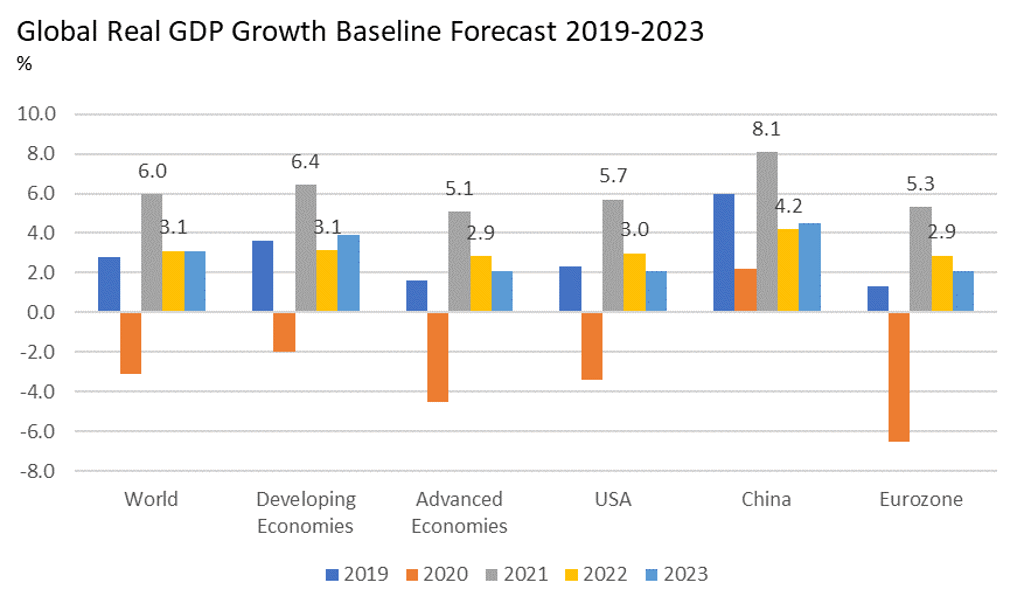

The global economy has faced a new round of headwinds following the Russian invasion of Ukraine in late February 2022, while the COVID-19 pandemic is not yet over. The war in Ukraine and its resulting sanctions imposed on Russia are projected to cause accelerated energy and commodity prices, further disruptions in global supply chains and reduced business and consumer confidence. Overall, global economic growth is forecast to slow down significantly from a strong recovery of 6.0% in 2021 to 3.1% in 2022 and 2023, while inflation is expected to surge to 7.6% in 2022 from 4.3% in 2021. A deteriorating economic outlook will affect consumer and business confidence, weighing on private investment and consumption in the short and medium term.

Significant downgrade in global economic outlook

The global economic outlook has worsened since the start of the war in Ukraine and the imposition of major economic sanctions on Russia. In Euromonitor International’s Q2 2022 baseline forecasts, global real GDP annual growth is revised downward to 3.1% in 2022 (with a range of 2.0-4.0%), 1.2 percentage points lower than the Q1 2022 forecast. Global growth is expected to remain at the same level of 3.1% in 2023 (with a range of 1.8-4.2%).

Global negative economic spillover effects from the war in Ukraine are mainly expected from higher energy and commodity prices, declines in private sector confidence and higher financial market risk premia effects due to higher geopolitical risks. The biggest short-term economic impact is likely to come from global energy and commodity prices, due to Russia’s role as one of the leading producers of energy and commodities. The baseline scenario assumes that the war could last 1-5 years, while the global economy adapts to a partial economic decoupling from Russian energy and commodity imports.

Source: Euromonitor International Macro Model

Note: (1) Data from 2022 are forecasts; forecasts updated 11 April 2022 (2) Regional real GDP growth using PPP weights

Beyond global spillover effects, the depth of the impact of the war in Ukraine varies among economies, with the Eurozone likely to be most affected given its relatively high exposure to Russian energy supply and the rising uncertainty around an intensification of the war. The Eurozone’s real GDP growth forecast is now downgraded to 2.9% in 2022, compared to 3.8% estimated in the last quarter. The war in Ukraine is likely to have a long-lasting impact on the Eurozone, with the region’s 2023 real GDP growth being forecast to slow down further to 2.1%.

For the US, the war is likely to have a moderate impact given the country’s energy independence. However, reduced economic activity would slow economic growth, with real GDP growth estimated to be 3.0% in 2022 (0.5 percentage points below the previous forecast) and 2.1% in 2023. China’s economic outlook is also revised downward to 4.2% in 2022 (0.5 percentage points lower than in Q1 2022), as the economy is being hit by higher energy and commodity prices, recent Omicron variant outbreaks and the country’s zero-COVID-19 policy leading to a tightening of restrictions and lockdowns in key cities.

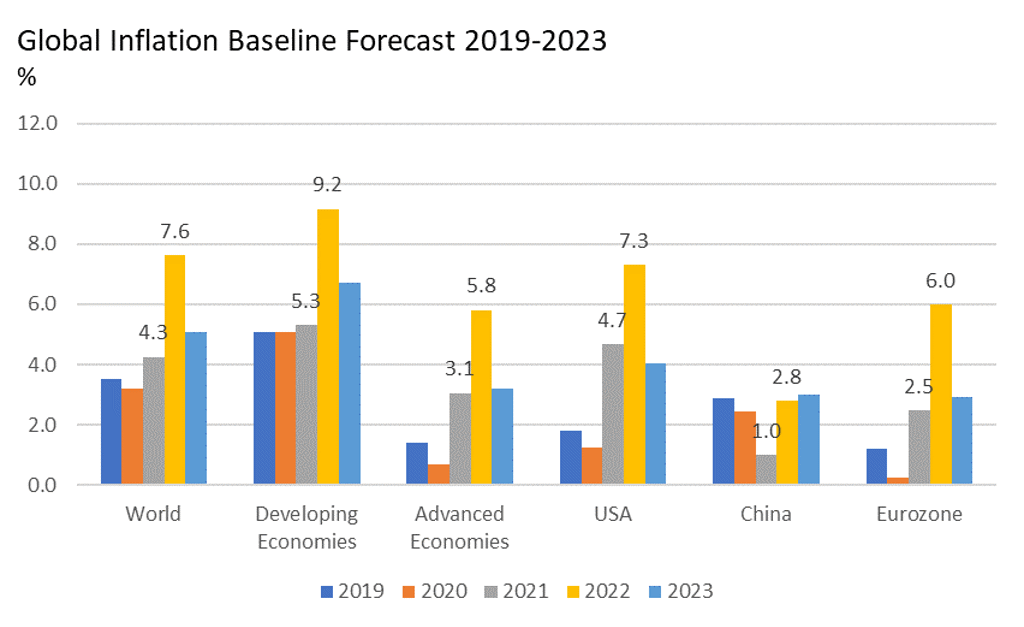

Substantial inflation increases expected amid rising economic uncertainty

The war in Ukraine and sanctions on Russia are expected to dampen some of the inflationary effects of the global demand recovery, by reducing private sector confidence and spending. However, the impact of higher energy prices on inflation is expected to increase relative to previous forecasts. In the baseline scenario, supply cuts, added volatility and upward pressures to energy and commodity prices following Russia’s invasion of Ukraine are expected to push global consumer price inflation towards 7.6% in 2022 (with a range of 6.3-8.8%) and towards 5.1% in 2023 (with a range of 3.6-6.6%), compared to 2001-2019 average annual global inflation of 3.8%.

Source: Euromonitor International Macro Model

Note: (1) Inflation refers to consumer price inflation measured by consumer price index (CPI) (2) Data from 2022 are forecasts; forecasts updated 11 April 2022 (3) Regional real GDP growth using PPP weights

Overall, higher inflation effects will be seen in economies with greater energy dependence including Germany, Spain and Italy. For some resource-driven emerging economies such as Brazil and South Africa, the rise in inflation will offset the impact of higher commodity prices. With inflation being forecast to stay elevated over 2022-2023, consumers in both developed and developing markets will increasingly feel the squeeze of rising prices, while businesses face heightened cost and profit margin pressures.

Global stagflation now the main downside risk

The global economy once again faces extremely high uncertainty, due to a combination of geopolitical, supply conditions and pandemic risks. The main risk now is that of global stagflation, as an intensification of the war in Ukraine with worse-than-expected global negative spillover effects would lead to stagnant economic growth combined with high inflation – the economic condition known as stagflation.

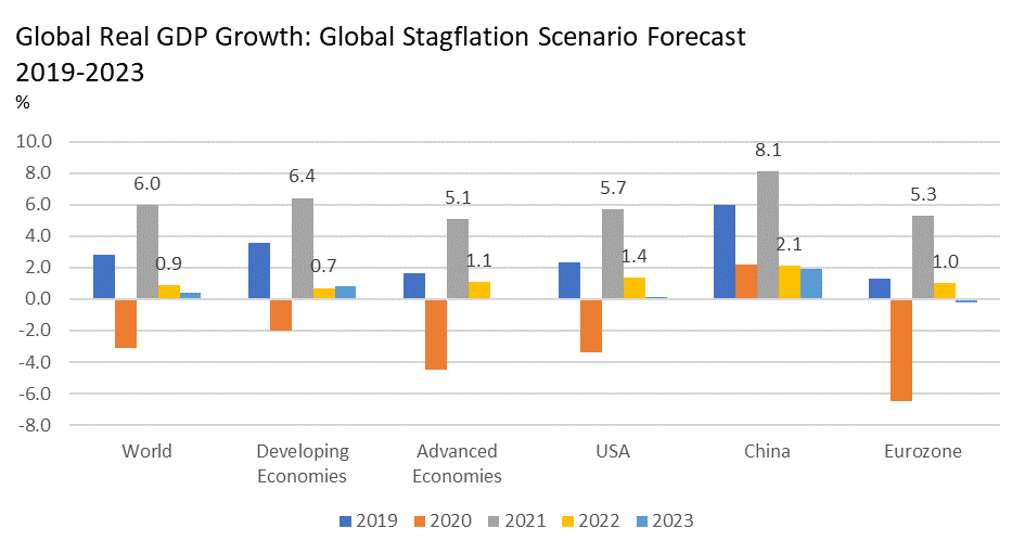

Euromonitor International’s global stagflation scenario assumes that more abrupt and significant cuts of Russian energy exports to advanced economies (especially in Europe) and greater difficulties in reducing dependence on Russian energy would lead to further increases in oil and gas prices, while further tightening supply constraints. Heightened geopolitical risks or an intensification of the war in Ukraine would cause more significant declines in private sector confidence and increases in financial market risk premia. These factors would further reduce consumer spending and business investment demand.

Source: Euromonitor International Macro Model

Note: (1) Data from 2022 are forecasts; Scenarios updated 19 April 2022 (2) Regional real GDP growth using PPP weights

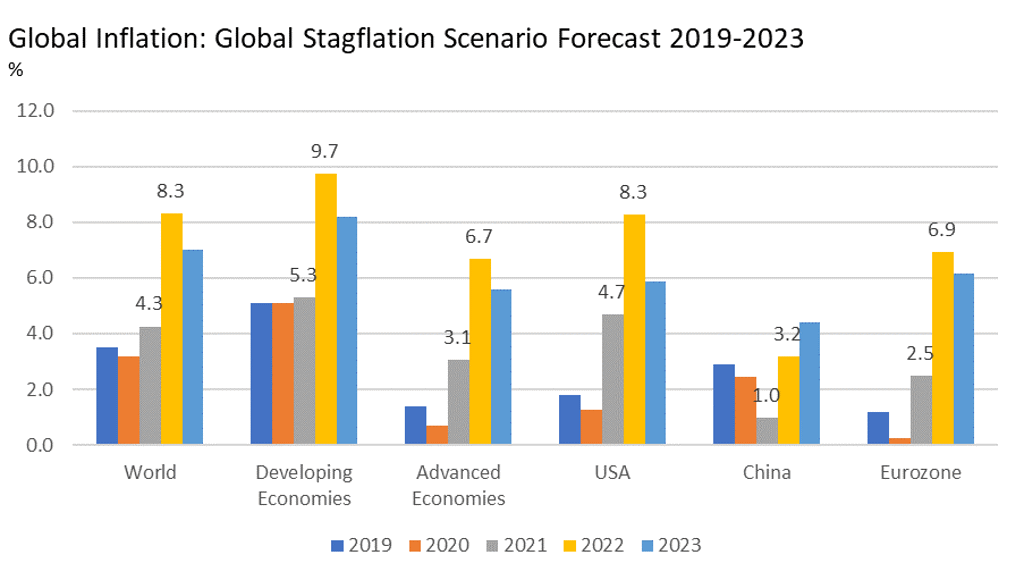

As a result, in this global stagflation scenario, global real GDP growth would decline to 0.9% in 2022 and to 0.4% in 2023. The worsening supply constraints would push producer and consumer prices even higher, with global consumer price inflation reaching 8.3% in 2022 and 7% in 2023. This scenario is assigned a 22-32% probability over a 1-year horizon.

Source: Euromonitor International Macro Model

Note: (1) Inflation refers to consumer price inflation measured by consumer price index (CPI) (2) Data from 2022 are forecasts; Scenarios updated 19 April 2022 (2) Regional real GDP growth using PPP weights

Further to the rise in geopolitical and supply conditions risks, the global economy still faces ongoing risks from the COVID-19 pandemic. In Euromonitor International’s COVID-19 Pessimistic scenario, the spread of a more infectious and highly vaccine-resistant virus mutation would require a renewal of intense lockdowns and social distancing measures in 2022-2023. Longer lasting and much stricter distancing measures would cause large drops in consumption, business revenues, employment and wages relative to the baseline forecast in 2022-2023. Under this scenario (13-23% probability over a 1-year horizon), global real GDP would decline to 0.1% in 2022 and to 0.7% in 2023.

Overall, the impact of war in Ukraine, sanctions on Russia and the ongoing COVID-19 pandemic pose major challenges to the global economic outlook in 2022-2023, threatening its recovery from the 2020 recession. While in the baseline scenario, the global economy continues to grow at around 3% annually amid high inflation, these forecasts are subject to major stagflation or recession risks. The rapidly evolving and uncertain economic situation means businesses will need to remain alert and aware of emerging global risks in order to generate timely responses.

Get more insights in our white paper, Global Economic Forecasts: Q2 2022.