With purpose becoming the business mantra in the Coronavirus (COVID-19) era, digital technology is increasingly seen as an enabler of purpose-driven innovation to achieve sustainable recovery.

Since the beginning of the outbreak, digital platforms have been key for businesses to show social purpose, with technology being leveraged to support the most vulnerable people during isolation. For instance, in response to COVID-19, Vodafone UK gifted technology to vulnerable groups at risk, with the company donating a one-button communication device called KOMP that allows the elderly and people with low vision to be in touch with loved ones.

Technology has also been used to demonstrate environmental purpose, with US-based Aspiration bank launching, right in the middle of the outbreak, a new feature called “Plant Your Change”, that allows customers to round up purchases to the nearest dollar, with the extra few cents going to tree planting. Since its launch in April 2020, over one million trees have been planted.

COVID-19 accelerating the digital transformation

The pandemic has re-imagined the way we live, shop, learn, play and connect with others, accelerating the shift to living. The health crisis has catalysed digital transformation with the rapid adoption of technologies by businesses, in many cases as part of their business continuity plans. Digital tools have become a lifeline for local businesses previously reliant on in-store experiences, with technology allowing them to stay operational.

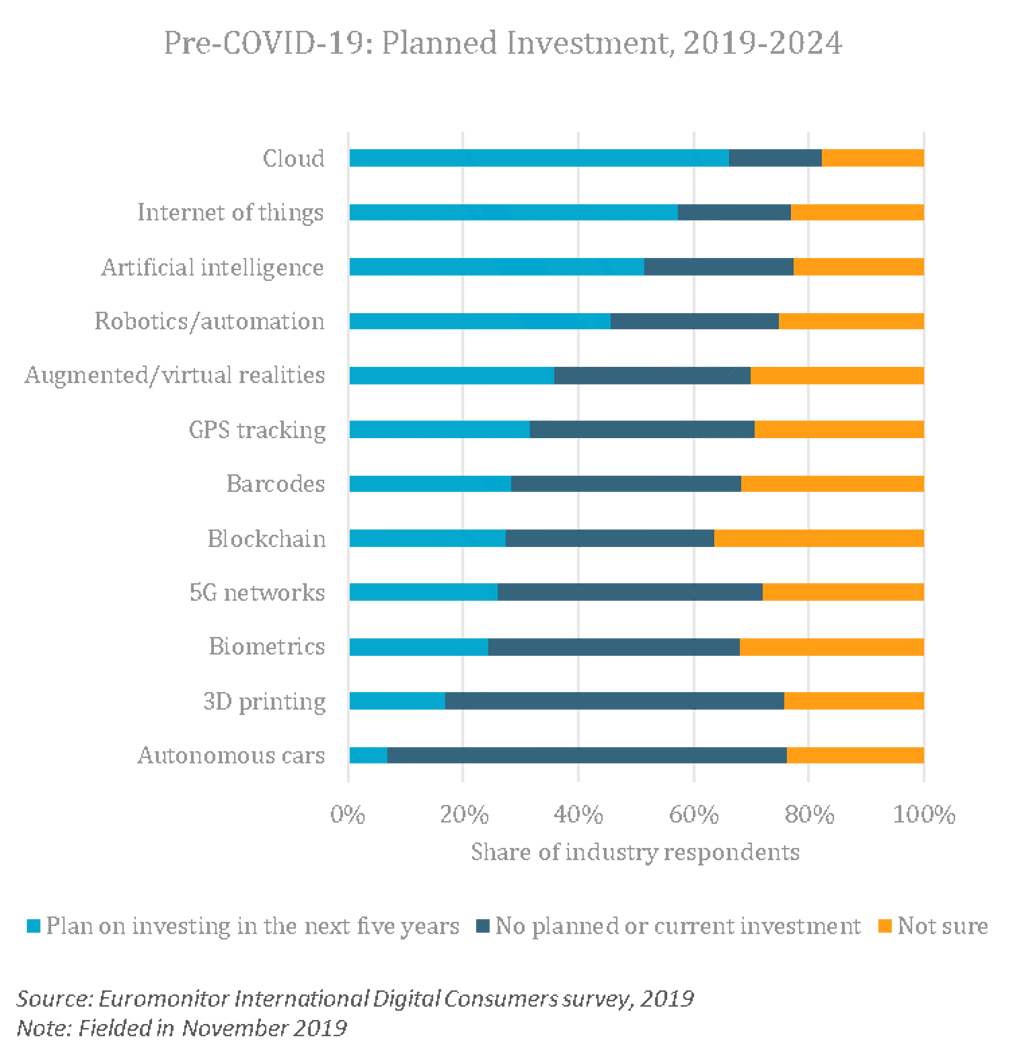

Pre-COVID-19, many companies were flirting with the digital world and pioneering investment in emerging technological innovations with promising applications in the sustainability space. When looking at pre-COVID-19 investments across different digital technologies, the cloud, the Internet of Things (IoT) and artificial intelligence (AI) top the list of future investments planned by businesses across all industries over the next five years, with more than half of surveyed companies planning to make an investment in these three areas, according to Euromonitor International’s Digital Consumer Survey, 2019.

Momentum towards digitalisation is likely to endure, with more companies leveraging supply chain technology to improve visibility, resiliency, and efficiency and to help plan for forecast demand. Post-COVID-19, investments in digital tools, robotics and automation are expected to accelerate, with three in ten companies planning to invest in automation, and digital supply chain technologies such as artificial intelligence, the Internet of Things and DNS digital supply chain networks (Voice of the Industry: COVID-19 survey, July 2020).

More businesses are announcing transparency pledges, with digital technology being pivotal to achieve them. For instance, in August 2020, Unilever announced the use of a pioneering digital technology that will allow the company to achieve farm level traceability. Developed by the tech company Orbita Insights, the technology uses satellite imaging with geospatial analytics and artificial intelligence, to bring supply chain transparency to farms and plantations of soy milk and palm oil in Brazil and Indonesia.

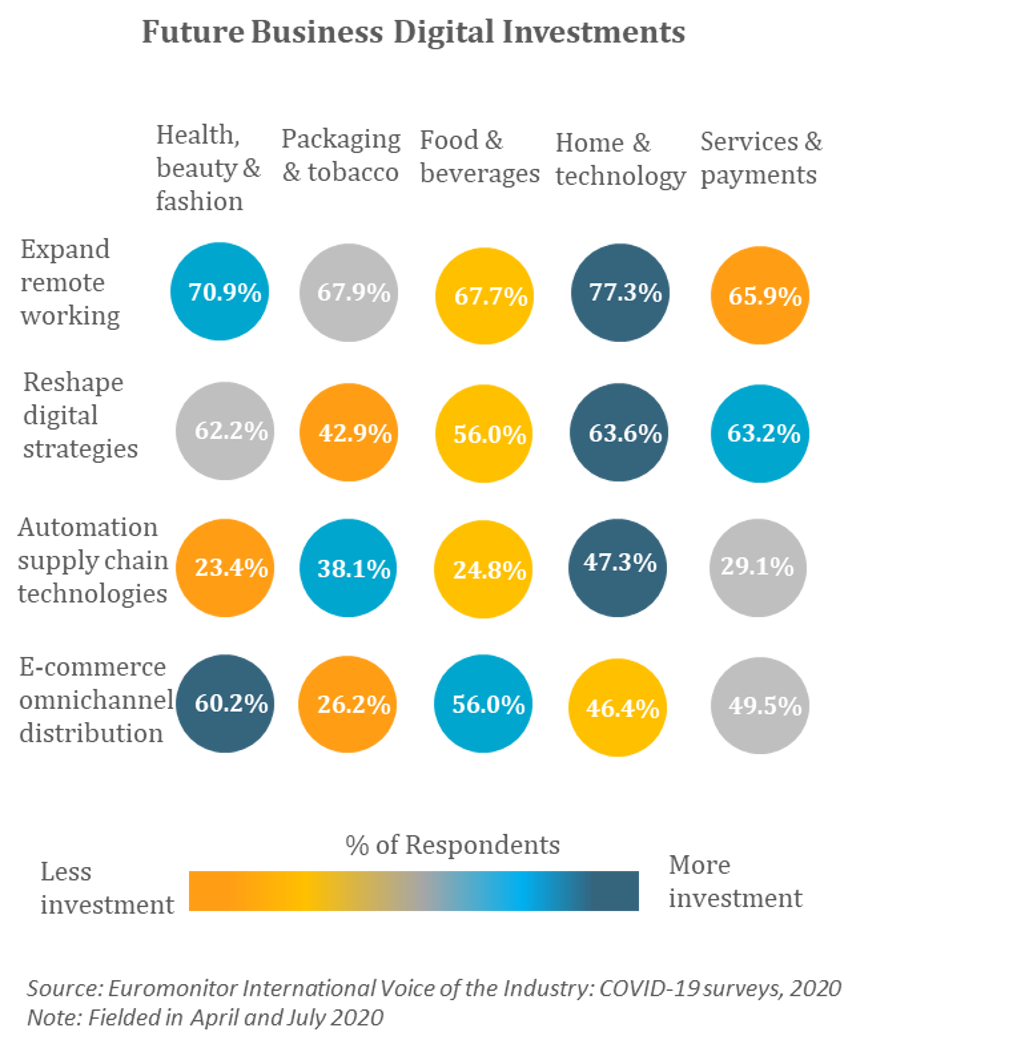

Home and Tech to lead digital investments

COVID-19 has affected different industries to varying extents, resulting in different responses, with the home and tech space leading digital investments in three out of the four key areas: automation of the supply chain, expansion of remote working, and reshaping digital strategies. Quicker to react, and with stronger digital assets compared to other sectors, home and tech companies are planning fewer future e-commerce investments than most other industries, except for packaging and tobacco.

Forced to close during lockdown, beauty and apparel retailers are leading investment in e-commerce and omnichannel distribution but lagging behind in investments in automation and supply chain technologies, despite greater pressure for apparel brands to create supply chain transparency. The packaging and tobacco industries plan the lowest investments in reshaping digital strategies, along with e-commerce and omnichannel distribution.

Digital strategies to offer long-term competitive advantage post-pandemic?

Leveraging digital innovation will be key for businesses to deliver on their purpose-driven promises. The opportunities of these technologies to impact businesses across all industries are limitless, including improving efficiency, transparency and the employee and customer experience, while also allowing for greater collaboration, brand reputation and accountability.

However, with some of these technologies still in their infancy, early adopters will face several challenges related to costs, uneven access across the world, data protection issues and workforce skills gaps, among others.

To overcome these barriers, brands need to design long-term digital strategies putting people first, maximising the value that digital innovation can bring to the triple bottom line and minimising potential for unintended consequences, such as job losses, environmental footprint and privacy concerns. While the use of digital tools is tied up in an open debate around ethics, the technology can be a force for good in terms of sustainability, with tech players such as Google and IBM now applying artificial intelligence to predict climate change with promising initial results.

Businesses that are agile in integrating digital tools into their sustainability strategy will gain not only a competitive advantage, but also the necessary social license to operate, whilst those relying on offline operations which are too slow to adapt will risk losing consumer trust and becoming outdated.

With the shift to online channels expected to be long-term, companies should keep an eye on emerging digital solutions such as blockchain, artificial intelligence or machine learning, with the potential to become more scalable and cost-competitive in the medium-term.

For more insights on the future outlook in the sustainability space, access the full report Rethinking Sustainability: No Purpose, No Gain