This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries. Please note the selected goods data used is through 23 February 2020.

COVID-19 first manifested itself in Italy on 30 January 2020, when two tourists from China tested positive for the virus. Even though the country immediately imposed a ban on flights from China, COVID-19 quickly spread to the north of the country, with the first 16 cases reported on 21 February, making Italy the most affected country in Europe. In order to contain the infection, 11 towns in the Lombardy and Veneto regions were placed under quarantine on 23 February.

E-commerce websites coming under pressure

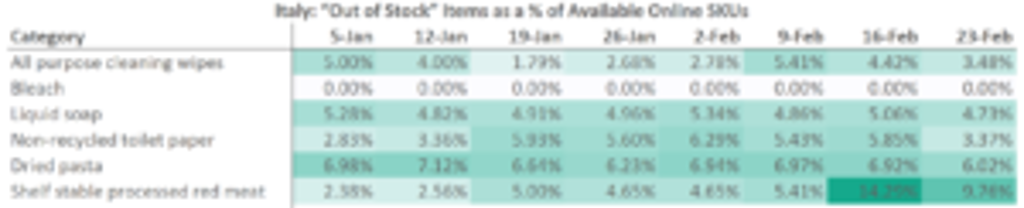

According to Euromonitor International’s new global e-commerce product and price monitoring platform, Via, from the beginning of February 2020, some – but not all – of the selected product categories began to see small to moderate increases in online out of stock levels. Even though the government did not begin to take aggressive measures to control the spread of COVID-19 until the end of the month, Italian shoppers began to buy more of certain products as soon as it became clear that the virus had arrived in Italy.

Source: Euromonitor Via (1 January - 23 February 2020)

Initial fears of running out of food pushed up sales – as well as online out of stock levels -– for non-perishable food items. Most notably, shelf-stable processed red meat saw its percentage of out of stock items increase from 2.38% at the beginning of the year to 14.29% on 16 February, before falling the following week.

Of non-consumables, non-recycled toilet paper showed a similar pattern to shelf-stable processed red meat as Italian consumers began to stock up on household essentials. The category’s out of stock percentage grew from 2.83% on 5 January to 6.29% on 2 February. While online availability began to improve from 9 February, out of stock levels remained higher at the end of February compared to the beginning of January. All-purpose cleaning wipes also saw a marked increase in online out of stock percentages during the week of 9 February as home hygiene became more important, but bleach remained readily available.

In addition, mobility restrictions and consumers’ desire to avoid as much human contact as possible have led to a general increase in online shopping. As buying groceries online is still not very popular in Italy compared to other European markets, this sudden increase in demand has put pressure on local e-commerce platforms’ ability to fulfill orders.

Growing concerns and uncertainty lead to price nervousness in Italy

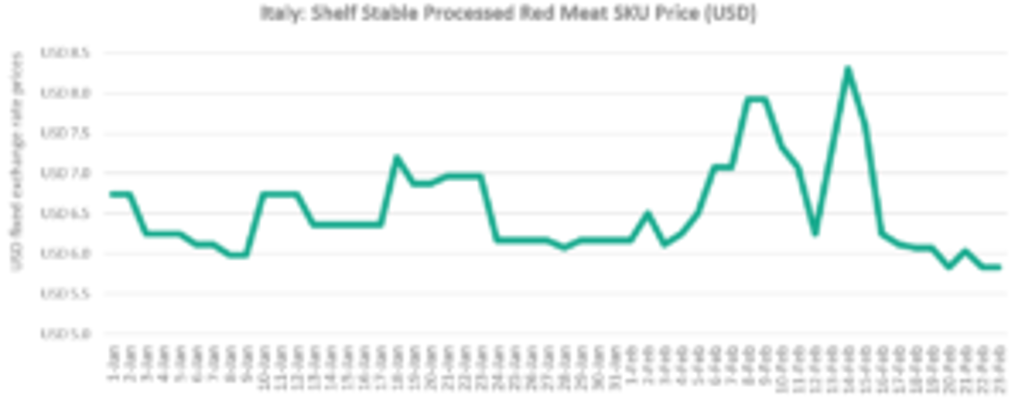

As a result of the sudden increase in online shopping and consumers beginning to stock up on non-perishable and essential goods, the median category online prices fluctuated significantly between 1 January and 23 February. For example, the online price of shelf-stable processed red meat experienced notable swings that are closely linked to online availability. As seen in the chart below, median category prices increased from 1 to 9 February alongside a slight increase in online out of stock levels. After falling quickly between 9 and 12 February, median online prices surged to USD8.30 on 14 February, mirroring a similar spike in online out of stock percentages.

Source: Euromonitor Via (1 January – 23 February 2020)

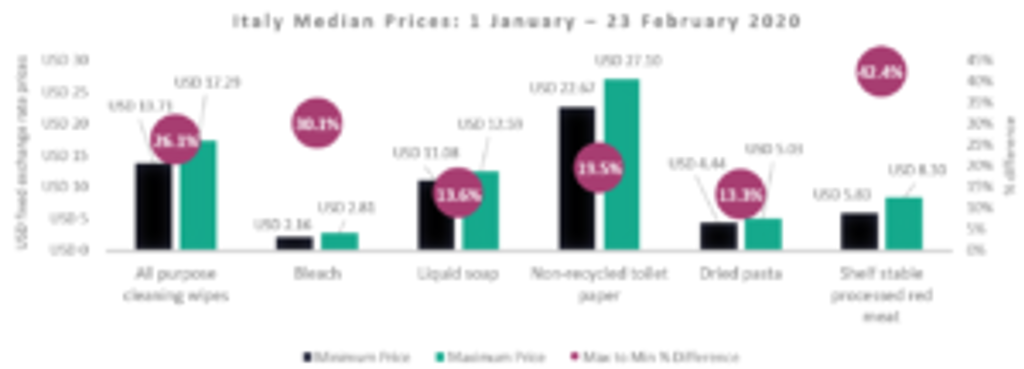

Online price volatility for shelf-stable processed red meat is further underscored by a notable 42.4% difference between the minimum and maximum median category price between 1 January and 23 February 2020. Median online prices for other categories related to COVID-19 preparation and prevention have shown similarly dramatic fluctuations over this same period. For example, home sanitizing and disinfectant products for objects and surfaces experienced strong demand as consumers looked to create a safe and hygienic environment at home. Hence, the 26.1% and 30.1% differences between minimum and maximum median prices for all-purpose cleaning wipes and bleach respectively.

Liquid soap has also been in high demand as hand washing has become a priority to avoid infection. In fact, all product categories under review saw double-digit differences between minimum and maximum median prices between 1 January and 23 February 2020, with further price volatility expected as Italian consumers and e-commerce players face a growing public health crisis.

Source: Euromonitor Via (1 January - 23 February 2020)

Next steps for Italy

While the time period examined in this analysis was just before Italy began its regional and then national quarantine, notable movements in e-commerce product availability and prices through to 23 February 2020 still indicate the impact of the early stages of the COVID-19 outbreak on selected consumer goods. With the entire country now under quarantine, online grocery shopping, which in Italy is still small compared to bricks and mortar independents and grocery chains, is experiencing a sudden boom. In future analysis, the online availability and prices of similar products will be examined to showcase the continued impact the outbreak is having on the Italian consumer goods market.