Ethical and sustainable fashion to take on rising competitive influence

As competition in apparel and footwear has intensified, players have been drawn into a particularly fierce spiral of competition to bring products to market faster and at lower cost than rivals. The ongoing decline in unit prices that has characterised the fashion industry for over 10 years, has hampered the profitability of even the most efficient and agile players.

Recognising this, brands across the globe have sought to reintroduce products at previously neglected mid-range price points; reducing the emphasis on price-competition and more towards a differentiated product and service offering. As evidence of this, after years of consecutive contraction, average prices per unit of both apparel and footwear are forecast to stabilise through to 2023.

More accommodating competitive landscape for ethical fashion

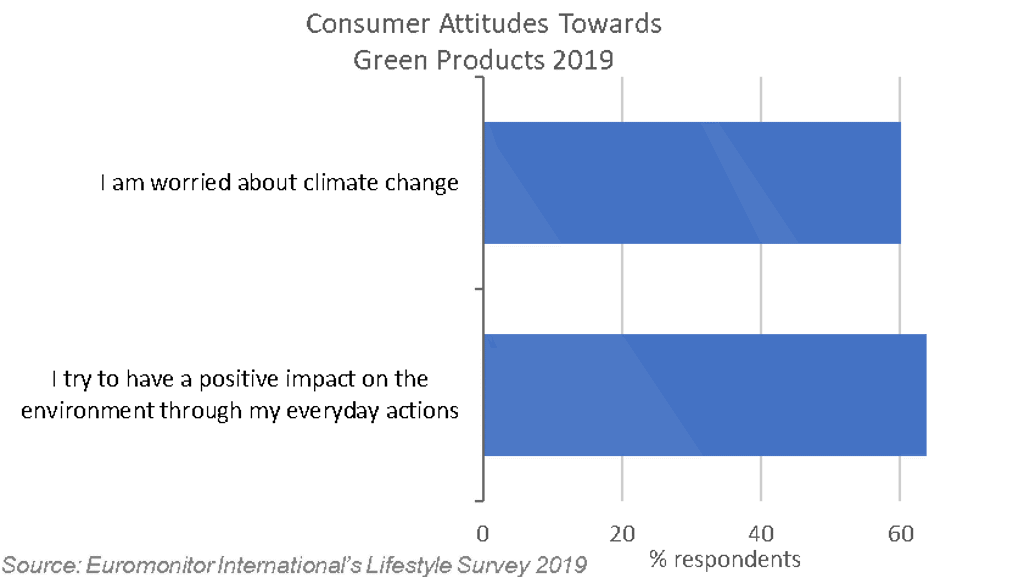

These trends coincide with growing consumer awareness of the impact of their ever-expanding fashion consumption. In 2019, 64% of respondents agreed with the statement “I try to have a positive impact on the environment through my everyday actions”. This has seen consumers and regulators place mounting pressure on fashion’s leaders to address the industry’s effect on people and the environment.

As competition shifts away from a focus on price, players are increasingly likely to promote the origins, ethics and environmental impact of their sourcing in order to differentiate themselves from equally agile and responsive rivals in the eyes of consumers. As leading players seek to wean consumers off continually falling prices, smaller ethically minded brands may face gradually reduced pressure from the market to cut costs themselves.

Combined, these dynamics are likely to produce a competitive landscape that is much more favourable to brands with strong ethical and sustainability credentials. Notably, as globally recognisable brands compete more open with claims of ethical and sustainable production, an initial benefit will be the general growth in consumer education and awareness brought to these issues.

With greater public scrutiny on ethical and sustainable production, brands that can claim to add tangible benefits to the communities and environments they source from will stand in stark contrast to those only seeking to reduce reputational risk. Smaller players like US sportswear, jeans and footwear manufacturer Origin USA, which produce domestically with strong claims to investment in the development of the local area and its craftspeople, are thus likely to attract new consumer interest.

There is further potential that as more companies seek to move away from production concentrated in traditional outsourcing markets like China and Bangladesh and closer to local markets, the supply of high-quality suppliers with transparent production processes will rise to meet the growing demand. As this develops, ethical brands may be able to choose from a greater number of suppliers at closer proximity and at lower cost than has been the case historically.

New challenges and opportunities shaping ethical fashion

As ethical and sustainable production takes on a greater role in the competitive landscape of apparel and footwear, smaller ethical brands seeking to exploit these trends will need to remain wary of new threats to their growth.

Chief among these is that there is little evidence to suggest that most consumers will significantly change their spending based on claims of sustainable production alone. In Euromonitor’s 2017 lifestyles survey, when asked which apparel product features they would be willing to pay more for, 42% of consumers cited “Comfortable” followed by 33% of respondents citing “High Quality”. “Sustainably produced” came in markedly lower at 6% of respondents.

This suggests that despite rising attention being paid to ethical fashion, unsurprisingly most consumers are unwilling to compromise on the core features that have traditionally attracted them to apparel and footwear brands in the first place.

Tangible Consumer Value

Players seeking to capitalise on the growing influence of ethical and sustainable fashion must continue the core task of innovation to combine aesthetic appeal and function in the clothing and footwear they produce, with promotion of the ethics of their supply chain coming in second. Consumers have shown far greater willingness to make practical changes to their spending where ethical or sustainable production also has a tangible impact on their experience of the product.

For example, ethically produced jeans made by skilled local craftsmen, or trainers made from a recycled material that produces a distinct look or added durability. As a result, ethical players operating in technical categories, such as sportswear, outwear, jeans and footwear where quality differences are more clearly visible to the consumer are likely to perform better.

Tell the total sourcing story

Additionally, in promoting the ethics and sustainability of their production, many ethical fashion brands have failed to tell a detailed and compelling story of the work they do to bring products to market. Commonly, brands in this space seek to promote an abstract idea of ethics and sustainability. This sees brands missing out on the opportunity to draw consumers into a brand identity or a mission they can readily be a part of with their purchases.

Beyond just ensuring good practices in sourcing and production, ethical players would do well to highlight the individual stories and motivations of their suppliers, their facilities and even the local communities from which they source. Origin USA for example, provides a compelling narrative of their mission to revitalise manufacturing in the United States going into detail on every aspect of their production using new digital media such as podcasts to involve consumers at every level.

A particularly innovative example of a total sourcing story comes from Dutch online pre-order service Unrobed. Offering capsule collections available for pre-order for 30 days, the brand uses organic materials, and ethical suppliers. This direct to consumer service provides a detailed breakdown of the price of every aspect of each garment’s production including raw materials, labour costs and transport.

Consumers are then kept up to date on the progress of their order with regular updates throughout the production process leading up to a home delivery. This level of detail not only educates consumers on how much work goes into their garments, and provides a compelling, tangible story they can buy into.

While the challenges of standing out amongst the vast range of apparel and footwear brands shows no signs of easing, the changes occurring in the competitive landscape suggest that as ethical fashion moves out of a niche product segment into the mainstream, ethically and sustainably produced brands with an innovative proposition may tap into far greater opportunities for growth than were previously open to them.

For more insight on the strategies behind becoming a more sustainable brand check out Euromonitor’s Whitepaper: How to become a sustainable brand