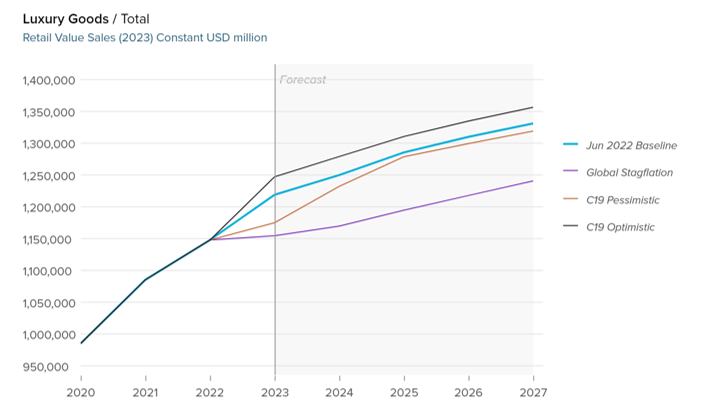

Global sales of luxury goods are set to grow by just under 6% in 2022 to reach USD1.2 trillion, according to the latest data published by Euromonitor International. The outlook also remains positive, with sales set to exceed the pre-pandemic level by 2023.

These numbers are hugely impressive against a backdrop of ongoing political and economic instability, major concerns over high and rising inflation and the cost-of-living crisis, not to mention the continuing effects of the global pandemic. Indeed, COVID-19 continues to challenge the industry in some key markets and to reshape our everyday lives and behaviour on almost every level.

China’s zero-COVID policy could add further headwinds to supply chain issues

Recovery across all regions remains uncertain due to China’s zero-COVID policy. The Chinese economy was the first to fully recover from the COVID-19-driven downturn, shifting the government’s focus from stimulating recovery to controlling financial system risks and robust credit expansion. However, China’s strict zero-COVID policy is slowing down the country’s robust growth, as even the smallest virus outbreaks are followed by strict quarantines and isolation.

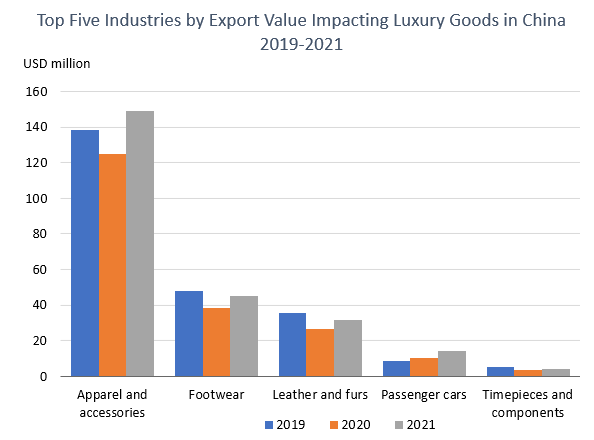

Despite company plans to increase investments in supply chains, the zero-COVID policy implemented by China is one of the risk factors that could impact global supply chains across luxury goods. The lockdown measures in China largely affect luxury goods companies purchasing high-tech goods, textiles and leather goods, cars and timepieces from Chinese suppliers. China accounts for over 30% of global exports in these industries, and extended trade disruptions could cause significant supply shortages, as witnessed at the beginning of the pandemic. Restrictions on economic activities in China could also impact exporters to China.

The absence of Chinese tourists still hugely apparent across luxury and hospitality

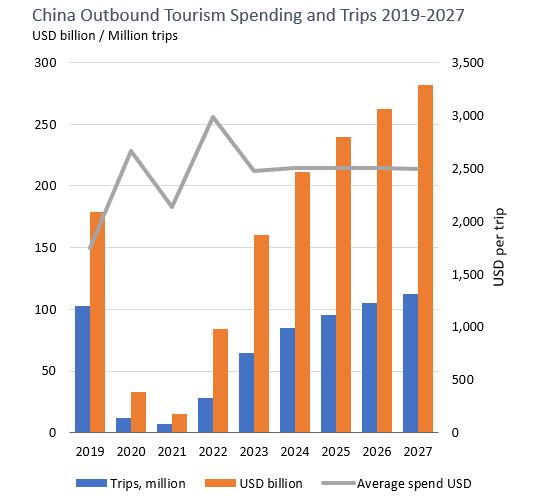

China’s zero-COVID approach has put a near stop to outbound tourism, a much-needed driver of recovery for personal luxury goods and hospitality for key countries around the world, let alone intra-regionally in Asia Pacific. In 2022, Chinese outbound tourism is expected to remain at 47% of pre-pandemic levels. Recovery of international tourism spending is going to take much longer than after the last global crisis, when it took three years to return to peak spending levels after the Global Financial Crisis in 2008-2009.

There have, however, recently been signs of a thaw, with the Pacific Asia Travel Association reporting that Chinese embassies in countries such as the US, Ireland, Denmark and Spain are easing pre-departure testing, and that business travel can recommence for foreign companies operating in China. The expectation is that China will return to international travel by the end of 2022.

Mindful consumption choices based on heightened and new-found values

Rising inflation and the weakened momentum of economic recovery thanks to the spread of COVID-19 have resulted in consumers focusing even more on value.

Today’s consumers, having experienced massive upheaval during the pandemic period and have been re-evaluating what is important to them. They are making more intentional and mindful consumption choices based on heightened and new-found values, motivations, and expectations. For luxury and fashion businesses, this means putting value creation at the forefront of innovation, ensuring the affordability of product and service portfolios while aligning their offerings with consumers’ core priorities. However, this comes at a time when costs across the entire global supply chain are increasing, with the end consumer paying the final price.

Luxury consumers are being more careful with their spending, not necessarily buying cheaper but, rather, buying the best they can afford. Luxury and fashion companies should look to build emotional bonds with consumers through sensory experiences whilst re-enforcing their attributes in terms of quality, longevity, heritage and craftmanship. People want to feel engaged with the products they buy and with the brands behind them, so companies need creative interactive innovations to appeal to consumers and build loyalty.

Rise of e-commerce and digital transformation continue to accelerate post-pandemic

The pandemic forced many people to work from home and reorganise their lives accordingly. These changes have had a profound long-term impact, with more people adopting a hybrid model of working between home and the office. This has spurred a huge surge in e-commerce, with online sales accounting for 20% of sales of personal luxury goods in 2022, versus 11% in 2019.

Luxury consumers want to continue to enjoy the convenience of e-commerce. Many luxury retailers and brands are thus investing in their e-commerce operations, seeking to improve consumers’ online shopping experience whilst rationalising their networks of physical stores. Improving in-store customer service and adopting a more customer-centric and personalised approach is also key.

Rising uncertainty and worsening supply conditions could trigger global stagflation

The consumer landscape has been transformed forever. Changes that were already afoot pre-pandemic have now been accelerated, and together these will continue to drive huge transformations in the future of globalisation, the future of work and education, and the future of consumer priorities, preferences and values. In addition, gloomy developments since early 2022 continue to set the global economy on a course of slower growth and higher inflation.

Our latest forecast data predict that global spending on luxury goods will continue to rebound strongly in 2023, increasing by just over 6%, buoyed by strong pent-up demand after almost three years of pandemic-induced restrictions and a healthy affluent population.

According to Euromonitor International’s latest Industry Forecast Model, in the two worst-case scenarios – COVID-19 Pessimistic and Global Stagflation – global luxury spending growth would slow to just over 2% and 0.5% respectively in 2023. However, in the most optimistic scenario – COVID-19 Optimistic – luxury good sales will see an increase of just under 9%. Either way, the industry has new challenges to face, such as the global surge in inflation. This may lead to a tempering of pent-up consumer demand as belts tighten in the face of soaring energy, food and commodity prices.

For further insight, read our report, World Market for Luxury Goods.