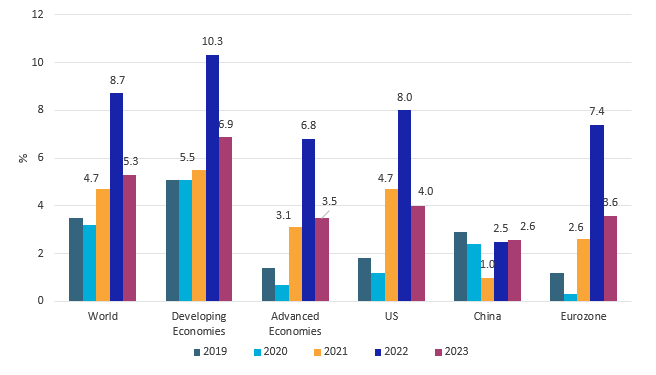

After a stronger rise in surging energy and food prices than expected in Q2 2022, global inflationary pressures have eased slightly in Q3 2022 as consumer price and manufacturer price data suggest that inflation may have reached a peak. Stabilisation of commodity prices and lower fuel costs are the main factors helping to cap the inflation surge. Under the baseline scenario, global inflation is now predicted to reach 8.7% in 2022 and then fall to 5.3% in 2023.

However, high inflation continues to erode consumer purchasing power as price growth exceeds consumer income growth. Changes in monetary policy and a rise in interest rates in many key economies are also expected to limit consumer purchasing power. Central banks are forced to tighten monetary policy to counteract inflation, although such policies are likely to intensify the global economic slowdown. Supply chain issues due to the war in Ukraine and China’s zero COVID-19 policy are also likely to persist in 2022 and at least the first half of 2023. Therefore, baseline inflation forecasts are likely to remain elevated in 2023.

Additional supply chain disruptions and potential energy price shocks remain among the key risks, and could accelerate price growth in Q4 2022 and beyond. Countries with greater dependency on energy imports, such as Germany, Spain and Italy, will feel higher inflationary effects in 2022-2023 in the event that energy price growth accelerates. This is expected to particularly increase inflationary pressures and undermine economic growth in the Eurozone.

Global Inflation Baseline Forecast, 2019-2023

Note: data from 2022 onwards are forecasts

Inflation in advanced economies reaches levels not seen since the 1980s

Given the faster increase in prices during Q2 2022, forecasts of 2022 inflation for most key economies are revised upward compared to predictions made in the previous quarter.

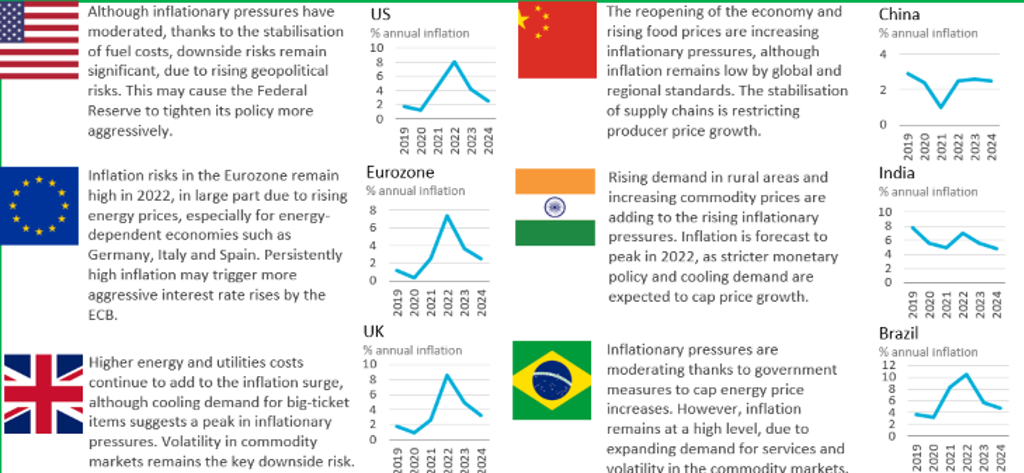

- Inflation in the US is forecast to increase to 8.0% in 2022. The inflation rate is reaching a peak as lower prices of fuel, natural gas and big-ticket items help to cap price increases. However, higher food prices and housing costs continue to add to the inflationary pressures and erode the purchasing power of consumers. The US Federal Reserve is expected to continue to tighten its monetary policy to tame inflation.

- Inflation in China is forecast to reach 2.5% in 2022 and is expected to remain moderate by global and regional standards. Lower demand for materials from the construction sector, stabilisation of domestic supply chains and efforts to strengthen price controls of major commodities are helping to stabilise price growth.

- Inflation in the UK is forecast to reach 8.6% in 2022. Inflationary pressures remain high due to the rising prices of fuel, utilities and food products. On the other hand, prices of entertainment services, used cars and big-ticket items have moderated, due to the cooling of consumer demand and rising financing costs. High volatility in the energy and commodities markets remain among the biggest risks that could fuel additional price increases in Q4 2022.

- Inflation in India is forecast to reach 7.0% in 2022. Higher energy and food commodity prices, as well as increasing consumption in rural areas are contributing significantly to the higher inflation rate. As the inflation rate is trending higher than the 2.0% to 6.0% range targeted by the Reserve Bank of India, in August 2022 India’s central bank raised the key interest rate by 50 basis points to 5.4%. This move is expected to help cool domestic demand and ease price pressures.

- Inflation risks in the Eurozone have increased, largely due to the rising energy prices and growing uncertainty over supply. Countries with high energy dependence, such as Germany, Italy and Spain, are expected to see sharper price increases in 2022 with inflation forecast at 7.3%, 7.2% and 8.0%, respectively. Persistently high inflation may trigger more aggressive interest rate rises by the European Central Bank.

Key Country Insights

Source: Euromonitor International from national statistics, Eurostat, OECD, UN, IMF

High energy costs, geopolitical risks and COVID-19 among the main risks for price stability

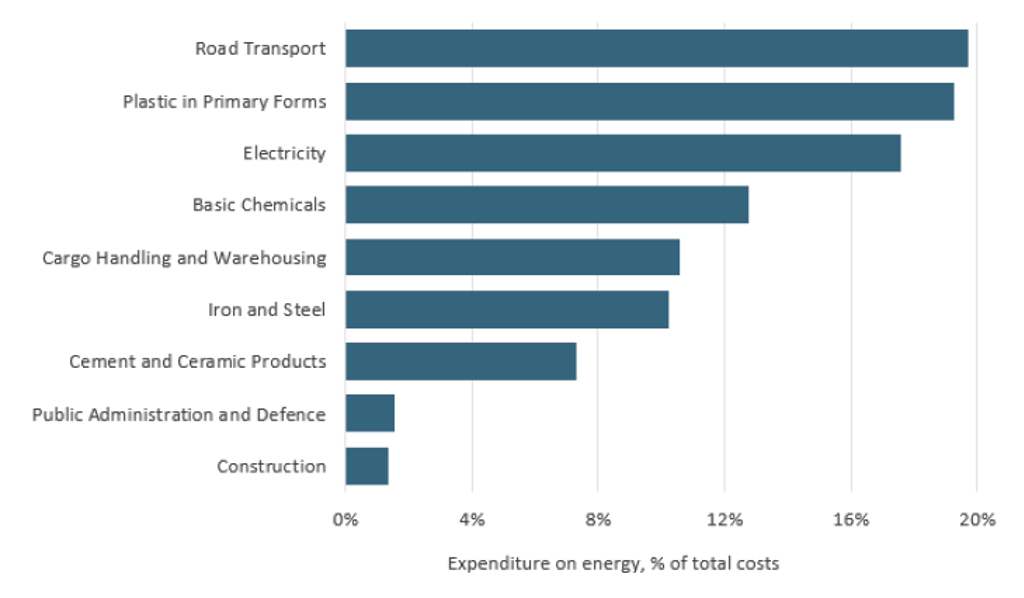

Potential punitive energy supply measures from Russia and lagging global production output of oil and gas remain among the key risks for inflation surge in 2022-2023. Energy-intensive industries, such as road transport, plastic products, chemical products and the electricity sector, would be the most heavily impacted by any increase in energy prices. Limited supply of chemical or plastic products would also have severe effects on global supply chains, as these products are used in virtually all of the largest B2B sectors as input materials.

Russia’s invasion of Ukraine also remains among the risks contributing to higher inflation levels in 2022 and potentially in 2023. Commodity supply disruptions and transportation bottlenecks are adding to the global B2B sector problems and contributing to the higher inflation level.

Lastly, new variants of COVID-19 could also add to labour market and supply chain problems, due to higher infection rates or potential lockdown measures in Q4 2022. This would particularly affect labour-intensive industries, such as agriculture, construction, retail, food production and business services. In turn, supply and production problems could contribute to the higher price growth in 2022.

Global Industries with the Highest Energy Intensity, 2021

For further insight into inflation trends access the Global Inflation Tracker: Q3 2022 report.