The focus on raising the profile of nutrition as an investment opportunity and boosting nutrition overall through fortification of traditionally consumed staples is growing in Africa.

Economic pressure sees many consumers survive on subsistence farming and there is a big opportunity to improve yield and route to market by commercialising both the production and sale of maize in the future.

Maize Production

Globally 95 percent of maize is produced for animal feed, whilst in sub-Saharan Africa the core focus of production is for human consumption. White maize is harvested earlier than yellow maize and its soft kernels make it suitable for human consumption, making it a product of paramount importance to food security in Africa. Whilst preparation methods differ across cultures, maize remains a key component of many meals and is traditionally consumed by all class groups.

Despite Africa accounting for 7 percent of total global maize production with a total of 84.2 million tonnes produced in 2017, 25 percent of the crop is lost during the process of getting the product from farm to fork.

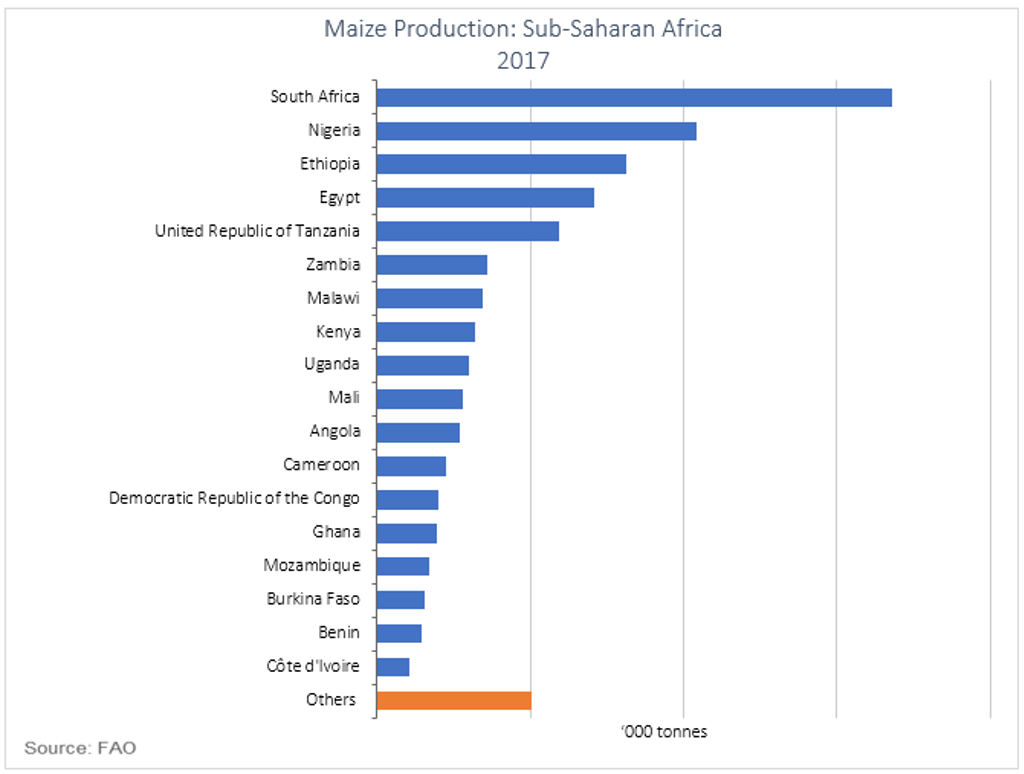

Maize occupied approximately 24 percent of farmland in Africa in 2017, more than any other crop, with South Africa being the largest producer.

However, unlike many other crops, maize is largely farmed by subsistence farmers who lack access to resources. These range from poor quality seeds and lack of fertilizer to no machinery and transport, hindering the route to market. Thus, whilst there is much potential for maize production to be increased, yields remain low.

Competition from more established packaged staples

Despite being one of the most important staples in sub-Saharan Africa and being the most widely planted crop, maize has strong competition from other staples such as rice and bread. These staples are more established, with a greater presence in modern retail outlets across a wider range of countries.

Unlike bread and rice, maize is most commonly sold unpackaged and purchased through outdoor markets, rather than through modern retail channels. Many view maize as a product that is consumed by the lower income group, and there is a greater status attached to consuming packaged bread and rice.

South Africa is an exception to this, with packaged maize being well established and leading food manufacturers playing in this category. Healthy competition in the category means that maize meal is more affordably priced than bread and rice, increasing its appeal.

Per capita consumption is high, at 81kg per person, far higher than the consumption of bread and rice. This is directly linked to the affordability of the product as a rise in price results in consumers switching to bread or rice, depending on which product carries the lowest price.

The tradition of consuming maize meal or “pap” is so entrenched in South Africa, that there is a government policy in place to fortify maize meal with vitamins and minerals in order to improve the health of lower income consumers.

Optimizing the potential of maize

It is here that opportunity lies to increase the investment potential of maize, at the same time ensuring that the greatest number of consumers have access to improved nutrition. Not only can governments focus on fortifying a product that consumers are already eating in large quantities, thus improving health across the board; but investors can stand to make good returns by entering into this market.

Governments can establish agricultural schemes and incentives to provide financial support to both farmers as well as small to medium enterprises (SMEs) so that together they can commercialise production, increase yields and increase consumer access to nutritious food.

To learn more, download a copy of the report: Maize Meal- A Look at the Ultimate Staple in Sub-Saharan Africa