Sales of hair loss treatments are growing rapidly across Europe. While recent scientific reports suggest that hair loss is a possible side effect of “long COVID”, the market is generally fuelled by increasing levels of stress, anxiety, and new kinds of work pressure generated by post-pandemic lifestyles. Hair loss treatment sales in Western Europe, the second biggest market for hair loss treatments globally, is expected to increase by 15% over the forecast period, and provide space and opportunities for brands to differentiate.

Beyond impact of COVID-19, economic downturn also accelerates hair loss

Hair loss has been reported as a common side effect following COVID-19 infection. According to a number of scientific studies published by, among others, Nature Medicine and Health University of Utah, hair loss usually occurs several months after infection and can last up to six months. Regrowth may take 9-18 months. Patients who experience hair loss from SARS-CoV-2 infection may notice hair falling out in clumps, also known as telogen effluvium. In addition, hair loss is a critical issue that is challenging an increasing cohort of consumers in the COVID-19 era. For one, economic uncertainty and the relentless rise in prices are undermining purchasing power and increasing economic anxiety.

This, in turn, drives opportunities for hair loss treatments because consumers are increasingly searching for effective hair loss remedies, hair thickening solutions, and hair growth products to combat this issue. In addition, they are also turning to these treatments to prevent hair loss before it occurs.

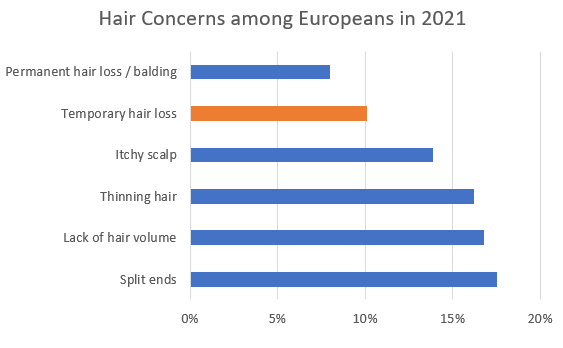

The rising prevalence of hair loss among consumers is driving demand for hair loss treatments, with sales in Western Europe expected to grow by an average 3% each year over the forecast period. Worry regarding hair loss was on the rise in 2021, with 9% of consumers in Germany and 14% in Turkey indicating this as a concern. According to Euromonitor International’s Beauty Survey (October 2021), as many as 10% of consumers in Europe were worried about temporary hair loss. This has been widely linked to COVID-19 infections and related side effects as well as pandemic stress, which has led to rising concerns over health, family and financial security.

An increasing mix of hair loss treatments and prevention, in addition to greater awareness, is creating opportunities for both categories. Shampoos and conditioners, oils, and serums are some of the prominent products used as both hair loss prevention products and hair loss treatments. In light of this, consumers are trying to adopt a more holistic approach, including general stress reduction tactics, as well as through scalp and hair health, which is improving opportunities for hair care.

Growing importance of hair health is driving demand

Increasing prevalence of hair loss among older consumers as well as pattern hair loss across younger populations, combined with stressful lifestyles and an uncertain future, provide a great opportunity for brands and products offering solutions to hair loss problems.

In Western Europe, dermatological brands such as Regaine, Vichy, Vinas Minoxidil and Alopexy have been recording strong growth over the review period. The leader Regaine’s popularity is supported by its offer of products designed for hair loss issues for both males and females.

The rise of wellness in hair care creates further opportunities for a general holistic positioning, particularly within hair loss treatments, which is expected to grow by 9% in 2022 in Western Europe. Nutrafol, which is well-known for its wide range of hair health supplements, has addressed this opportunity by launching a Growth Activator hair serum in October 2021, utilising ashwagandha (herbal treatment in Ayurvedic medicine) to boost cell renewal and protect the scalp against stress.

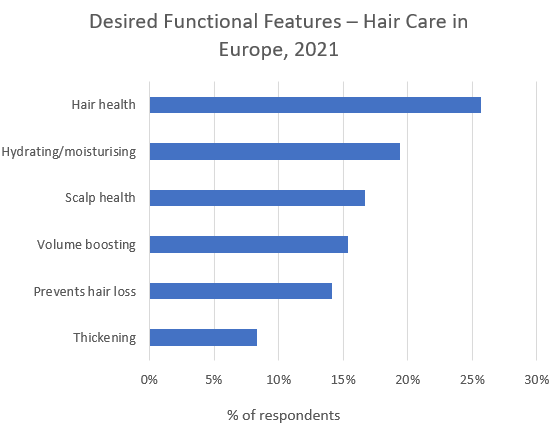

According to Euromonitor International’s Beauty Survey, scalp health was the fourth most desired functional feature in Europe in 2021, cited by 17% of respondents. This rate is rising, as consumers become increasingly aware of the impact of scalp health on hair growth and shedding, hair health and dandruff. Players entering this space in 2021 and 2022 include The Inkey List, Dr Barbara Sturm and Drunk Elephant, while existing brands which stand to gain include Philip Kingsley, which has many years of clinical expertise in trichology (the branch of medical and cosmetic study and practice concerned with the hair and scalp). Such long-standing expertise provides consumers with a sense of trust that is increasingly important in this emerging segment.

Sales of hair loss treatments in Western Europe are set to rapidly expand over the forecast period, due to older consumers becoming increasingly concerned by thinning hair as well as lack of volume. While men are most prone to balding, some women are impacted by female pattern hair loss most common after menopause due to significant hormonal changes during this period.

Baby boomers and Generation X are likely to benefit from clinically-backed products targeting hormonal hair loss. While the concerns of younger generations are oriented around hair loss prevention, brands could serve to build communities to better utilise social media. Influencer-led beauty brands have utilised their in-built communities and knowledge of social media strategy to engage with their customers, as well as giving a face and personality to the products.

Demand for healthy-looking hair is on the rise, with scalp health, the microbiome, and skin-influenced ingredients developing in the space of hair loss treatments. Incorporation of specific features will be the driving force of hair care moving forward, with consumers increasingly aware of the hair care benefits available to them across multiple price points. Both the premium and masstige segments are expected to perform well over the forecast period. Beyond investment in premium brands, companies can further instil these premium qualities across all price tiers, offering a higher value perception through products that are simple, efficacious and tailored to consumers’ needs.

For related content and further insight, see the report Maximising Prospects in Hair Care.