The shaving industry over the past decade has been quite tumultuous in the U.S. Dollar Shave Club and Harry’s entered this market with resounding success, forcing historic players such as Gillette (Procter & Gamble) and Schick (Edgewell) to reconsider their approaches to product design, pricing and overall messaging to consumers. On top of these companies entering the market, loosened social stigma against beards has resulted in decreased consumption for shaving products as a whole.

Over the past few decades, innovation relied on the addition of extra blades, changes to the lubricating strip and so on. For what some would consider a marginally better shaving experience with the added innovation, razor prices continued to rise. The strategy proved to be successful as sales continued to grow – until they didn’t. Since 2015 the industry has seen sales drop as consumers no longer responded to “better” and pricier product launches.

Today’s consumers define and perceive quality differently, opening the doors for disruption. In 2011 the Dollar Shave Club capitalised on this by offering cheaper, quality razors with the added convenience of the product being delivered to the consumers’ door through a subscription service.

Harry’s added to the direct-to-consumer disruption with another quality, yet cheaper, razor, which it predominantly promoted as being just as effective as the most expensive ones. The success of the shaving clubs was based on products as well as direct, transparent communication with consumers.

Acquisition, a way to recover the lost share

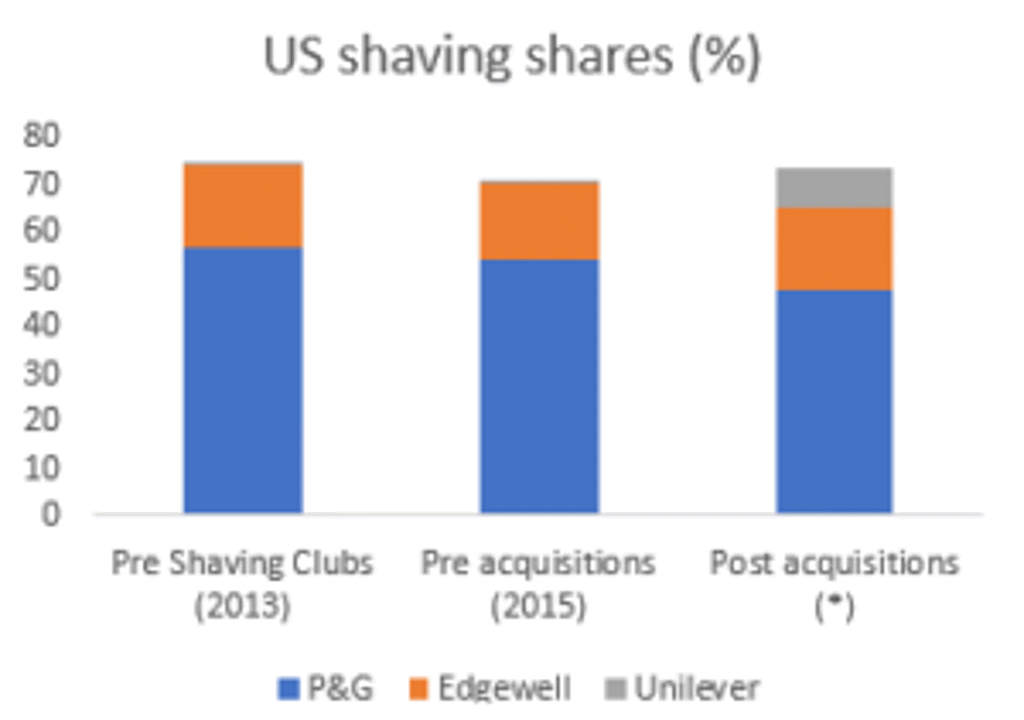

Unilever was the first-mover in the latest batch of acquisitions. In 2016, the company paid USD1 billion for the Dollar Shave Club and, in so doing, cornered 6% of the shaving market.

In 2018, Procter & Gamble acquired Bevel, a brand targeted at men of colour, for an undisclosed amount. By the time of the acquisition, Bevel’s sales already accounted for almost USD6.5 million. With this move, Procter & Gamble renewed its focus on diversifying its reach to a wider audience, namely that of African Americans in the U.S.

In May 2019, Edgewell, owner of Schick and Wilkinson and the number two player in the US shaving market, announced a USD1.37 billion deal to acquire Harry’s.

This deal will add 3.5% to Edgewell’s share and the once purely D2C brand, Harry’s, will get access to the global footprint of Schick’s manufacturing base, which could be a springboard for international expansion.

Edgewell continues to strengthen its grooming offer beyond shaving, a strategy that started in 2016 when the company acquired the UK-based brand Bulldog and continued in 2018 with the acquisition of Jack Black, a US premium brand that was able to position some of its products among the most sold in their categories. This is a clear attempt to overcome the challenges of shaving and invest in one of the fastest-growing categories of personal care: men’s grooming.

Note: Shaving includes razors and blades, pre and post-shave products according to Euromonitor International definitions

(*) Based on 2018 data and including Harry’s sales under Edgewell

The next move, grooming beyond shaving

Shaving in the U.S. has shifted from value to volume. Growth will no longer come from price increases, but from targeting specific segments or from venturing into new categories.

Key players are challenged to rethink their strategies and invest in the fastest-growing categories of men’s grooming: hair care, skin care, and bath and shower. Many brands are aiming to fill the gaps in their grooming product offerings, to boost sales. The goal is to offer consumers the whole set of products that are now part of the men’s grooming routine. Fragrances and deodorants will not be completely disregarded, but competition is more intense in these categories.

Harry’s and Dollar Shave Club have already increased their product offering to include bath and shower, skin care and even oral care. Dollar Shave Club went beyond that, launching products in more saturated categories like deodorants and fragrances.

The very consumers responsible for the sales decline in shaving could be the ones to bring growth back. For that to happen, companies like Procter & Gamble, Edgewell and Unilever need to understand the new consumer’s needs and respond to them appropriately.

To successfully respond to the complex needs of this new consumer, the product is only one piece of the puzzle. The shopping experience also plays a role. Companies are challenged to make consumers’ lives easier. That could translate into a pure D2C strategy, a wider availability in bricks-and-mortar or a combination of both in a well-developed omnichannel approach.