This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries. Please note the selected goods data used is through 23 February 2020.

While originating in China, COVID-19 quickly spread to South Korea, with the first reported case on 20 January 2020. Similar to China and Hong Kong, the response to COVID-19 in South Korea has been to limit the mobility of citizens and enforce a variety of work-from-home and containment measures. This has tested the country’s e-commerce infrastructure, and in this article, the impact on online pricing and availability of selected goods will be examined.

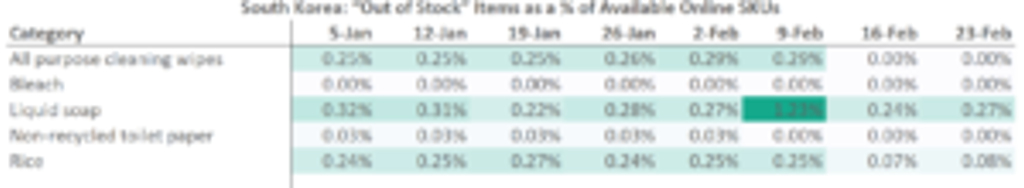

Availability of items due to COVID-19

According to Euromonitor International’s new global e-commerce product and price monitoring platform, Via, South Korea has managed to keep many products in stock that have seen high demand since COVID-19 as a result of the country’s strong logistical network and third-party merchants.

Source: Euromonitor Via (1 January - 23 February 2020)

While some categories, such as all purpose cleaning wipes, rice and in particular liquid soap, saw an increase in out of stock items on e-commerce websites until 9 February, most of these increases were fairly negligible, with the slight exception of liquid soap. Moreover, the e-commerce channel was able to quickly recover to manage the increased demand. This was largely possible due to South Korea’s heavy reliance on third-party merchants selling through online marketplace platforms like 11th Street and Gmarket, which provides opportunities for various sellers to reach consumers.

Pricing dynamics in South Korea

Despite consumers having access to products and not seeing a run on goods, prices did still fluctuate strongly following the COVID-19 outbreak. Liquid soap remains a highly demanded product based on the South Korean Government’s recommendations for increased hand washing to reduce the spread of the virus. Analysing nearly 2,400 liquid soap SKUs across 23 e-commerce retailers between 1 January and 23 February 2020, there is significant movement in the category’s median price.

Starting at USD16.62 on 1 January, liquid soap’s median price per SKU reached a peak of USD18.38 on 3 February. This increase was mainly caused by panic buying as consumers looked to improve their hygiene and ward off spreading the virus further. As seen in the chart below, after hitting its peak in early February, median category prices remained above a USD17.50 threshold until 18 February. Median prices then began to decline steadily over the following week as enough supply was secured by consumers and focus shifted elsewhere.

Source: Euromonitor Via (1 January – 23 February 2020)

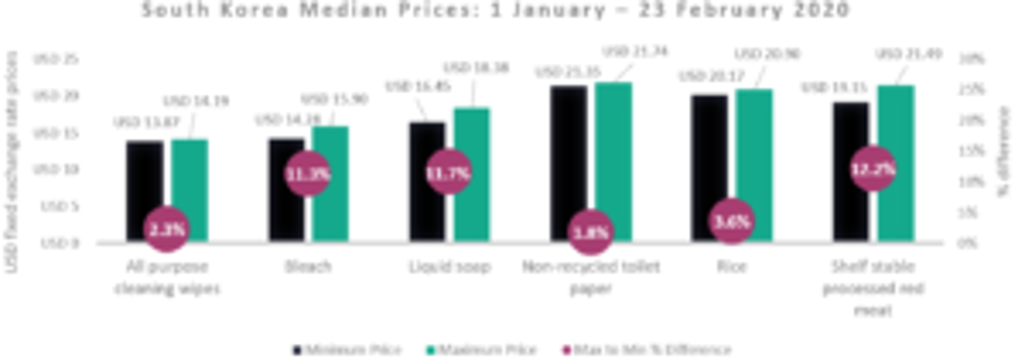

As mentioned previously, liquid soap’s maximum median price during this time period reached USD18.38. As seen in the chart below, this was 12% higher than its minimum median price between 1 January and 23 February 2020. Comparing a select basket of products in high demand due to COVID-19 fears, the difference between minimum and maximum median prices differs greatly.

Unlike in other countries where non-recycled toilet paper has been in demand, category median prices showed little movement in South Korea and the difference between minimum and maximum median prices stood at 2% throughout thanks to sufficient local supply. Rice also experienced a relatively small median price swing during the surveyed period. However, the South Korean Government places controls on the price of rice, which prevented significant fluctuations in online prices or price gauging, despite increasing consumer demand.

Source: Euromonitor Via (1 January - 23 February 2020)

Next steps for South Korea

As the Government continues to restrict movement and South Koreans adapt to the new normal of travel restrictions and working from home, consumers can hope to see goods that have recently increased in price start normalising as they work through their stockpiles. There is a general feeling that the country has done well in preventing the further spread of COVID-19 cases due to strong government measures. While e-commerce retailers have seen their logistical networks stretched to the max during the outbreak’s immediate aftermath, the current hope is that the worst has come and gone.

Looking ahead, more ‘at-home’ products are expected to show a strong performance via e-commerce channels in South Korea. As still worried consumers adapt to recent restrictions imposed upon them, there will be a shift in purchasing occasions and habits that may cause other product categories, like premium packaged coffee and ready meals, to see dynamic online pricing movements as well as a greater proportion of out-of-stock items.