The latest edition of our Global Economic Forecast report has launched for Q2 2019, looking at the quarterly macro changes for the world’s key economies and what these mean to our view of the likely, optimistic and pessimistic scenarios for the global economy.

Global economic expansion slowed down in 2018 to 3.7% and this weak growth momentum is expected to carry on to 2019. In 2019-2020, annual global output expansion is forecast to decline to 3.3-3.4%.

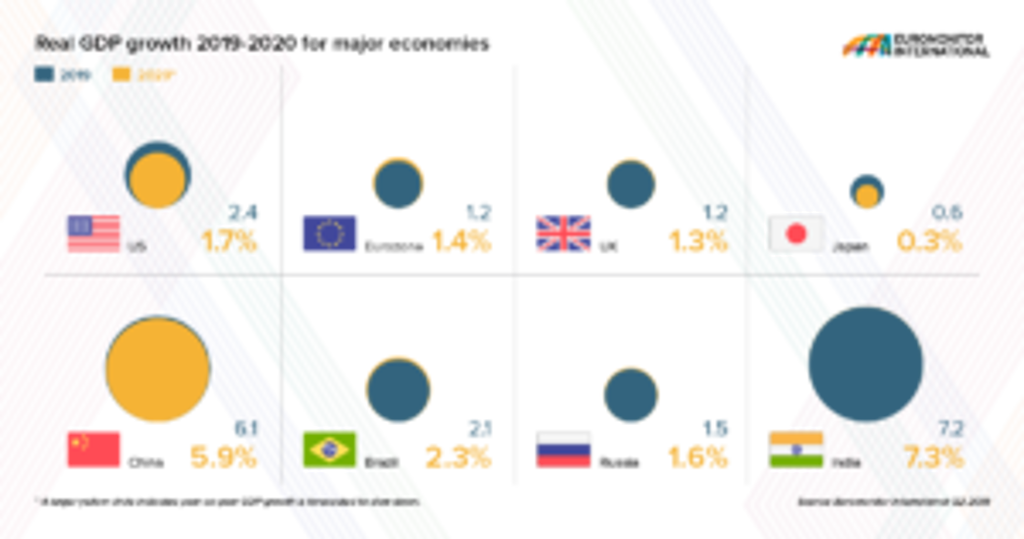

Advanced economies are expected to see their economic activity slow down gradually in 2019-2020, with real GDP growth averaging 1.5-1.8% annually in 2019-2020. Labour productivity and real wage growth will improve but remain disappointing at 0.7-1.7% annually.

Emerging economies, by contrast, are anticipated to witness improving economic dynamics and expand by around 4.6-4.8% annually in 2019-2020. India and China, despite the gradual slowdown of the latter, will remain a core of emerging economies’ output growth.

Global financial conditions have improved since the end of 2018 after big negative shocks in Q4 2018, but they remain tighter than in October 2018. The loosening monetary policy stances of the main global central banks have also supported the stock markets’ rally in Q1 2019. Global monetary policy will tighten very gradually over 2019-2021, with both the Fed and ECB providing forward guidance of delaying further interest rate increases in 2019.

Risks remain high

Global economic risks remain skewed to the downside. Main risk factors include escalating trade tensions between the US and China or the EU, growing geopolitical uncertainty in Europe and Asia, greater vulnerability of US corporate debt to financial market or monetary policy shocks and risks of a no-deal Brexit. Broader risks of lower economic recovery momentum and greater uncertainty in financial markets in general also remain relevant.

Biggest forecast changes for the Eurozone, Canada and the UK

The Eurozone

Economic data since the beginning of 2019 has confirmed the slowdown in the Eurozone economy relative to 2017-2018. We now expect GDP growth in 2019 at around 1.2% (compared to 1.7% forecast in the beginning of 2019). Previous expectations of an ongoing recovery from the Eurozone Crisis of 2011-2014 have disappeared. The Eurozone slowdown is concentrated in the manufacturing sector which contracted at the end of 2018 and is still stagnating in 2019. The main factors in the slowdown have been worsening global trade environment, ongoing Gilets Jaunes protests in France and disruptions in car production due to new environmental emissions standards.

Canada

The Canadian economy has slowed down due to a combination of negative oil sector supply shocks and worsening consumer spending growth. Production restrictions were imposed in the oil sector in an attempt to boost the relatively low price of Canadian oil. While this expected to improve revenues over a 1 to 2-years horizon, the short-term effect is a significant decline in output and revenue. A potentially more persistent problem for the Canadian economy is excessive household debt levels. These have led to higher household borrowing costs, an increase in precautionary household savings and a decline in the growth of consumer spending and housing investment. GDP growth in 2019 is expected at around 1.2% in 2019, with a moderate rebound to 1.5% growth in 2020 (compared to a long-term growth rate of 1.7%).

The UK

Uncertainty over a no-deal Brexit risk peaked in Q1 2019, with a fast-changing political situation, policy paralysis in the UK parliament and the approaching end of the Article 50 period without a settled deal. In April, the EU agreed to an extension of the Article 50 period until 31 October 2019. This has eliminated the immediate risk of the UK crashing out of the EU without a deal and has made a Customs Union or Light Brexit outcomes more likely. However, political uncertainty remains high and is expected to cause business investment to stagnate during 2019. The 2019 GDP growth forecast has been revised down to around 1.2%.

Euromonitor International’s new macroeconomic outlook, Global Economic Forecasts: Q2 2019 provides the latest Euromonitor International macroeconomic forecasts, assessment of the global economy, discussion of recent events and a deeper analysis of key economies. Download Global Economic Forecasts: Q2 2019 to stay ahead of risks and opportunities as they emerge on a macroeconomic basis.