The EU and the UK did not agree to extend the transition period by the deadline of 1 July 2020 set in the Withdrawal Agreement Bill. This means that the special circumstances that the UK enjoys now - being out of the EU but trading with the bloc without tariffs - will end at the end of 2020. The new trade deal needs to be signed before then otherwise the UK will leave the EU with no deal and revert to the World Trade Organization (WTO) trading conditions. This could cause shortages of goods, queues for importing and exporting products, and difficulties in crossing the UK and EU border. On top of that, it is unknown how Northern Ireland, which has a land border with the EU, could deal with the EU in the case of a No-Deal Brexit.

However, Brexit is not the only source of risk in 2020. The UK has had the highest number of deaths from coronavirus (COVID-19) within Europe to date. Due to COVID-19, the UK economy will contract by 10.3% in real terms in 2020 and is expected to rebound by 5.0% in 2021. The level of output that the British economy produced in 2019 will be reached only in 2023. However, the Brexit process ending in a no-deal could impede and prolong an already fragile economic recovery.

Probability of a No-Deal Brexit has increased since the beginning of 2020

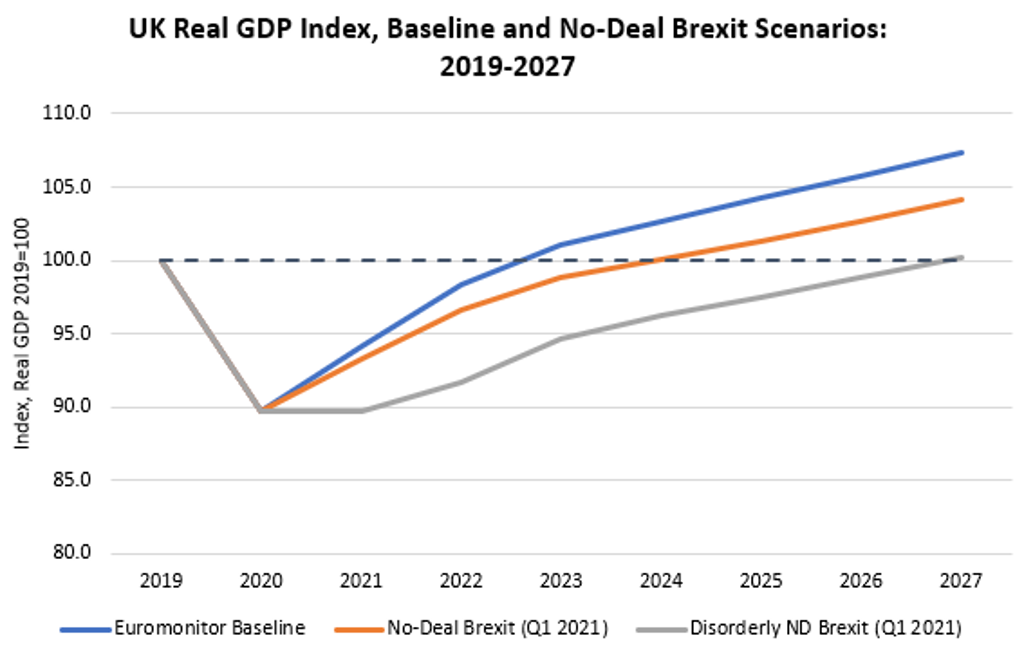

In our view, the probability of a No-Deal Brexit has increased after the parties did not agree to extend the transition period. Time is ticking and only half a year remains to reach a deal. Currently, Brexit negotiations are at standstill with many issues remaining to be sorted out: level-playing field for businesses, fisheries and migration laws, to name a few. Hence, we have raised the probability of a No-Deal Brexit scenario from 35% to 45%:

• In our most likely No-Deal Brexit scenario, the UK leaves the EU without reaching a new trade agreement during the transition period. We expect this scenario to play out with a 30% probability. Trade relations with the EU default to WTO conditions with significantly higher barriers. Severe disruptions at the border last for 1-2 quarters until UK and EU customs services develop the capacity to handle the massive increase in work volume and complexity. Supply chain disruptions lead to slowdowns in factory production lines. The UK economy grows at 4.0% in 2021 in real terms in this No-Deal Brexit scenario compared to 5.0% growth in 2021 under the baseline scenario where a Free Trade Agreement is reached between the parties and No-Deal Brexit is avoided. It will take up to 2024 to reach the 2019 level of real GDP under this No-Deal Brexit scenario;

• In the Disorderly No-Deal Brexit scenario, the UK leaves the EU without a trade deal during the transition period. This Disorderly No-Deal Brexit scenario is expected to play out with a 15% probability. Trade relations with the EU default to WTO conditions with significantly higher barriers. Any attempts by the UK to sign new trade deals require lengthy and difficult negotiations. As a result, no significant new trade deals are signed during the first five years after exiting the EU. Delays in establishing smooth customs and regulatory controls at the border lead to chaos and shortages of certain goods in the short term. Supply chain disruptions lead to slowdowns in factory production lines. In this scenario, the UK economy stalls in 2021 in real terms. In this more extreme economic scenario, the UK will take up to 2027 to reach the 2019 level.

Source: Euromonitor International Macro Model. Note: Data for 2020 onwards are forecast.

Businesses face double uncertainty: Brexit and COVID-19 pandemic second wave

A possible second wave of the COVID-19 pandemic is one of the main risks that economies around the world face and are trying to build contingency plans for. The UK is no exception. Since June 2020, the UK started reopening the economy and relaxing social distancing restrictions. However, the elimination of restrictions will be gradual and dependent on the ongoing pandemic situation. Given the large presence of COVID-19 cases and high rise in jobless claims, consumers are likely to remain cautious for a considerable period of time.

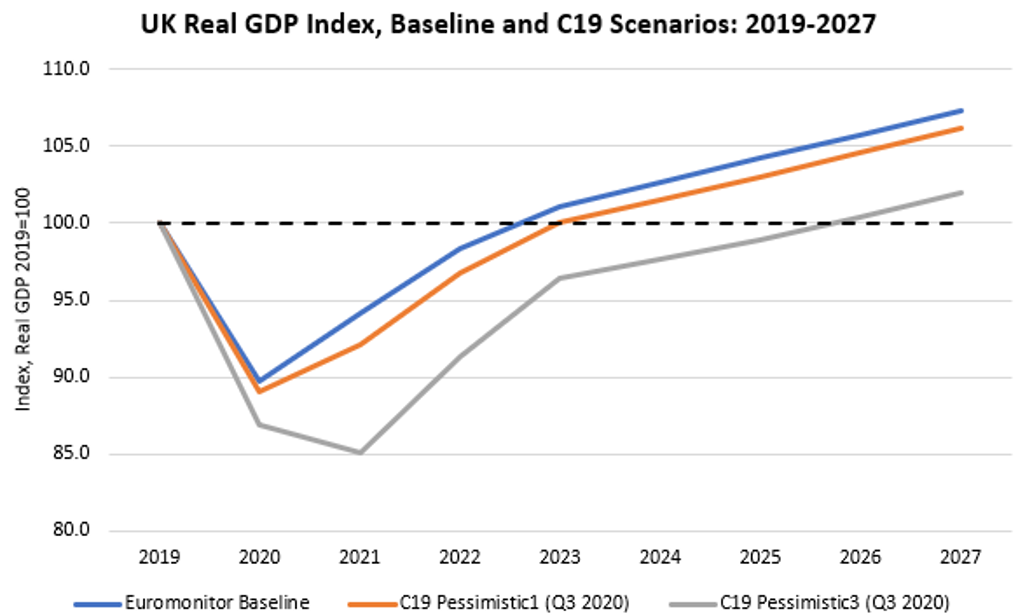

We expect a 50-55% probability of seeing a second wave of the pandemic in the next year. Thus, our baseline forecast with a single-peaked pandemic is likely to play out with a 45-50% probability. In our baseline scenario, social distancing effects subside in the UK in the autumn of 2020. Businesses reopen and the economy can start a recovery in 2021. The recovery still takes a long time due to a massive shock to labour markets, consumer finances and businesses this year. In this scenario, real GDP shrinks by 10.3% in 2020 and rebounds by 5.0% in 2021. The economy reaches 2019 level in 2023.

In our C19 Pessimistic1 scenario, the pandemic returns with a stronger force in Q3 2020 and social distancing effects last until Q2 or Q3 in 2021. The financial crisis is not triggered, and businesses still have access to financing limiting the amplification of the additional shock. UK real GDP drops by 11.9% in 2020 and grows by a meagre 1.0% in 2021. The economy rebounds to 2019 level in 2024.

In our C19 Pessimistic3 scenario, the pandemic also returns with a strong force in Q3 2020. Social distancing effects which impede economic recovery last until Q4 2021 - Q2 2022. On top of the severe health crisis, the financial crisis also hits. The crisis reaches the economy via two channels: social distancing effects and lack of financing for businesses in need. In this most pessimistic scenario, the UK economy would contract by 13.2% in real terms in 2020, it will stay in recession in 2021 shrinking by 2.0% and it would rebound by 7.0% in 2022. The 2019 level would be reached in 2027.

Source: Euromonitor International Macro Model. Note: Data for 2020 onwards are forecast.

Public attention is likely to come back to Brexit in the second half of 2020

The UK economy is experiencing the largest economic crisis since WWII and faces significant risks from two sources: a potential No-Deal Brexit and a second wave of COVID-19 infections, significantly dampening consumer and business confidence. The economy will take years to recover and reach the 2019 level of output. Even though the priority is safeguarding the population from the rise of COVID-19 infections, Brexit risks should not be overlooked. For the short-term economic outlook for 2021-2022, effects of a rise in infection rates are similar to a relatively mild No-Deal Brexit scenario. However, a No-Deal Brexit, unlike the COVID-19 pandemic, is likely to affect long-term potential growth as well. The economy would fall onto a slower growth path for years if the Brexit process ended with no deal where the UK would crash out of the EU trading bloc on 1 January 2021.