Part of this article first appeared in the Korean business magazine, Chosun Economy, on 1 June 2022, in an interview with Lan Ha on global food prices.

The prices of food commodities are rising, hitting economies, manufacturers and consumers worldwide. Food inflationary pressures are likely to remain high in 2022 and beyond, as some pandemic-induced supply bottlenecks remain, while Russia’s invasion of Ukraine added a major supply shock and a wave of export restrictions emerged. Furthermore, climate change impacts will continue to threaten agricultural yields and food security.

COVID-19 pandemic and war in Ukraine are major factors driving up global food prices

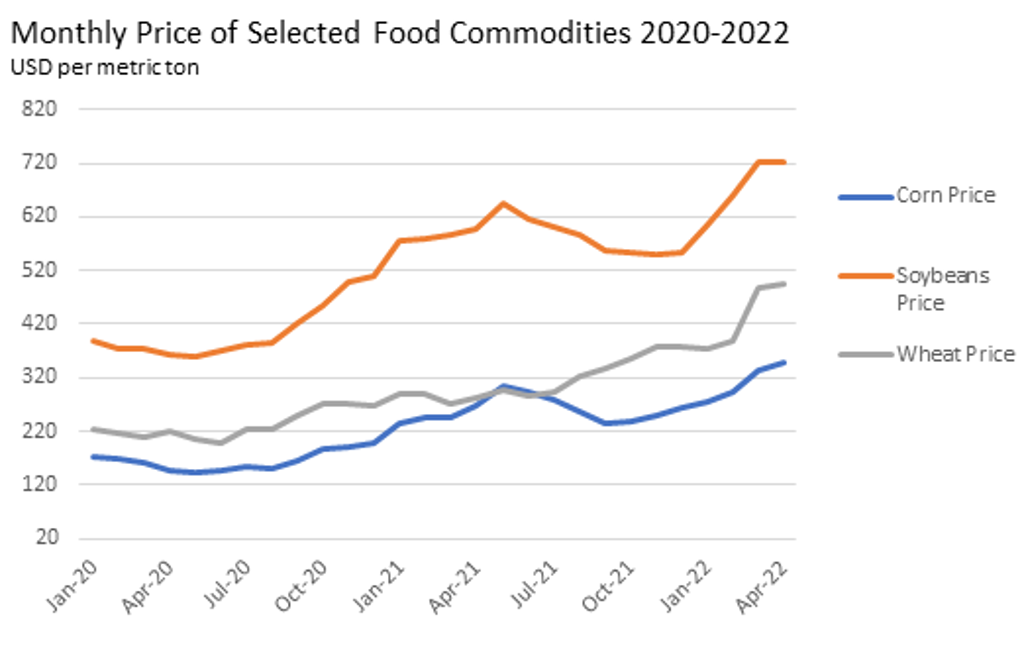

The global increase in food commodity prices had already started during the global COVID-19 pandemic in 2020-2021. In 2021, the global wheat price (in USD per metric ton) increased by 36.1% over the previous year. This was driven by growing demand for home consumption, coupled with supply chain bottlenecks, including labour shortages, factory closures, port congestion, and higher transportation prices that occurred during the pandemic, leading to higher input costs for food producers.

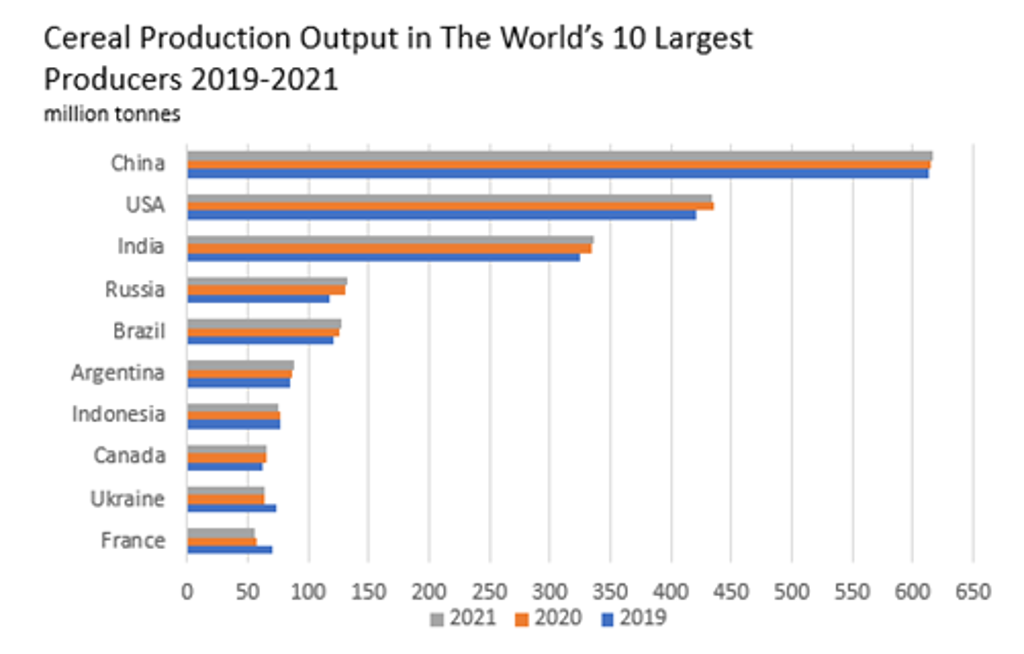

The war in Ukraine since February 2022 has caused another big shock by further disrupting the global supply of food, given the role of both Russia and Ukraine as major global wheat producers, accelerating pressures on food prices. In 2021, the two countries provided 14.7% of the world’s total wheat production. Following Russia’s invasion of Ukraine, the global wheat price jumped by 12.5% in March 2022 compared with February 2022. The overall global food index (2010=100) hit a record level of 159 in April 2022, significantly up from 141 in February 2022.

Extreme weather conditions and trade protectionism add further pressure

While the pandemic and Russia’s invasion of Ukraine have been the major factors inflating global food prices, bad weather conditions and export restrictions are also contributing to higher price pressure globally. The current dry and hot weather in France and India, and recent droughts in the US and Canada, have raised concerns about lower crop outputs in these major grain-producing countries. In 2021, several bad weather events (eg, heatwaves in the US and flooding in Australia) already affected production and grain supply in some parts of the world. Global cereal output increased by only 0.3% in 2021, compared with the above 1.0% growth levels seen during 2019-2020. Global cereal output, particularly of wheat, could drop in 2022, which, combined with the expected decline in output in Ukraine and a shortage of fertiliser, threaten global food security, pushing food inflation higher. Climate change impacts will continue to challenge agricultural yields, making it a long-term driver of food price inflation.

The rise of agricultural protectionism is another factor that could fuel food price inflation further, as some exporters curb overseas crop sales to ensure local supplies. Indonesia's ban on exports of palm oil – a key ingredient used in many food as well as non-food products – in April 2022 triggered uncertainty and heightened price pressures in the global market. The ban was fortunately lifted a few weeks after, as local prices were stabilised. In May 2022, India announced an export ban on wheat, as the country’s wheat crop was heavily affected by a recent heatwave. As geopolitical risks are rising and bad weather events are undermining agricultural output, food protectionism may rise further in 2022.

Food-importing economies and consumers in lower-income countries to be hit the hardest

Countries that are dependent on food imports, particularly those in the Middle East and Africa region, will be hit hard by the global rise in food prices, as they will face skyrocketing import bills and the risk of food shortages. Egypt is one example: food imports accounted for more than one fifth of Egypt’s total goods imports in 2021. As the country relies heavily on imports, consumers in Egypt are highly vulnerable to fluctuations in the global food market.

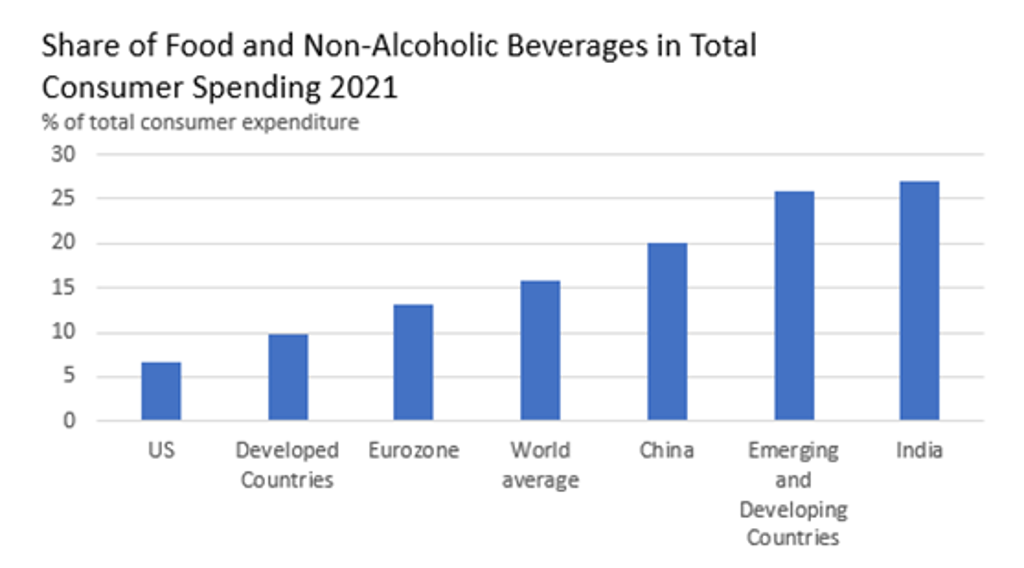

Consumers in developing countries will be more affected by rising food prices compared with their counterparts in developed nations. This is mainly because most consumers in lower-income countries must allocate a larger share of their spending to necessities, including food. For example, food and non-alcoholic beverages made up on average 27.8% of the total spending of Indian consumers in 2021, compared with 6.7% in the US and 12.1% in South Korea. However, consumers in wealthy economies are not immune to food price increases either, and may cut back their spending amidst a cost of living crisis.

Given the various short- and long-term factors, global food commodity prices are expected to stay elevated in 2022-2023 and beyond. This will continue to push up input costs for businesses in food-related sectors, including packaged food, groceries, as well as foodservice, requiring them to adapt. Businesses will also need to keep track of consumers’ changing spending and shopping behaviour, as they are increasingly feeling the squeeze of higher grocery bills.

Read our article, What is Driving Global Inflation? for more analysis on the drivers of global inflation, and listen to our webinar, Inflation at Breakfast: Tracking Inflation from a Variety of Perspectives.