Since the onset of the COVID-19 pandemic in March 2020, snacks has been the most affected within the packaged food industry. Greater health concerns, coupled with a drastically reduced number of impulse purchase occasions, have been major factors behind the slowdown in the growth of snacks in value terms. Confectionery has undoubtedly been the category most exposed to these new circumstances, but not all has been negative, as savoury snacks came out of 2021 even stronger, as the top snacks category. Going forward, there are six trends that will further shape the industry: the rise of special diets; sugar reduction; hometainment; digitalisation; sustainability; and plant-based eating.

Health as a priority: Special diets and sugar reduction

The importance of food as medicine and preventative health has benefited functional food, with consumers seeking to boost their immune system, and eager to actively manage their physical as well as mental wellbeing. On the other hand, as consumers’ mobility has greatly reduced along with COVID-19 containment measures and home seclusion, weight management has risen once again as a concern. Lifestyle diets such as keto, paleo and low-carb are thriving in this context.

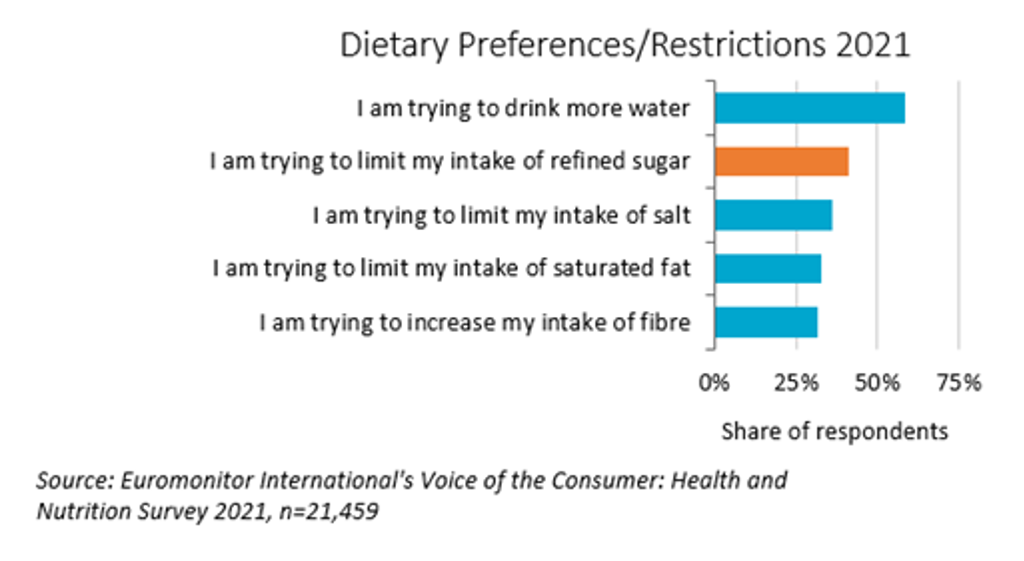

In addition, consumers are limiting the intake of sugar to feel healthier, lose weight, and due to medical recommendation from their doctor. Limiting the intake of refined sugar was the second most widespread dietary preference/restriction amongst consumers in 2021, according to Euromonitor International’s Voice of the Consumer: Health and Nutrition Survey. Companies have been responding with new products and the addition of “no sugar” claims. Governments are also pushing this trend, worried by high obesity rates across the world.

Entertaining and shopping at home: Hometainment and digitalisation

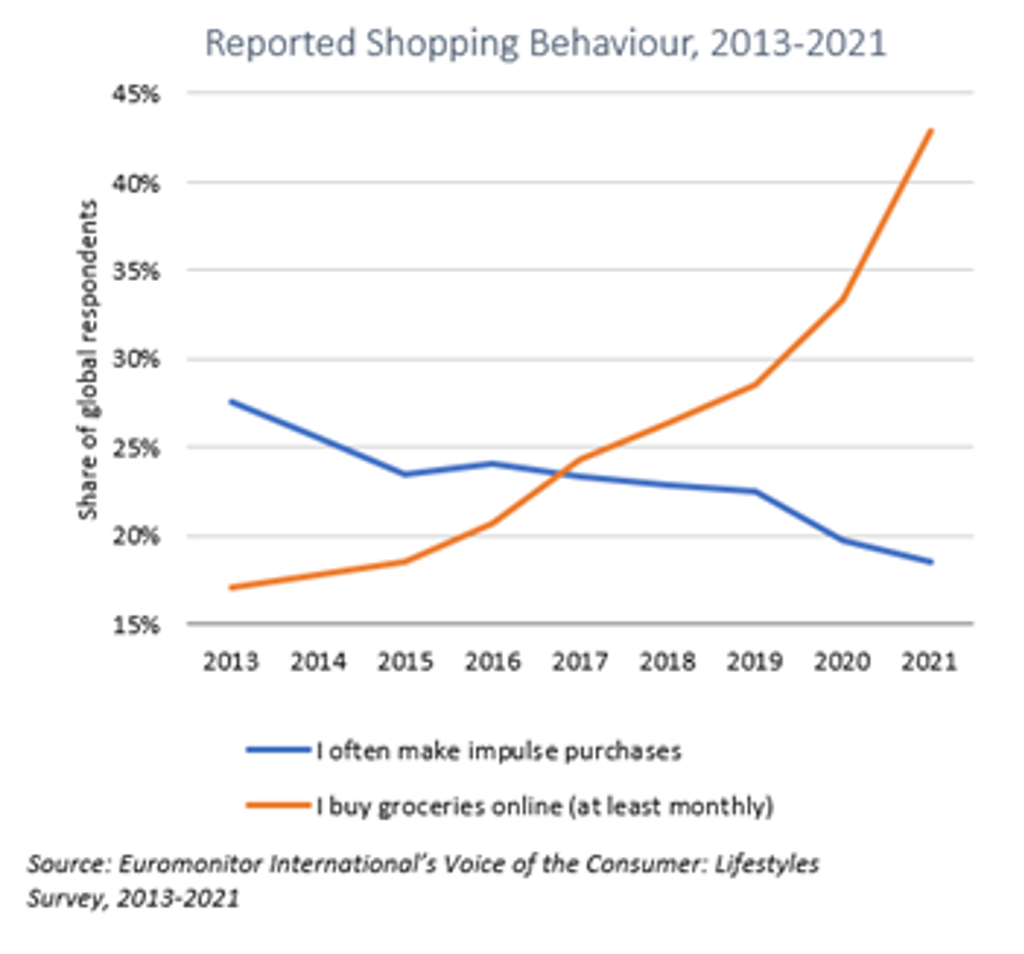

Snacks consumption is shifting from out-of-home impulse to at-home indulgence. Lockdown conditions and work-from-home policies have given consumers more time at home, increasing the amount of time spent watching TV and streaming services, and playing video games. Opportunities have arisen for snacks companies that offer products for occasions of content consumption and gaming. For example, with families and friends increasingly snacking while they entertain at home, products for sharing are gaining traction.

The growth of e-commerce has been one of the biggest consequences of the pandemic. Snacks companies are embracing the new digital ecosystem not only to increase sales, but also to understand and engage with consumers. This has translated into the launch of direct-to-consumer websites, livestreaming events, and the use of social media to connect with consumers. In particular, TikTok showed the highest growth during the last year: while 24% of consumers were active monthly users in 2020, this rate reached 34% in 2021, according to Euromonitor International’s Voice of the Consumer: Digital Survey.

Snacks going green: Sustainability and plant-based eating

Although reducing their impact on the environment is still a top priority for consumers and snacks companies, the pandemic has shifted attention to corporate responses focused on social action, including support for the vulnerable, for local farmers and communities, employees, suppliers, and other business partners. Initiatives from major snack companies include the development of sustainable ingredients, the reduction of waste in packaging, tackling climate change, and in general making a positive impact on the planet and its inhabitants.

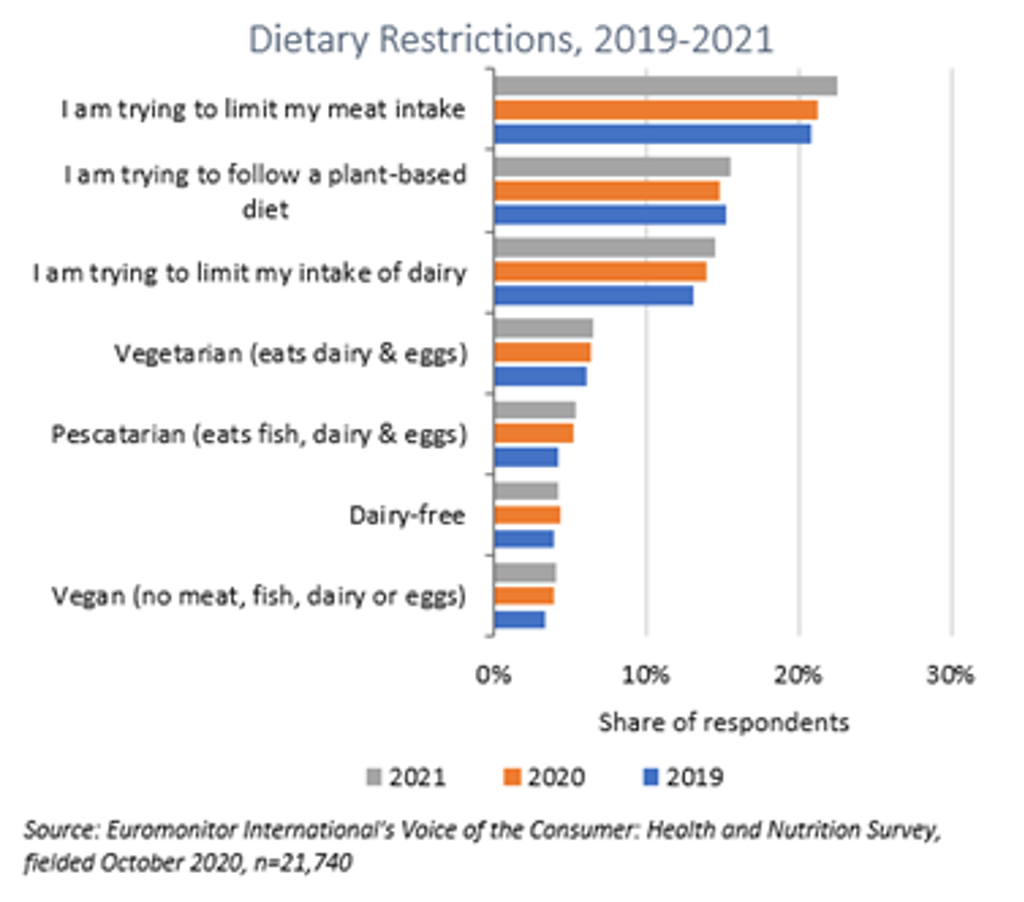

On the other hand, the expansion of plant-based products is one of the most significant current trends in the food industry, propelled by health, the environment, and animal welfare. This wave has further penetrated snacks, with the appearance of many new products beyond ice cream, within chocolate confectionery and snack bars. While the number of vegan and vegetarian consumers is small worldwide, the number of people who are trying to limit their consumption of animal products is much more significant, according to Euromonitor International’s Voice of the Consumer: Health and Nutrition Survey.

Higher growth expected, boosted by innovation

Over the forecast period (2022-2026), value sales of snacks are expected to show higher growth rates overall than in 2020 and 2021, with savoury snacks projected to see the highest CAGR. Confectionery is set to see the lowest CAGR, still affected by trends such as widely adopted work-from-home policies, which will limit impulse consumption and affect breath-related categories such as gum, mints and medicated confectionery. Innovation will be key for recovery. Potential actions in this regard include the implementation of sustainable packaging, functional benefits, emotional attributes such as nostalgia, and the launch of products for specific consumers, such as gamers.

Further insights on these trends are included in our briefing World Market for Snacks