If 2019 was deemed "White Claw Summer" in the United States, what does that mean for summer 2020?

Perhaps no drink had quite the impact in the U.S. in 2019 as White Claw, an alcoholic seltzer which exploded in sales and became a national topic of conversation last summer. Sales skyrocketed so high that production struggled to meet demands, thus forcing White Claw to declare a nationwide shortage of the product.

This success, though, has failed to convince the numerous seltzer sceptics that remain. They look at the success of White Claw and its competitors and see nothing more than the most modern version of similar beer challengers like hard sodas and Zima, which enjoyed brief moments of prominence and then quickly faded away. One of the key questions hanging over American beverages at the start of 2020 is therefore whether hard seltzers are here to stay and, if not, what will replace them.

Hard seltzers are not just a fad

Hard sodas came to prominence at a time when anti-sugar feelings were intensifying among consumers. As a result, increasingly sugar-averse consumers were willing to try hard sodas for novelty’s sake but rarely became repeat customers. Zima did not have this problem, but it did have one with appealing with two men and was never able to shake the stigma it had with male consumers.

Hard seltzers have overcome both problems. Their low-calorie, clean ingredients list fits well into the health goals of modern consumers and while some men are still hesitant about the category, its consumers base is now nearly evenly split between male and female consumers. New male-focused marketing initiatives like Truly’s sponsorship deal with the National Hockey League should further help the category make further inroads with men. With larger trends like sugar avoidance and mindful drinking still strong hard seltzers are in a good place for the long-term.

Provided, of course, that no other beverage emerges that addresses those consumer needs more effectively.

Can others keep up with hard seltzers?

To displace hard seltzers, a beverage will need to speak to mindful drinking trends, meaning it will have to offer consumers a way to indulge that does not throw off their larger health goals. It would naturally also have to have an appealing taste and capture at least some of the social media magic that the seltzers did.

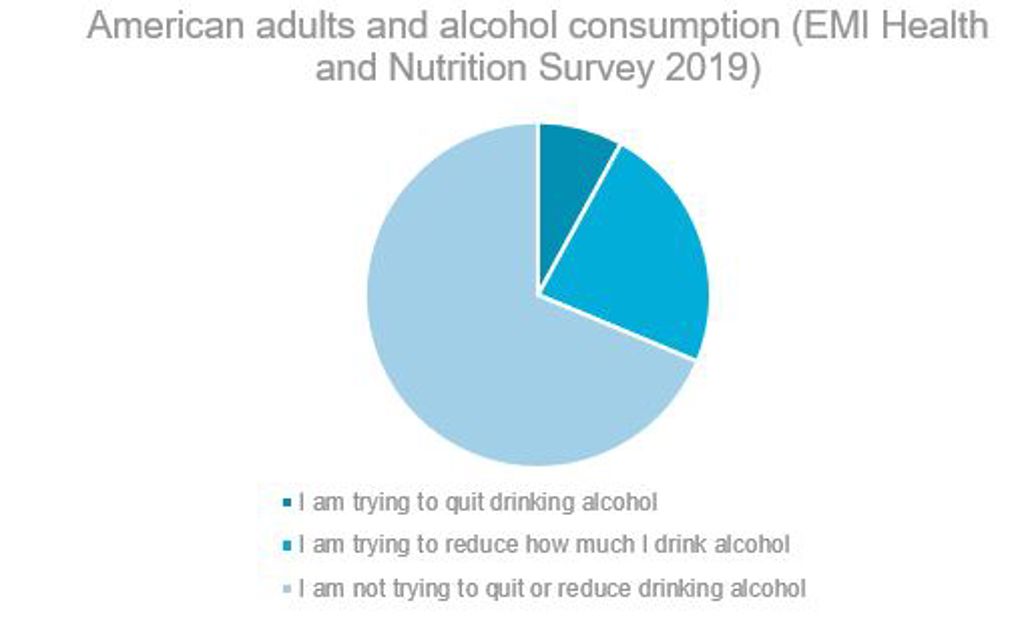

Hard kombuchas often come up as a category that could potentially do this, but kombucha has only a fraction of the consumer base of seltzers so it is difficult to see their full-alcohol variants ever reaching the mass appeal of hard seltzers. Hard teas are also promising, but many of the leading brands are quite high in sugar, which is a huge weakness in this current climate. Finally, non-alcoholic options are also sometimes brought up as a seltzer-killer. The evidence though points very strongly to Americans wanting to drink in more moderate and responsible ways rather than abstain entirely, which again favours the light, low-ABV seltzers.

[caption id="attachment_60234" align="alignnone" width="562"]

The absence of a credible challenger at this current time means that consumption of seltzers will only continue to grow in 2020. That does not mean though, that 2020 is not going to be very different than 2019 was.

Hard seltzer is already the unofficial drink of summer...again

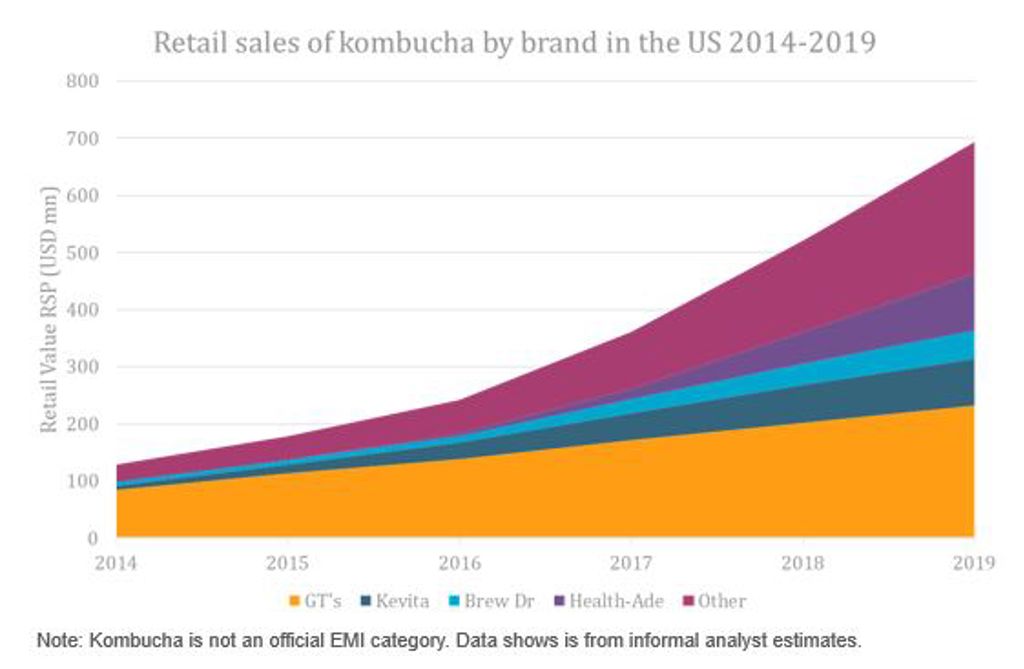

The word that will best summarize hard seltzers in 2020 is fragmentation. White Claw will remain the dominant brand, but it will unlikely be able to hold onto its current share given the wave of new competition entering the category. This is what happens to most emergent beverage categories. In kombucha, for example, EMI data shows market leader GT’s went from two-thirds of the category in 2014 to just one third in 2019 despite seeing positive sales growth in absolute terms every year.

[caption id="attachment_60235" align="alignnone" width="510"]

And new entrants are entering hard seltzer much faster than they did in kombucha. In the last half of 2019, countless new competitors readied themselves to take White Claw down. This includes a newly reformulated version of key competitor Truly, seltzer entrants from several major beer brands (Bud Light, Corona), numerous products aimed at men (Four Loko, Natural Light), and an emergent craft segment. It is difficult to imagine White Claw being able to fend off so many different competitors with so many different key selling points. It is looking particularly vulnerable outside of retail channels, with Truly launching a new draft-only version designed for on-premise usage and craft breweries starting to explore seltzer options.

The seltzer consumer though will have more options than ever before, which should work to the benefit of the category overall and help ensure than seltzers become ever-more entrenched in the American beverages landscape.

For more analysis, check out “Looking Back on the White Claw Summer: Inside the American Hard Seltzer Explosion.”

Questions? Reach out to Beverages Consultant, Matthew Barry or Food and Beverages Analyst, Karina Alvarez.