Virtually all fmcg businesses have struggled with global supply chain disruption. Across Western Europe, EUR156 billion in new pandemic-driven e-commerce sales (growth in 2020 and 2021) has created unprecedented demand for goods and unprecedented strain on supply chains. At the same time, the regularity of economic shocks – whether it is inflationary pressure and increased prices, the war in Ukraine and the shift away from Russian natural gas, the global semiconductor shortage, or China’s ongoing zero-COVID policy – is becoming a kind of new normal. One challenge follows another, and many companies dependent on intricate pre-COVID global supply chain systems are feeling increasingly vulnerable.

Supply chains, which normally operate seamlessly behind the scenes, are suddenly in the spotlight. Regular consumers watched the 2021 Suez Canal blockage on the news. They saw first-hand when products were unavailable on store shelves, or had to wait months for things such as bicycles or cars. In the short term, product availability will be a key market advantage for those companies with more resilient supply chains. While this is true for companies everywhere, in Europe, companies must also balance supply chain resilience with supply chain transparency, leveraging decarbonisation strategies to comply with regulations that are coming, and to meet the values-driven expectations that consumers in Europe increasingly have.

Nearshoring for supply chain resilience

Nearshoring, or shortening the supply chain, has been one important tactic for European companies looking to navigate global supply chain challenges. Generally, shorter supply chains are more durable and easier to trace. For the most globalised fmcg companies, such as IKEA, the shorter the supply chain, the less vulnerable the company is to disruptions outside Europe, and the more likely products remain available on store shelves. Since 2021, IKEA has been nearshoring the production of many products from manufacturing centres in East Asia to Turkey, to better serve stores across Europe and the Middle East.

Another tactic has been to take on more direct control of the supply chain, rather than outsourcing to third-party services. Lidl, for example, a large German-based retailer with a 31% share of the discounters channel across Western Europe (in 2021), recently established Tailwind Shipping Lines to ship and distribute Lidl products. Lidl has chartered three ships and is acquiring a fourth, according to recent reports. While this may seem extreme, it illustrates the importance that brands place on reliable supply chain structures. Even if consumers have become more tolerant as they have become more aware of global supply chain issues, they will nonetheless gravitate towards those products and brands that are readily and dependably available, and may build loyalty along the way.

Decarbonisation and the way forward in Europe

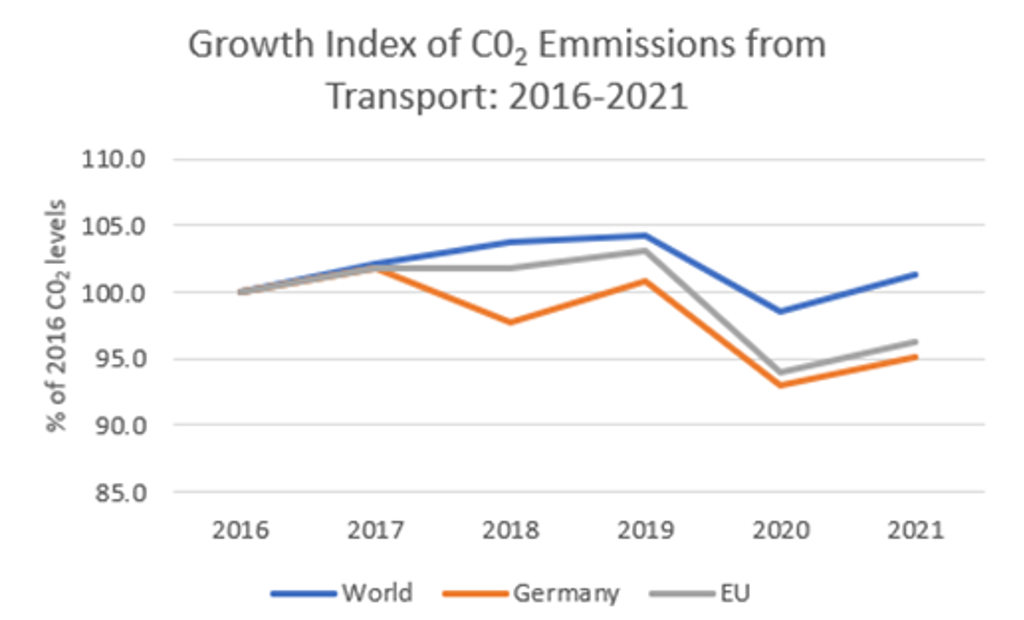

If resiliency helps minimise disruption now, decarbonisation is crucial for remaining competitive in Europe moving forward. Transport logistics are traditionally a major contributor of carbon emissions and are subject to increasing regulation by the EU Commission. The European Green Deal, a major investment vehicle meant to help the EU become the world’s first net-zero economy by 2050, will force companies to report emissions. This includes emissions across the entire supply chain, which means supply chains will need to be transparent and traceable. In Germany, for example, a new Supply Chain Act will introduce new reporting requirements from 2023 onwards. Those businesses that exceed limits (or cannot accurately trace their supply chains) will be forced to pay penalties that become stricter each year.

Ambitious decarbonisation plans are driving innovative decarbonisation strategies. Ocean-based shipping remains the dominant form of goods arriving to and from Europe, but Europe is investing in a multi-modal inland (or hinterland) distribution network to extend global supply chains through Europe in a more sustainable way. In place of truck-based shipping, which is highly carbon-intensive, Europe benefits from extensive rail and inland waterway systems. According to the Port of Rotterdam, roughly 30% of goods arriving to Europe’s largest port are shipped further inland by river barge. With more inland points of distribution, supply chains are less prone to disruption and goods are more likely to arrive on time.

Logistics services and the ports themselves are also adopting greener strategies. Port operations are increasingly digital, facilitating the more efficient flow of goods and allowing for better tracking. More logistics machinery is battery powered. Electric pickers (vehicles that shift containers from one place to another) are increasingly available and viable, and shift containers from ships to trains, which are operating on increasingly electrified tracks. Choosing greener logistics providers can help decrease a company’s total carbon output as a business and avoid penalties for not doing so.

Once an afterthought, supply chains are increasingly in focus and increasingly relevant to a company’s ability to operate in a decarbonised Europe, and there is a lot at stake. While change is costly and often challenging to implement, especially for the many small and medium-sized businesses operating in Europe, there are more options and more incentives to do so. Navigating these complex supply chain issues successfully means being available to consumers who have more expectations about the goods they choose to buy than ever, and creating a market advantage along the way.

For more insights on global supply chain challenges, visit Euromonitor’s new Inflation Surge insights page, or consider a bespoke consulting solution.