The US, the world’s largest economy, producing around a quarter of all global output in US dollar terms, now faces major disruption, which could affect the global economic recovery from Coronavirus (COVID-19)-induced recession.

Americans are currently voting in the presidential election. The outcome of this will influence the stance of US international trade, as well as the scale of domestic fiscal stimulus aimed at cushioning economic damage during the recession. More immediate than this is the national health crisis stemming from the COVID-19 pandemic. In addition to the health crisis comes pronounced uncertainty for global trade: the first phase of the trade agreement between the US and China is not working as expected since Chinese imports of US goods have not reached the agreed amounts. At Euromonitor International, we model economic scenarios to project “what-if” analyses, to help businesses see beyond this uncertainty and prepare contingency plans.

US election to have limited immediate impact on US economic growth

Regardless of the election outcome, we are likely to see additional fiscal stimulus measures in 2021, such as increases in unemployment benefits or direct stimulus cheques sent to households and expanded loans for small businesses to safeguard the economy during the downturn and limit long-term damage. A key difference between the candidates is that Biden is likely to implement more generous fiscal stimuli than Trump, even if a Republican-controlled senate forces him to scale down his plans.

Our baseline outlook assumes a Joe Biden victory. In the event of a second Trump Presidency, policies are likely to lean towards fewer social distancing restrictions and more economic activity in high social contact sectors, at the cost of much higher infection rates of COVID-19 than under Biden.

Overall, the direct impact of the election on the US economic outlook is likely to be modest, with a Trump win meaning around 0.1-0.2 percentage points lower real GDP growth in 2021. Our current baseline forecast is that US real GDP will grow by around 3.5% in 2021.

Lower risk of a trade war if Biden wins

One potential caveat to the modest change in the economic outlook under different Presidents is that a Trump victory would significantly raise the risk of an escalation in the ongoing trade war with China. Even a more global trade war, including the EU, Canada and Mexico, could start. Escalating trade war scenarios could reduce US economic growth in 2021 by 0.2-0.6 percentage points. It could also significantly impact global trade, as the US accounts for around 13% of global imports and 9% of global exports. In contrast, a Biden presidency is likely to cause a major improvement in trade relations with the EU and other countries and lower risks of a worsening US-China trade war.

US Economic Growth Baseline vs US-China Trade War Scenario: 2021-2023

Source: Euromonitor International Macro Model

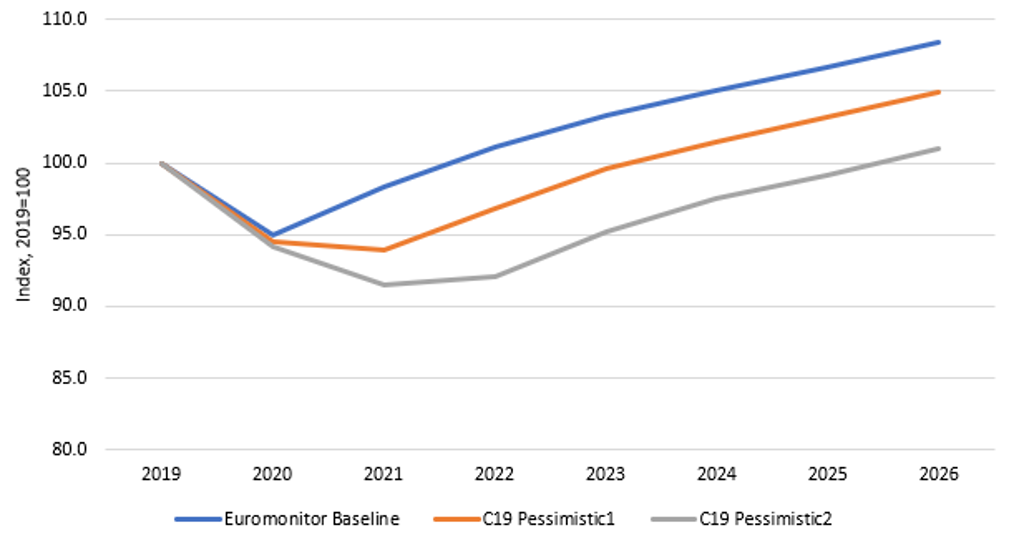

Worsening COVID-19 situation remains the key risk for US economy

Nevertheless, the main risk to the US and global economies remains the COVID-19 pandemic. If the US were to introduce strict lockdowns amidst increasing infection rates, prompting further business and factory closures, projected US economic growth in 2021 would fall from 3.5% to -0.5%. We give around 32% probability for this situation. Under this scenario, social distancing effects would last until mid-2021, with a vaccine for COVID-19 becoming available and widely distributed. In these conditions, the US economy would still need until 2023 to return to 2019 performance.

However, the outlook is likely to worsen if vaccine development is delayed beyond mid-2021. In our C19 Pessimistic 2 scenario, we assume that a vaccine for COVID-19 will become widely available only in 2022 or 2023 and social distancing effects will continue till such time. The economy would only start to rebound in 2023. Here, the economy would contract by 2.9% in 2021 and grow by only 0.6% in 2022. It would take until 2025 to produce the 2019 level of output.

US Economic Output Under COVID-19 Scenarios: 2019-2026

Source: Euromonitor International Macro Model

The US economy faces considerable risks, with the COVID-19 pandemic likely to have the heaviest impact in the short-term. The risk of trade war associated with the outcome of the US presidential elections should, however, not be overlooked, since a US-China trade war could prolong the economic downturn and slow economic recovery. Serious deglobalisation risks could even reduce the long-term economic growth and prosperity for the US by lowering international trade, which the US heavily depends on in sectors such as energy and technology.