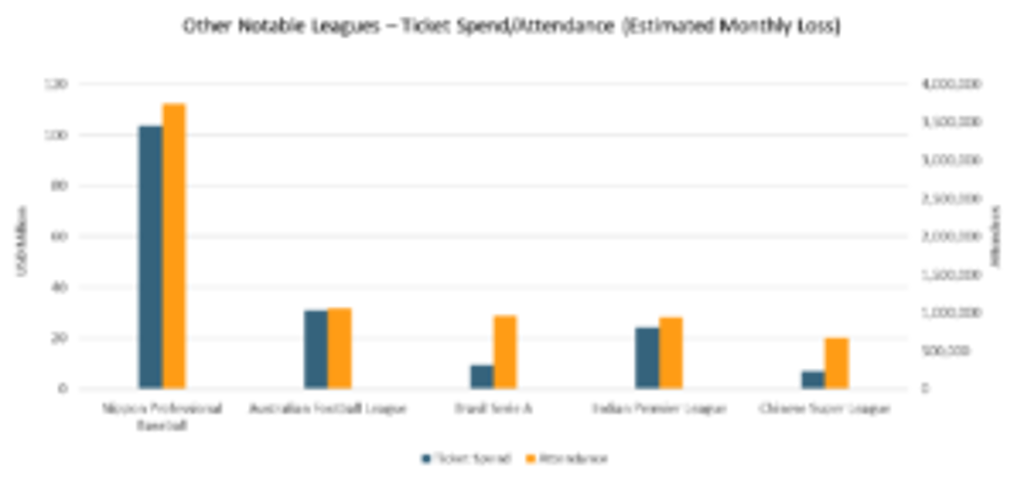

Nippon Professional Baseball set to lose out the most within Asia Pacific

In Asia Pacific, Japan’s top Baseball League, Nippon Professional Baseball, is set to incur by far the highest losses of all leagues in the region, owing to a dense schedule that results in a high number of games being cancelled monthly. The estimated attendance loss is above 3.7 million, with a ticketing loss of over USD100 million a month. In the country where the COVID-19 outbreak originated meanwhile, the Chinese Super League kick-off, originally planned for 22 February, has been postponed until 18 April at least, with an estimated monthly attendance loss of 500,000.

Other Notable Leagues: Ticket Spend/Attendance (Estimated 2020 Monthly Loss, based on 2015-2019 data)

Source: Euromonitor International

E-sports is the most efficient way to keep fans engaged during the lockdown

As clubs and leagues are not on the pitch, commercial partners can no longer rely on the much-needed media exposure from sponsorship deals with events, leagues, teams and athletes. When the pandemic emergency ends, a transition period of broadcast-only will be needed before it will be possible to see fans crowding stadia and arenas. All the involved stakeholders need therefore to focus on other marketing channels to keep the industry going before it will be deemed safe for sports to resume as normal.

Arguably, the most efficient way to keep fans engaged is the digital sphere, in particular e-sports events and competitions. While these are not a novelty, the outbreak has boosted their relevance and following, accelerating their debut on the linear broadcast. E-sports events that were usually streamed exclusively online, on platforms like Twitch, YouTube, and Facebook, are now, in fact, broadcasted also on linear TV channels. Some of these e-events include La Liga Santander Challenge, Formula 1 Virtual Grand Prix Series, and eNASCAR iRacing Series.

The combined linear and digital broadcasting of e-sports is important to reach a wider audience and keep fans engaged while real events are postponed. However, it is crucial for sponsorship reasons: thanks to the unprecedented level of detail that videogames can now cover, official sports videogames feature the official sponsors listed by the organiser and teams involved.

Though the level of brand exposure achieved cannot yet be compared to real-life sports events, in times of unprecedented disruption, it represents an unmatched way for sponsors to keep potential consumers aware of their product/service. When sports events resume, sports properties that have invested in e-sports will be able to leverage this sector’s boom with partners, and possibly include virtual attention in the assets they can offer to investors.