The cooking ingredients and meals industry is seeing unprecedented pressure from inflation. Although commodity prices were already on the rise on the back of the COVID-19 crisis, they have soared due to Russia’s invasion of Ukraine. Within the cooking ingredients and meals space, edible oils has been the most affected category, although the impact is being felt across the entire industry.

The supply chain crunch of edible oils puts prices at record highs

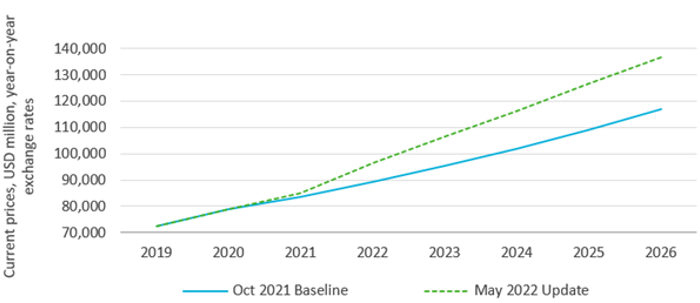

The effects of the edible oil shortage have been felt around the world. Sunflower oil is one of the major edible oils globally, and Ukraine and Russia are major suppliers of this commodity, which has sent prices rising to record highs. Euromonitor International’s May 2022 data update shows the upgrade of edible oils’ retail value sales over the forecast period. India, as a top importer of this commodity and given the importance of this oil in local cuisine, is the market most affected by the sunflower oil supply crunch, with significant shortages. This has meant a downgrade of volume sales in India of almost two million tonnes in 2022.

Edible Oils (Total): Retail Value Sales, 2019-2026

The shortage of sunflower oil has made it necessary to look for alternatives, including soy, palm and rapeseed oil. However, there are also disruptions in the supply chain of these oils which is exacerbating the situation.

Drought in Brazil and Argentina in 2021 reduced harvests of soybeans. Palm oil is also facing challenges. As demand for the commodity has increased, Indonesia, the largest producer of this oil imposed an export ban in April 2022, so it could secure its own domestic supplies. This has resulted in increased exports from Malaysia, the second largest producer, but the country is still navigating the shortage of workers on the back of the pandemic. These challenges are pushing prices through the roof, causing significant increases to sales value in this category.

The shortage of sunflower oil has also meant a shift to olive oil in various markets, most notably Spain and Italy. Refined olive oil is where a peak of demand has been seen, given that it is a more affordable variant than virgin and extra virgin olive oil. However, the gap is also closing between these variants.

Sales of ready meals set to slow down

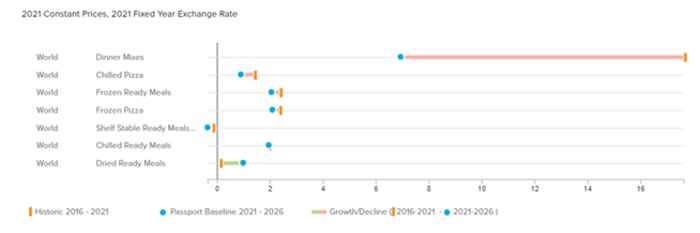

Shortages of wheat, rice and sunflower oil that are present in many ready meals have driven up prices of this category, which is evident in the upgrade of retail value sales of ready meals in 2022 of almost USD3.8 billion in Euromonitor International’s May 2022 revision versus the October 2021 baseline.

Ready meals performed extremely well during the pandemic given the closure of foodservice and the demand for convenient meal solutions by consumers on the back of cooking fatigue. With foodservice reopened, growth slowed during 2021, a trend that is set to continue over the forecast period. Furthermore, the category is expected to be affected by the economic crisis and, with consumers’ discretionary incomes reduced amid high inflation, categories such as dinner mixes, which includes subscription meal kits, although still expected to see a positive performance, are set to grow at a much slower pace compared to the review period. On the other hand, more affordable meal solutions such as frozen ready meals are expected to be slightly more dynamic over the forecast period than chilled variants, which tend to carry higher price points.

Ready Meals by Type: Retail Value Sales, USD mn, 2021-2026 CAGR %

A mustard shortage threatens in Germany

Rising raw material costs and logistic fees are again the key reasons for the increase of prices for table sauces overall. Key manufacturers in the space such as Kraft Heinz are under considerable pressure and have been forced to pass the price increases on to the consumer.

Mustard producers specifically also have concerns about supply shortages of imported seeds, especially in markets that rely on imports from Russia and Ukraine, as in the case of Germany. On the back of this, mustard producers could face difficulties in the second half of the year and in 2023, which is expected to result in shortages and further price increases.

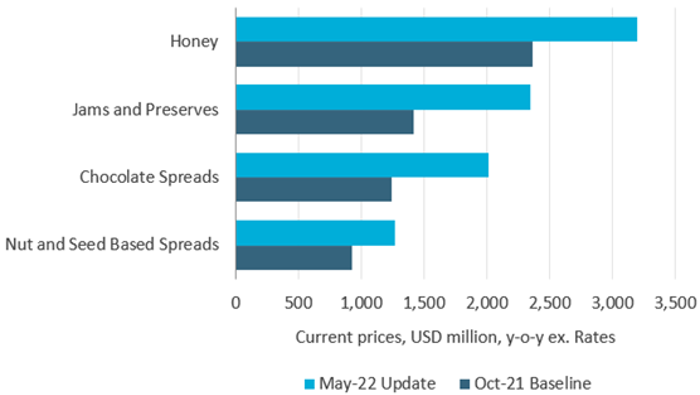

Shortage of ingredients places price pressures on sweet spreads, most notably honey

One third of Europe’s honey imports originated from Ukraine before the start of the war, and this could disrupt global honey trade for the remainder of the year. Replacing honey from Ukraine is a challenge and very costly, which will result in price pressures for the end consumer. Together with skyrocketing prices for essential raw materials, Turkey, the world's biggest hazelnut producer, is suffering from a currency crisis that has stretched the supply chain of hazelnuts, and resulted in a significant impact on the price of chocolate spreads. France and Italy, which rank among the markets with the highest sales of chocolate spreads globally, have seen significant upgrades in retail value sales in Euromonitor International’s May 2022 update.

Sweet Spreads by Type: Upgrades in Absolute Value Growth, 2021-2026

Cooking ingredients and meals: Future outlook

Logistical problems and shortages of workers in the supply chain will continue to cause supply bottlenecks. In addition, price rises in electricity, gas and fuel are resulting in production costs of most cooking ingredients to rise significantly, with no signs of this ceasing in the short term. This will result in increasing numbers of manufacturers seeking alternative raw ingredients and recipes, streamlining portfolios and passing the costs on to the consumer, who in many cases will have no choice but to trade down.

For further insight, read our Cooking Ingredients and Meals Half Year Review.