With Coronavirus (COVID-19) plaguing the world, the consumer health industry in Southeast Asia is well-positioned to grow, as consumers stockpile on necessities such as over-the-counter drugs and immune-boosting supplements. The region’s total retail sales of consumer health are set to grow by 3% from 2019 to 2020 in real terms, more dynamic that Asia Pacific’s aggregated growth of 1%.

Vitamins and dietary supplements to see prolonged growth

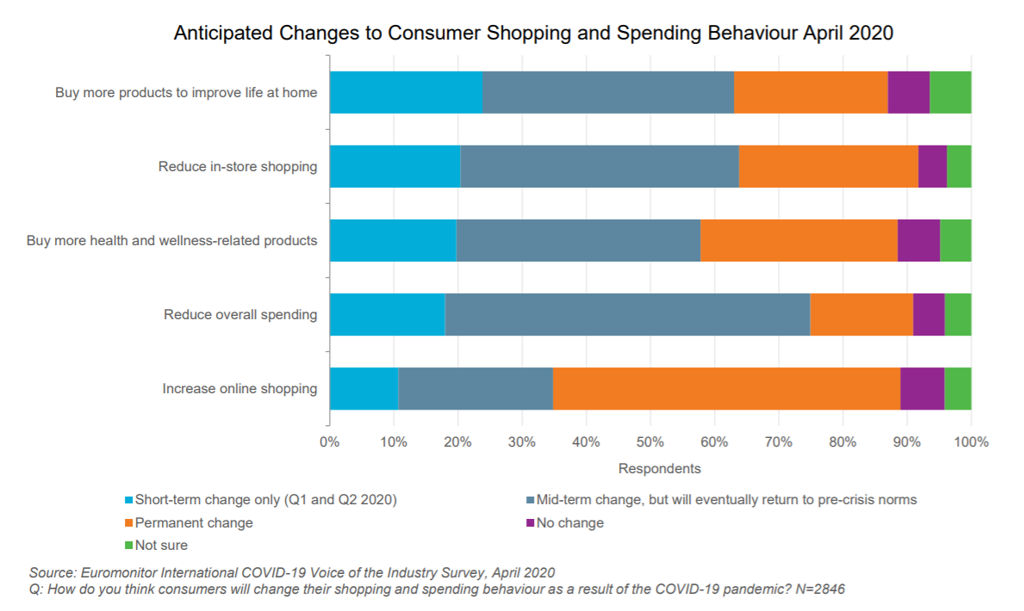

Sales of vitamins and dietary supplements are seeing strong interest throughout the region, as consumers gravitate to products perceived to boost immunity. Such health consciousness is likely to have a long-lasting impact on consumer mentality and behaviour. The projection is also supported by Euromonitor’s Voice of the Industry: Coronavirus Survey, where more than a third of global respondents highlighted that “buying more health and wellness-related products” was a “permanent” change.

Fast-growing developing economies such as Vietnam and Indonesia registered double-digit retail growth in vitamins and dietary supplements from 2019-2020, and are expected to see further growth momentum from 2020-2025, rising by CAGRs of 8% and 7% respectively. Compared to Asia Pacific, where vitamins and dietary supplements recorded just 2.5% growth in 2019-2020, Southeast Asia’s growth rate of 8% paints a rosy picture for companies which are keen to expand into the region.

Strong growth momentum for herbal/traditional remedies

COVID-19 has reinforced belief in naturopathy and nutraceuticals, strengthening a back-to-basics mentality, with sales of herbal/traditional remedies in Southeast Asia set for accelerated growth.

Ingredients used to make herbal drinks such as echinacea, red ginger, turmeric and lagundi have surged in demand as locals believe consuming them can defend against bacteria and viruses. Other traditional Chinese medicine supplements, such as cordyceps and lingzhi, are also gaining popularity in Southeast Asian markets like Singapore, which has a high percentage of Chinese ethnicities.

In addition, more young people are showing an increased interest in herbal remedies. Indonesia’s herbal products market leader Sido Muncl has tapped into this opportunity, introducing seven new herbal and vitamin products in the form of soft capsules amidst the pandemic, including Tolak Angin, Tolak Linu and Sari Kunyit. Such a move bodes well among younger audience who prefer easier modes of consumption. With COVID-19’s catalytic effect, sales of herbal/traditional products in Southeast Asia are expected to grow by a CAGR of 5% to 2025 in real terms, with the Philippines and Vietnam being the key growth drivers, followed by Malaysia and Indonesia.

COVID-19 accelerates digital healthcare transformation in Southeast Asia

Owing to factors such as restricted access to hospitals, fear of physical consultations and scarcity of medical staff, more patients are resorting to digital healthcare tools and platforms in Southeast Asia. Halodoc in Indonesia, MyPocketDoctor in Philippines and WhiteCoat in Singapore are some of the leading players which saw seismic growth in usage during the initial peak of COVID-19.

An already aggressively expanding industry in Southeast Asia prior to the virus outbreak, health-tech has seen a surge in investment in 2020. In March 2020, Singapore-based Doctor Anywhere raised USD$27 million in funding as COVID-19 fuelled demand for telemedicine services. Growing in tandem with this is an increasingly sophisticated value chain that brings together players like delivery companies and online pharmacies.

Governments across the region have also sought to optimise growth potential by acting as intermediaries to bridge the gap between telehealth operators and consumers. In April 2020, The Indonesian Government’s virus task force added links to 20 telehealth services on its website and created a "digital call centre" to direct traffic, while Malaysia’s Ministry of Health teamed up with local start-up DoctorOnCall to provide free COVID-19 consultations for all Malaysians in the same month.

With reduced behavioural barriers and solid government support, telehealth service is expected to enter a more mainstream phase, albeit with increased market competition, tighter regulations and stricter liability mechanisms.

What’s next for consumer health in Southeast Asia?

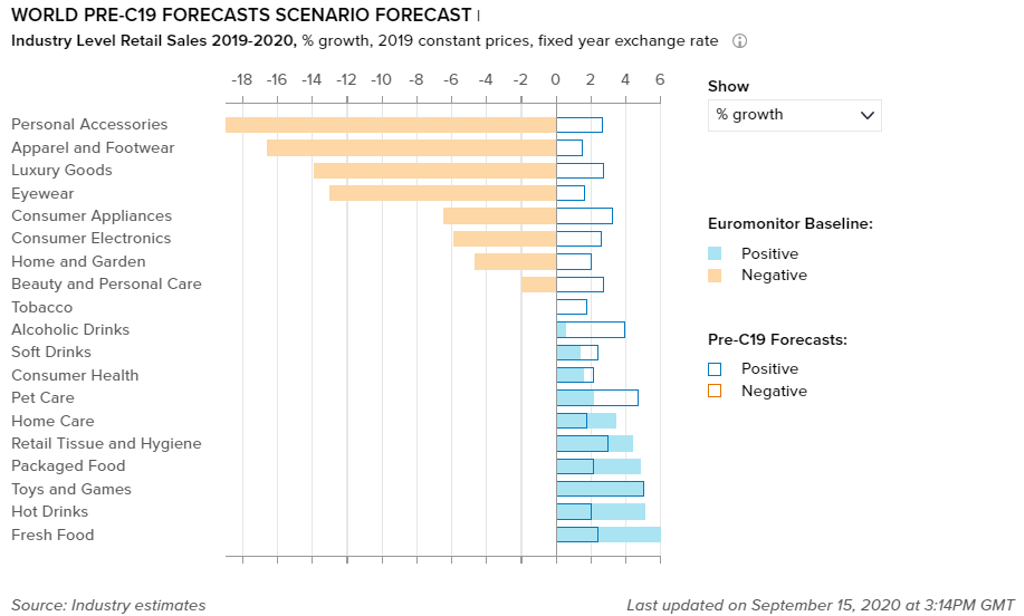

According to Euromonitor International’s COVID-19 baseline scenario forecast, consumer health remains the only industry that expects to see the least difference between pre-C19 and post-C19 growth rates, due to suppressed interest in a variety of consumer health categories such as dermatological, wound care and sports nutrition.

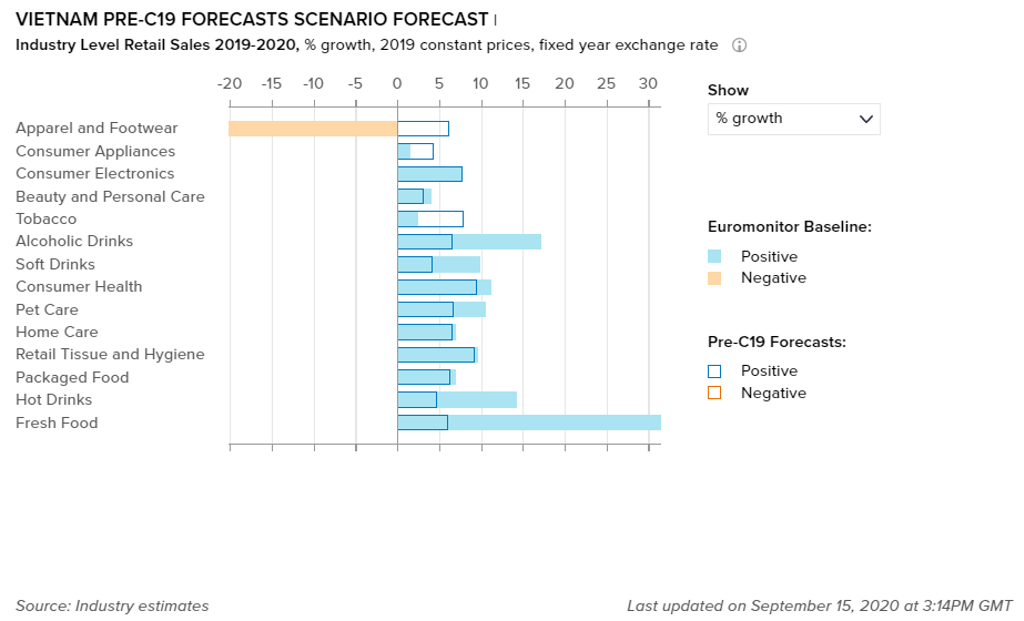

Zooming in on Southeast Asia, Vietnam is well-positioned to see the fastest growth in consumer health, in line with Euromonitor forecasts, which foresee 16% growth in 2020. Being the fastest-growing economy in the region, factors such as young demographics, emerging middle class, and rising small business activities make Vietnam the most resilient to pandemic-induced economic turmoil, according to the Asian Development Bank.

Proactive consumers, empowered by technology and knowledge, will assume a new role in personal healthcare regimen, particularly as COVID-19 reinforces the preventive health mentality among Southeast Asia consumers. The right fundamentals and infrastructures in place will lay a solid foundation for the consumer health industry to take off in a post-Coronavirus age.