This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

As of 18 February, there were over 73,000 confirmed cases of coronavirus, with the majority in China, and over 900 cases outside of China. The number of deaths was reported to be 1,875 with five deaths reported outside of mainland China.

Cases have been confirmed in 25 countries so far outside China (including Hong Kong, Macau and Taiwan). They are Japan, India, South Korea, Vietnam, Singapore, Malaysia, Cambodia, Thailand, Nepal, Sri Lanka, Philippines, Australia, USA, Canada, Mexico, France, Germany, UK, UAE, Italy, Finland, Russia, Spain, Sweden and Belgium.

During a briefing call on 12 February, the World Health Organization (WHO) stated that the focus is currently on containment. When asked whether the outbreak has peaked, the WHO responded it was too early to say.

Preventative measures

Travel advice has been published by the WHO, advising measures to control the spread of coronavirus by the Chinese government such as exit screening checking for symptoms and for those countries wishing to conduct entry screening. The Chinese government also suspended domestic and international group tour and flight + lodging packaged tour bookings, whilst internal flights and inter-city train services were restricted.

Restaurants such as Starbucks and Hai Di Lao closed half and all their outlets, respectively, across China. Theme parks such as Disneyland Shanghai have been closed as well.

According to Euromonitor’s China Analyst, Dorrit Chen, there are reports of hotel occupancy dropping by 80% in China, with some hotels reporting occupancy of less than 10%.

International action

Other measures are being taken by individual governments in terms of travel advisories. In the case of the UK, all but essential flights to China (excluding Hong Kong and Macau) were advised by the Foreign and Commonwealth Office. British Airways meanwhile suspended its flights to China along with multiple other airlines such as Air Canada, Air France, American Airlines or reduced capacity to mainland China, such as Cathay Pacific, by 90%.

Cruise impact

In Japan, the cruise ship, Diamond Princess, with over 3,700 passengers and crew, has been placed in quarantine, with reports of 218 cases out of Japan’s total 247 coronavirus cases. The Japanese government banned Chinese tour groups and turned away a cruise ship from Hong Kong. JAL and ANA, the largest scheduled carriers announced that they will cancel some of their direct flights to China until the end of March 2020.

Potential impact on inbound tourism

Head of Travel Research, Caroline Bremner comments, “During the SARS virus in 2003, global arrivals fell from 717 million to 707 million over 2003, a decline of -1.3% while inbound receipts fell faster by -4.3% to USD831 million”.

Euromonitor International’s Travel Forecast Model indicates that in a coronavirus epidemic scenario where there is an extreme level of fatalities over 2,000, then inbound arrivals to China may fall by 8.8 million compared to the baseline forecast for 2020, to 70 million arrivals.

Source: Euromonitor International – Travel Forecast Model Note: Epidemic scenario - extreme level of severity, run for Q1 2020

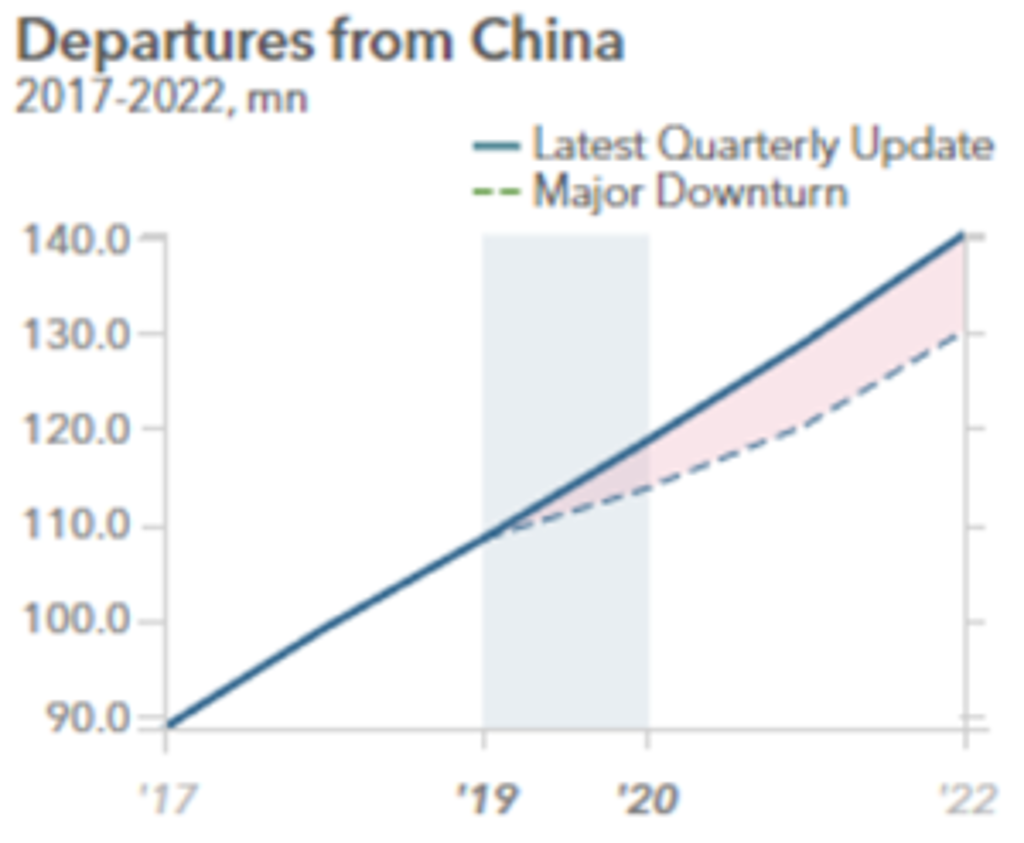

Potential impact on China outbound

Due to the lockdown in regions like Hubei along with the extended holiday period and closure of businesses, it is expected that the Chinese economy may experience a major downturn. The economic effects would lead to departures falling by 8.6 million compared to the baseline over 2020/2021.

Looking at the SARS epidemic as a comparison, potentially outbound departures could fall by -5% over a year as seen in Hong Kong in 2003, depending on the scale of the outbreak.

Major events such as the Formula One Chinese Grand Prix were postponed and Mobile World Conference in Barcelona was cancelled, with a cloud hanging over events and meetings in the months to come.

In Macau, the government ordered that casinos close for two weeks. The duration and final scale of the outbreak remain key risks to the global travel and tourism industry.

Source: Euromonitor International – Travel Forecast Model Note: Major downturn scenario run for Q1 2020