While consumers defining their own approach to beauty is nothing new, Coronavirus (COVID-19) has accelerated this pre-crisis trend towards a new, elevated version of conscious consumerism that encompasses even higher standards around skin health and sustainability. Conscious beauty is defined as a culmination of a 360˚ understanding of consumers’ needs and the environment around them, balancing both intrinsic and extrinsic awareness factors. It not only takes a personalised approach to understand skin types, but consumers also evaluate the wider ethical and environmental impact of a purchase with the same gravity as personal priorities.

Conscious beauty has underpinned the industry for some time, fuelled by the overwhelming amount of product choice, lack of standardised certifications, elusive definitions and greenwashing tactics, with consumer trust in green labels declining since 2017.

Source: Euromonitor International’s Lifestyles Survey, 2020

Consumers take an ingredient-led approach to treating skin concerns

The intrinsic element of conscious beauty is about taking a tailored and targeted approach to skin care, built on consumers’ understanding of their individual skin type, sensitivities and needs. The saturation of skin care brands has led consumers to self-educate on active ingredients, becoming familiar with what niacinamide or hyaluronic acid do for the skin. As consumers’ quest for skin health becomes increasingly important, safety, transparency and origin of ingredients are more sought after. The pandemic has placed even greater importance on signature ingredients associated with anti-viral, immunity and natural healing, as the search for products that strengthen and protect skin defences is heightened.

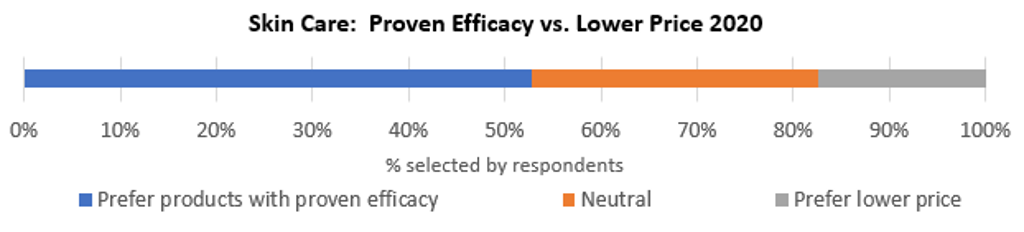

As COVID-19 elevates a back-to-basics approach, brands that play on simplicity, transparency and no-frills packaging, such as The Ordinary and The Inkey List have seen great success. 2020 has since seen more brands and retailers tapping into ingredient-led beauty, including Boots with Boots Ingredients, and Holland & Barrett with Vitaskin. Moreover, the affordability of such brands makes them a fiercer rival to premium players in a period of economic downturn, provided they can deliver the same efficacious results to consumers, which remains a priority for most, over lower price.

Source: Euromonitor International’s Beauty Survey, 2020

Ethical and eco-consumption become integrated into consumers’ lifestyles

On the extrinsic side, COVID-19 has spurred mindful consumption around sustainability. In 2020, 47% of consumers globally believe that climate change will impact their lives in the future more than it does now, compared to 42% in 2019, according to Euromonitor’s Lifestyles survey. As the harsh reality of climate change sets in, green strategies are no longer just the preserve of niche companies, with 2020 witnessing major beauty players dedicate significant resources to eco-initiatives. Personal care giant Unilever unveiled its largest in-store refill trial in Europe at a UK Asda store in October 2020, while Procter & Gamble plans to launch its own shampoo refill scheme in 2021, looking to embrace a circular economy.

Exploring packaging for the future has become a bigger priority; Shiseido launched its first biodegradable lip palette and L'Oréal has developed a bottle made from captured carbon emissions. Supply chain transparency is also gaining relevance, with Estée Lauder piloting blockchain technology to improve the traceability of its Madagascan vanilla supply chain, while the “farm-to-face” movement has seen brands look at how they can control and oversee more of the formulation process. As the pandemic has rendered safety and hygiene more vital to consumers around the globe, 48% of beauty and personal care companies have reported that the development or launch of sustainable products by their organisation has been paused or postponed due to COVID-19, according to Euromonitor’s Voice of the Industry Sustainability survey. Consumers’ endeavour for sustainability is expected to accelerate post-crisis and companies are planning to resume investments in various eco-initiatives.

Source: Euromonitor International’s Voice of the Industry Sustainability Survey, conducted in June 2020

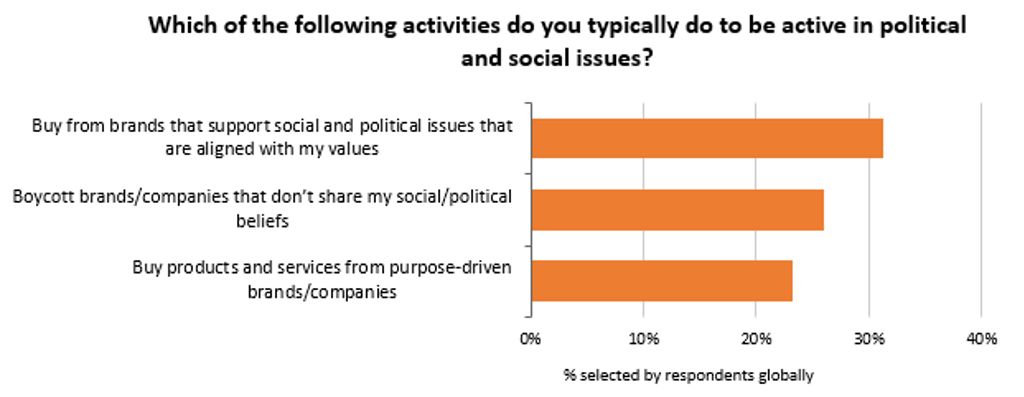

Sustainability expands to include purpose-driven action

COVID-19 has also brought a new consciousness that goes far beyond merely compensating for a company’s negative impact on people and the planet, as consumers increasingly search for morally-aligned brands. As a result, the definition of sustainability is evolving beyond ethical credentials and environmental concerns, towards purpose over profit, a more holistic approach that aims to create social, environmental and economic value.

In Euromonitor’s Voice of the Industry Sustainability Survey, 60% of beauty and personal care respondents reported that their company will balance social and health issues with environmental issues in the future. Beauty brands are recognising their ethical and moral responsibilities, further fuelled by brands being held accountable for unethical actions. The Black Lives Matter protests drew major backlash over brands selling whitening products promoting fair skin as idealistic, whereby companies such as Unilever and L’Oréal have since removed words relating to whitening, lightening and fairness. At the same time, the industry is receiving a wake-up call to represent and cater to inclusion and diversity. Sephora is committing to the 15 Percent Pledge initiative, whereby 15% of shelf space in US stores will be dedicated to Black-owned brands, while ongoing demand is rife for racially inclusive and gender-fluid beauty products.

As conscious consumerism is set to stay, all realms of beauty will continue to be affected – from product innovation to sustainability and diversity. Demand for effective and tailored skin care results will continue to be a priority, while beauty companies will be under more scrutiny to raise sustainable commitments for a more eco-friendly and ethical future, with purpose expected to remain a core part of corporate strategies going forward.