In an April 10th summit, the EU and British Prime Minister (PM) May agreed on an extension of Article 50 until 31 October 2019. Brexit uncertainty is now expected to continue until the end of 2019. The British Parliament still appears deadlocked, negotiations between PM Theresa May and Labour leader Jeremy Corbyn on reaching a Brexit compromise are proceeding slowly, and the governing Conservative party is at risk of implosion due to infighting between Brexiteers and Remainers.

This article updates Euromonitor’s Brexit Scenarios Tool outlook for the last phase of Brexit. All our previous scenarios remain on the table, though the baseline has shifted more decisively towards a likely Customs Union. The main changes are a shift in scenario timing due to the extension of the Article 50 negotiations period, and a moderate decline in the probability of leaving the EU without a deal relative to the beginning of 2019.

| Scenario | Probability |

| FTA/CU (Baseline) | 50 |

| Light/No Brexit | 25 |

| No-Deal Brexit | 15 |

| Disorderly No-Deal Brexit | 10 |

Baseline Scenario: the EU and UK agree on a Customs Union

Estimated Probability: 45-55%

The ongoing negotiations between British PM Theresa May and Labour leader Jeremy Corbyn are expected to converge on a Customs Union (CU), close to Labour’s current proposed Brexit agreement. The Customs Union motion was close to passing in the last series of indicative votes in Parliament, failing to get a majority due to abstentions by some pro-Remain Members of Parliament. Parliament is likely to pass a CU in another round of indicative votes, which the PM has promised to respect. Yet another possibility is that a No-Confidence vote in the government triggers an election, which weakens the pro-Brexit Conservatives or results in a Labour government. This again would probably lead to a CU agreement being approved by Parliament.

The CU maintains tariff-free trade in goods between the EU and the UK, except for several agriculture and fisheries products. Relative to the European Single Market, the CU leads to significant non-tariff barriers, especially for services. The loss of Single Market membership significantly raises administrative costs for firms exporting to the EU, and the UK loses its financial services EU passport. As a result, financial institutions shift key parts of their operations from London to the EU.

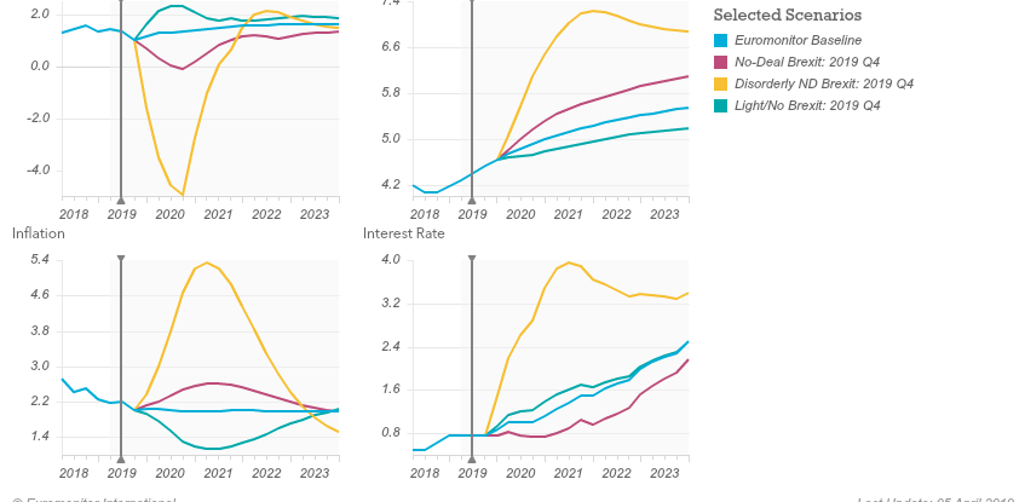

The UK exits the EU by November 2019, but there is a transition period until the end of 2020. During the transition period, the UK continues to make payments to the EU and follows all EU rules without any EU voting rights. In exchange, the UK continues to benefit from the European Single Market in 2019-2020, and UK-EU trade proceeds essentially as before Brexit. UK annual real GDP growth in this baseline scenario 2019-2021 is 1-2%.

Source: Euromonitor International Macro Model

Light/No Brexit Scenarios Remain Possible

Estimated Probability: 20-30%

So far, motions to hold a second Brexit referendum or to pursue a closer relation with the EU have failed to gain a Parliamentary majority. However, the second referendum motion was close to passing in an indicative vote at the end of March. Furthermore, there is strong pressure on Labour leader Corbyn to push for a second referendum in the ongoing negotiations with PM May.

Pro-EU factions may still prevail in the British Parliament, leading to the UK targeting a final deal close to Norway’s European Economic Area conditions together with a Customs Union (Norway Plus). Alternatively, the UK could hold a second referendum between implementing a trade deal based on the November 2018 UK-EU agreement and staying in the EU. Recent polls suggest remaining in the EU would win a second referendum, though the vote would remain close.

In this scenario, the UK retains access to the European Single Market, Customs Union and financial sector passporting rights. UK citizens also retain full EU movement and immigration rights. In exchange, the UK allows free movement of EU citizens. Business investment recovers from the slow growth in 2016-2018 and consumer spending rebounds. Real GDP growth recovers to around 2% annually in 2019-2021. The level of GDP increases by 1-3% relative to the baseline forecast over a five-year horizon.

No-Deal Brexit Risks Remain

Most Likely/Moderate No-Deal Brexit, Estimated Probability: 10-20%.

Disorderly No-Deal Brexit, Estimated Probability: 5-15%.

Leaving the EU without a deal remains the default if no deal is agreed by 31 October 2019. The No- Deal Brexit option was strongly rejected during Parliament’s votes in March. However, the EU is unlikely to grant further article 50 extensions after October 2019. Furthermore, MP’s of the ruling Conservative- DUP coalition mostly prefer a No-Deal Brexit to a Customs Union.

Theresa May now plans to remain the PM until the end of October 2019, to implement a deal and avoid the No- Deal outcome. However, her position inside the Conservative party is weak, with many Brexiteers openly calling for her to leave earlier and feeling betrayed by her decision to facilitate an article 50 extension. If May is forced out in a no-confidence vote, the new leader of the Conservatives is likely to be a hard Brexiteer and supporter of exiting without a deal. This could lead to a situation in which the current Conservative-DUP coalition stalls any progress in negotiating a deal, until the UK exits without one by default in November 2019.

In the No-Deal scenarios, the UK leaves the EU at the end of 2019 without reaching a new trade agreement. Trade relations with the EU default to World Trade Organisation (WTO) conditions with significantly higher barriers.

In our main No-Deal scenario, severe trade disruptions last for 1-2 quarters, until UK and EU customs services develop the capacity to handle the massive increase in work volume and complexity. Supply chain disruptions lead to slowdowns in factory production lines. Pessimism about future profits reduces business investment and labour demand. Consumer spending also declines due to lower wages, higher inflation, higher unemployment and reduced future income prospects. Declines in trade and foreign investment reduce long-term labour productivity. The level of UK GDP declines by 2-5% below the baseline forecast over five years.

In a more severe Disorderly No-Deal scenario, border disruptions last for 2-4 quarters, trade responsiveness to higher tariffs and non-tariff barriers is stronger than expected and the British economy is hit by significant financial shocks after exiting the EU without a deal. In this case, the UK economy would enter a severe recession, with GDP contracting by 5-7% relative to the baseline scenario, one year after the UK crashes out of the EU. UK real GDP declines by 5-9% below the baseline forecast over five years.

The extension of the article 50 negotiations phase until November 2019 has prevented the UK from crashing out of the EU on 12 April and has given the UK more time to reach a deal. However, the country remains strongly divided between the Leave and Remain sides, and reaching an agreement between the different UK political factions remains a difficult obstacle course. The risk of a No- Deal Brexit in 2019 has diminished but remains substantial. This uncertainty is likely to continue to dampen consumer spending and business investment over most of 2019.

Euromonitor International’s Brexit Scenarios Tool helps clients to understand the impact of different scenarios on our baseline forecasts for the UK economy, industries and consumers. It offers a range of outcomes, providing the tools to stress-test strategy, plan ahead and remain profitable in these challenging times.