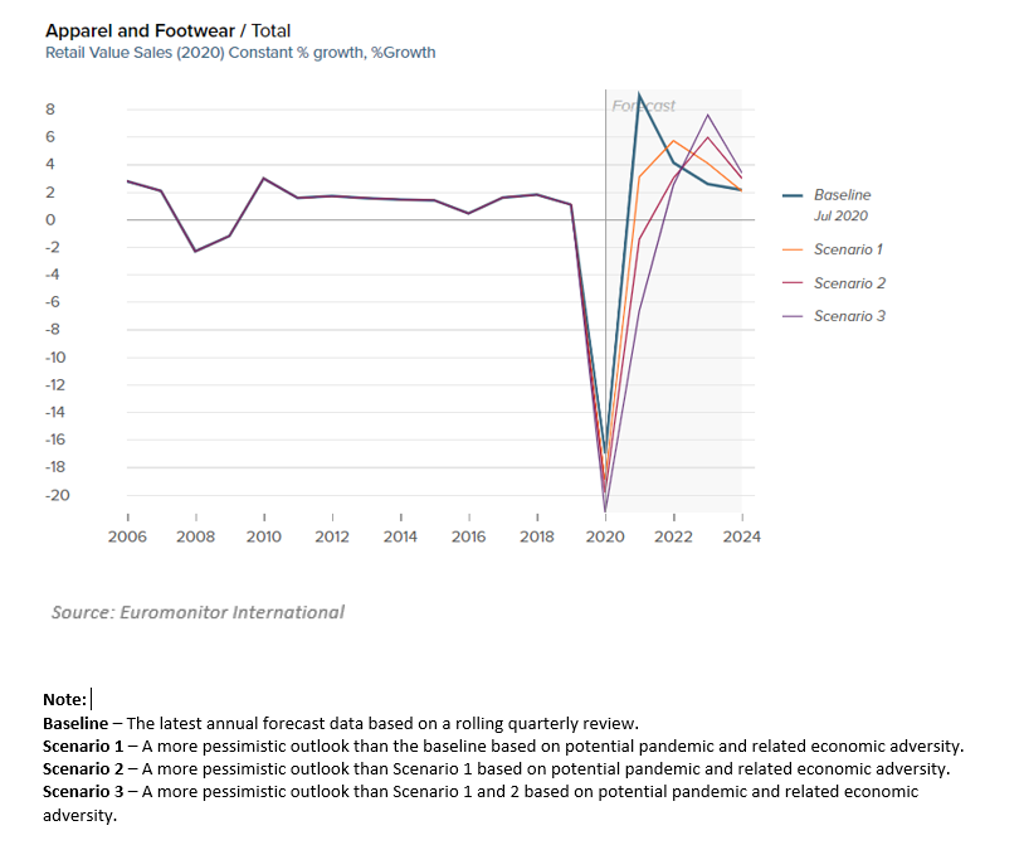

Coronavirus (COVID-19) has been disrupting the fashion industry, from end consumption to manufacturing and distribution. Euromonitor International’s baseline scenario forecasts global sales of apparel and footwear will decline by 17% in constant terms in 2020, in contrast to 2% originally forecast, prior to the pandemic. A Back to Normal scenario cannot be foreseen.

Euromonitor has identified five strategies that fashion companies could consider putting in place in order to survive in this challenging terrain, including digitisation of supply chains and increased cross-brand collaboration.

Digitalisation

This pandemic is forcing companies within the entire fashion value chain to revisit current operations. COVID-19 has accelerated the shift to digital in the distribution chain through e-commerce, and the fashion industry is no exception.

Before the pandemic, online sales of clothing were already growing fast. Between 2014 and 2019, global online sales including sales tax and in constant value terms, were up 125%. Post-pandemic, consumers of all generations will have been forced to take the digital plunge and many people previously reluctant to purchase online are now becoming used to it as a way of shopping, and as a way of engaging with brands.

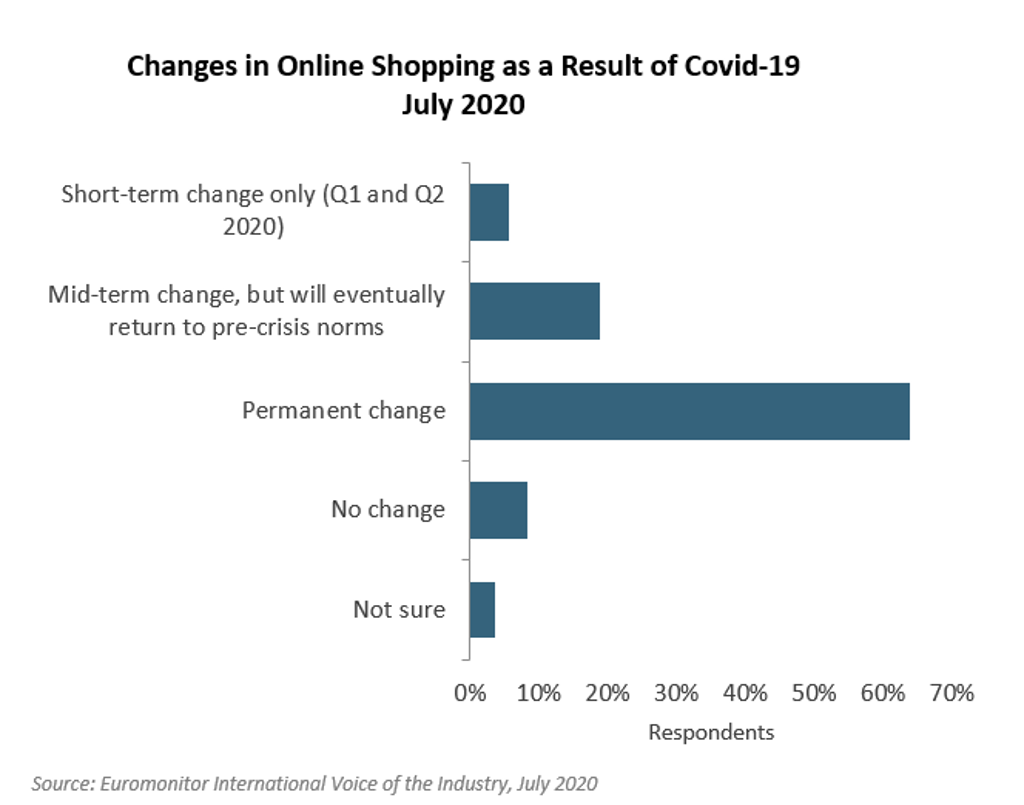

In 2020 alone, sales of e-commerce are expected to grow by 24%. Euromonitor’s Voice of the Industry survey, which was conducted in July 2020 among industry players around the world, reveals that 64% of respondents globally think that there will be a permanent change in online shopping as a result of COVID-19. Smaller retailers and brands can now use tools such as Facebook Shops, with no-fees attached, to sell their products across both Facebook and Instagram.

COVID-19 will further accelerate the shift to digital at the corporate back end, including its suppliers. The Southeast Asian garment sector, predominantly in Bangladesh, was hit hard by the pandemic as billions of dollars’ worth of orders were cancelled or suspended, leaving workers across the region without jobs and raising doubts about the long-term survival of the industry.

Technology is expected to be used in all parts of the supply chain and the companies who do not use tech will be left behind. Wholesalers will be required to work on automation, 3D sampling and virtual fairs to name a few. In 2019, prior to the crisis, US designer brand Tommy Hilfiger, for example, announced it will only use 3D design to create, develop and sell samples from its Spring 2022 collection.

Immersive technology such as virtual reality (VR), augmented reality (AR) and live streaming technologies adopted by brands during the lockdown are also set to be used on a much larger scale in the wake of the crisis. British online fashion retailer ASOS is one example and has used AR technology to show simulated models and brands, while the company was unable to work with models during the outbreak.

Mergers and acquisitions

2020 will be a difficult year, with several brands disappearing, as the temporary closure of shops will put pressure on retailers, and once the dust settles, we can expect a wave of M&A and private equity activity.

Large companies with cash will look horizontally to take over direct competitors who are left vulnerable by the crisis, while it is possible that players may also seek out opportunities vertically within the supply chain. We have already seen signs of activity in Europe, with French Connection-owned French fashion brand Naf being bought by its Turkish supplier.

Collaboration

Businesses will need to collaborate effectively to address the unusual issues and complications arising from COVID-19. Some of the great advantages of collaboration are the opportunity for knowledge-sharing, saving money, solving problems and growing networks.

British designers Halpern, Julien Macdonald, Liam Hodges, Mulberry, RAEBURN and RIXO joined forces in June 2020 with the launch of non-medical charity face masks. Fashion retailers could also take a lesson from the food retail sector. In Germany, for example, Aldi had partnered with Germany’s McDonald’s during the lockdown, where McDonald’s sent workers to Aldi in order to cope with the high demand.

Brand for purpose

COVID-19 is accelerating brand purpose as a business strategy. Consumers today expect authentic and thoughtful messaging, seeking out companies that align with their own values and have a positive impact on the world, rather than focussing exclusively on profit. 52% of respondents from Euromonitor’s Lifestyle Survey in 2020 agreed that they only buy from companies and brands that they completely trust.

Many smaller, younger brands have been very good at building a cult following around core values that speak to people. For example, luxury online boutique Rêve En Vert has focused on high-end sustainable products and reported stronger sales in May 2020 than for Christmas.

Service as a product

Finally, as the fashion industry adapts to social distancing, we can expect to see growth in the personal shopping experience, particularly at the premium fashion end. This will be an opportunity for brands to connect with their customers on a personal level and understand its customers’ needs, while the customer will benefit from having a great personalized experience.

UK retailer John Lewis has launched a free, virtual personal shopping service for customers to receive the product advice they would get in the department store without leaving their home. Italian luxury brand Gucci is also betting on personalised video consultations spurring sales, having just launched its own video service, Gucci Live.

While the health and social distancing measures will no doubt one day disappear, several of these fashion trends arising from COVID-19, including e-commerce, technology investments, purpose-driven marketing and the personalised customer shopping experience, are expected to stay in the long term, far after the pandemic subsides.

For more apparel and footwear insights, access the report "Apparel and Footwear: Quarterly Statement Q3 2020".