This article is also available in Japanese.

On 25 March 2021, the torch relay for the Tokyo Olympics and Paralympics began, one year late. However, as illustrated by the third state of emergency declared on 25 April 2021 in response to the increasing number of cases, concerns about the pandemic still prevail in Japan.

Coronavirus (COVID-19) has significantly changed both corporate activities and consumer behaviour. The widespread need to work from home has forced Japan's corporate culture to change, a culture with a previously entrenched emphasis on face-to-face and paper-based communication. The widely publicised risk of infection from large social gatherings such as dinners, live events and seasonal events has boosted a digital shift. COVID-19 has also prompted a rapid increase in interest in new habits such as sterilisation, ventilation, and stress management, as well as wearing masks, washing hands, and gargling – although these concepts were already established as part of daily healthcare in Japan, so already quite prevalent.

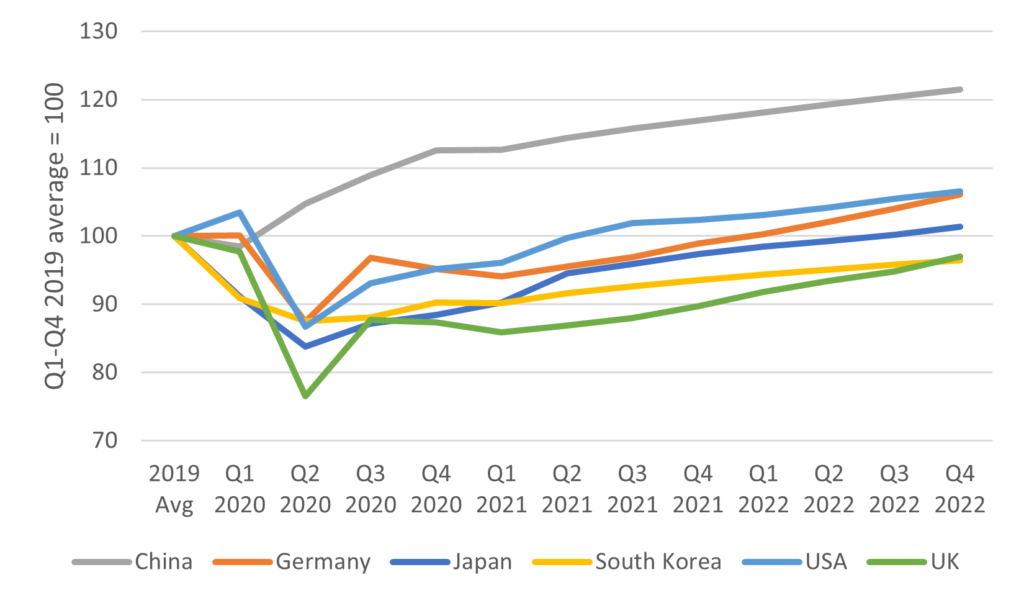

In tackling the pandemic, Japan has taken soft measures, such as "requesting" people to refrain from going out, without legal force, rather than lockdown seen in other countries. Rapid deterioration in employment has been halted by emergency measures such as financial support for companies and other subsidies. However, repeated waves of infections and self-restraint in lifestyles have led to a cooling of consumer confidence. Furthermore, priority vaccination for those aged 65+ only started from 12 April 2021 and it is difficult for people to hold out hope for the pandemic to be quickly contained. According to Euromonitor International's Global Recovery Tracker, the overall recovery index scores for major countries, excluding China, are expected to return to pre-pandemic levels after Q2 2021, and for Japan after Q3 2022.

Recovery Index for Major Countries: Q1 2020-Q4 2022

Source: Euromonitor International, Global Recovery Tracker

Note: Data for Q1 2021 onwards is forecast

Euromonitor’s team of industry experts in Japan explore the changes across Japanese goods and services in 2021 and beyond, in terms of three key trends - home experiences, the focus on health and shift to digital.

Beauty and Fashion: Brand strategies cater to consumers in the new normal

Fashion masks change make-up routines: The shortage of disposable masks that occurred in early 2020 has quickly created a market for re-usable fashion face masks. As vaccination becomes more widespread, the market is expected to shrink slowly from summer 2021 onwards. However, because Japanese consumers were already accustomed to wearing masks before COVID-19, the market for fashion face masks with improved functionality and design will remain about three times larger than before COVID-19. The overall colour cosmetics market, including lipsticks and other lip products, is unlikely to recover to its pre-pandemic levels even after 2021, linked to the increased use of face masks. However, more consumers are using multiple make-up items for eyebrows and eyes, which are still exposed when wearing a mask, and powders and sprays that prevent colour from coming off as finishing touches for base make-up and lip make-up. It is vital for businesses to adapt to these new make-up routines that create more opportunities. Additionally, increased skin problems such as dryness that are caused by wearing masks can support growth of dermocosmetics and products that claim moisturising capabilities.

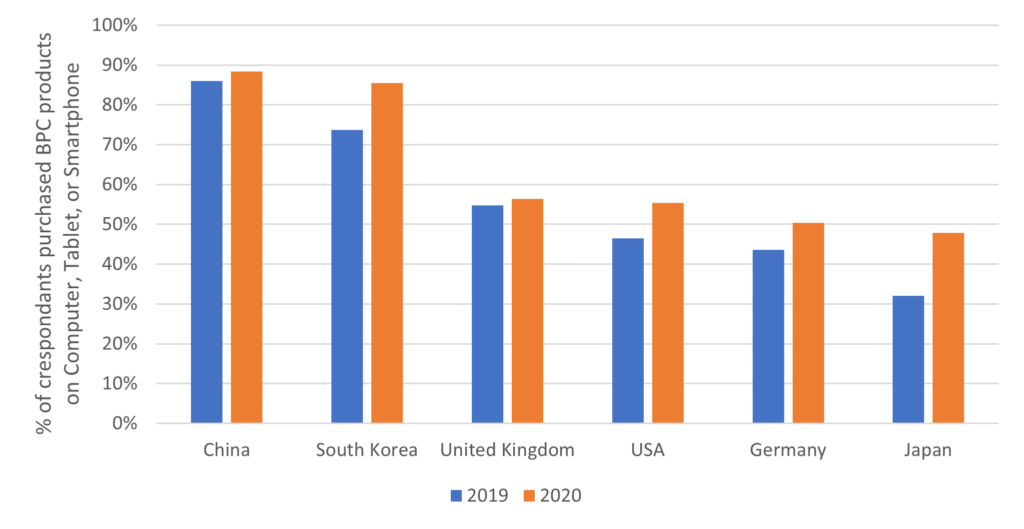

Accelerated digital shift: Many of Japan's leading beauty and fashion brands and retailers have pushed forward with the expansion of their e-commerce channels using live streaming and online consultation. An increasing number of consumers, particularly Generation Z and Millennials, see a value in being involved in the brand's communication, as well as participating in product development by writing reviews, helping consumers to be even more loyal to these brands, helping customer retention. A heightened awareness of hygiene caused by COVID-19 may lead to a prolonged situation in which make-up touch-ups and face-to-face customer service are not as freely available as in the past. Bridging online and offline services, such as expanding in-store virtual make-up touch-ups/try-ons and drawing customers from bricks-and-mortar stores to e-commerce platforms, will continue to be a priority for businesses.

Consumers Who Purchased Beauty and Personal Care Products on Computer, Tablet, or Smartphones: 2019/2020

Source: Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January to February 2020, 2021 (2020 N=32,241, 2021 N=29,985)

From inbound consumption to cross-border e-commerce: Now that consumers and brands are more directly connected online than ever before, it will become more viable for Japanese consumers to purchase cosmetics and clothing from overseas. However, cross-border connections between companies and consumers can be both a threat and an opportunity for businesses operating in Japan. In fact, after losing inbound customers, many brands have stepped up their cross-border e-commerce efforts and are already seeing positive results. Once travel restrictions are lifted, consumers will be able to choose between destination shopping and cross-border e-commerce within their own country. It is crucial to foster loyalty by expanding loyalty programs and by collecting and centrally managing customer information, regardless of the location of the contact, to provide a seamless purchasing experience.

Drinks: Continued at-home consumption and rising awareness for a clear reason for consumption

Replicating drinking out at home: In the alcoholic drinks market, as foodservice outlets continue to struggle, home drinking is expected to become a popular alternative – albeit one that can replicate the experience of drinking out. Among the RTD alcoholic drinks that made great strides in 2020, some of the lemon sour products, which claimed to be authentic due to their manufacturing methods and high juice content, won consumer hearts and minds, as they offer the taste of an izakaya at home. In 2021, companies are stepping up their efforts to replicate the taste and experience of drinking out at home, including flavours and mouthfeel. For instance, Kirin Brewery Company is strengthening its monthly subscription service of its home beer dispensers. The need for an alternative experience of drinking out at home is expected to subside in accordance with COVID-19's gradual slowdown, but this is the most important trend in the short-term.

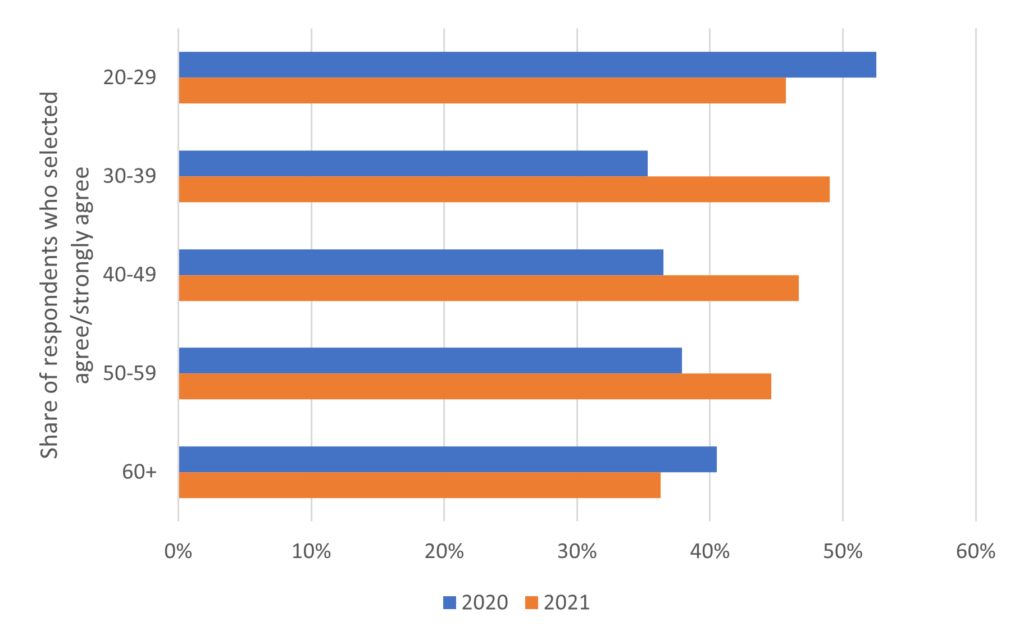

Switch between work and personal life: With the spread of working from home, many home workers are turning to drinks as a convenient way to switch between work and personal life, for example, having a coffee in the morning to get them into work mode, having a carbonated drink to get refreshed during a break, and having a low-alcohol drink to feel relaxed after work. Even before COVID-19, consumers in their 20s tended to draw a clearer line between work (or study) and personal life than older generations. However, consumers in their 30s to 50s have also come to reinforce the line in the past year. Since this age group falls into the child-rearing generation, the change in attitude shows their struggle to balance work and child-rearing in Japan's cramped living environment with the introduction of working from home. It is crucial to develop a brand image and consumption scenes in advertising that evoke a change of mood to capture the switching demands.

Japanese Consumers Who Draw a Clear Line Between Work (or Study) and Personal Life, by Age: 2020/2021

Source: Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January to February 2020, 2021 (2020 N=1,003, 2021 N=1,010)

Seeking a clear reason for consumption: As opportunities for drinking at foodservice outlets have been largely reduced, clearer focus values are expected to emerge in foodservice, such as face-to-face interactions or the unique tastes and experiences that can only be found at those locations. Izakaya appealing to consumers simply by their convenient location and low prices will become less likely to be chosen by consumers. Also, as today's health-conscious consumers want to be in control of their sleep quality and alertness and are becoming more conscious of their caffeine and alcohol consumption, decaffeinated, low-alcohol and non-alcoholic drinks will continue to see strong growth. In 2021, Asahi Breweries launched a beer-based alcoholic drink with 0.5% ABV. Furthermore, consumer desire for clear and specific values is not limited to benefits for themselves. A fast-growing movement of plastic-free in the drinks industry, and new initiatives such as tackling food losses by turning to-be-discarded sake lees and beer into new spirits, will be one of the reasons to encourage consumers to choose the brand.

Food and Nutrition: New eating habits and values following COVID-19 are key to growth

Ongoing demand for home cooking: In 2020, sales of time-saving cooking products such as meal kits and frozen meals saw rapid growth, as people refrained from going out. As working from home becomes more common, demand for such products will remain solid. Particularly in meal kits, where sales have been growing rapidly in recent years due to an increase in double-income households, new entrants and reinforcement of production capacity are increasing. For example, Watami's Takushoku, a home delivery lunchbox business for the elderly operated by Watami, a major foodservice company, entered the market in 2020. Oisix, a leading meal kit company, will expand its distribution capacity in 2021. The market will continue to grow as existing users repeat and increase their frequency of use, and as new users are attracted.

Staying in shape and reducing stress: Products with health claims increased significantly in 2020, driven by a growing awareness of prevention through diet. Health consciousness among consumers will be entrenched as a trend after COVID-19. The need for consumers to stay in shape and reduce stress will continue to be high, especially as working from home takes hold and there are continuing concerns about weight gain due to lack of exercise and increased stress due to environmental changes. For example, products with high protein claims and products containing GABA and l-theanine, which are used to reduce stress, are areas that many companies are focusing on.

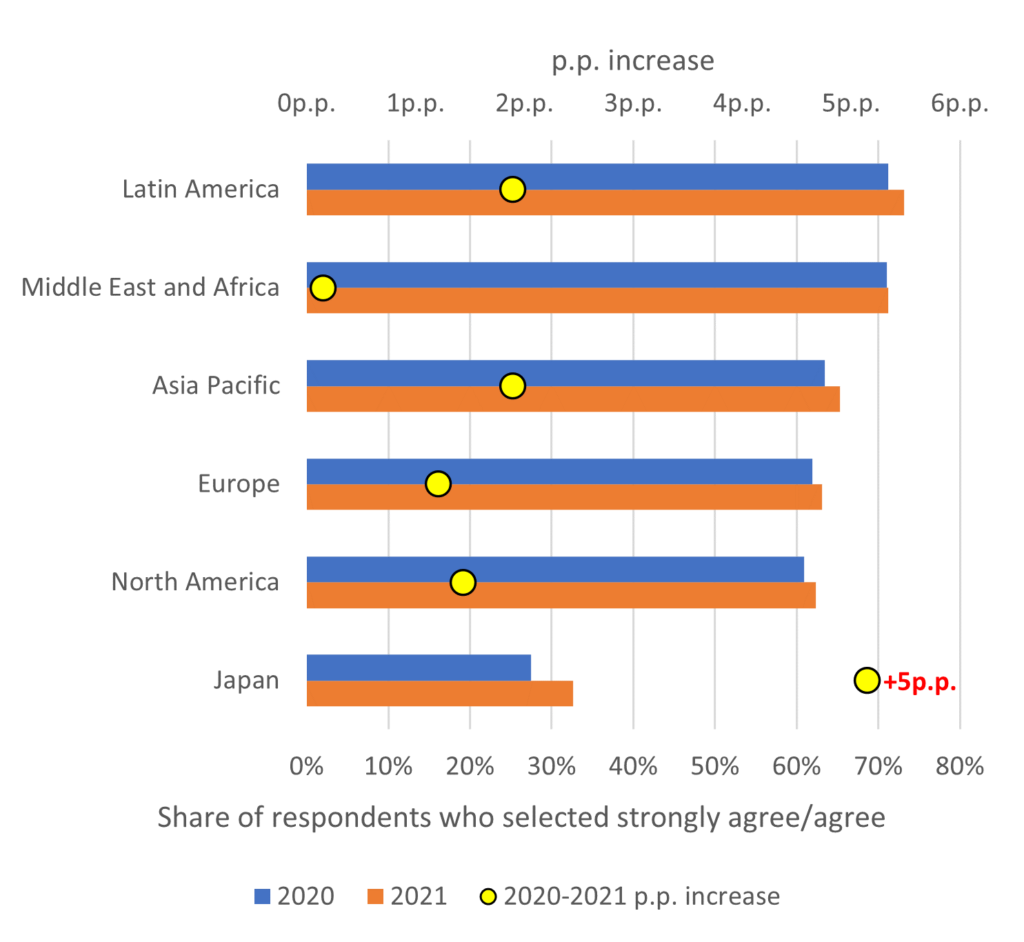

Growing awareness of sustainability: Japanese consumers’ interest in sustainability is still comparatively low. However, COVID-19 has helped Japanese consumers to think about social issues as a personal problem, which has greatly increased the awareness of sustainability. Japanese companies are also accelerating their ESG initiatives, for example, Meiji Holdings Company is investing JPY30 billion in ESG initiatives across the group’s companies over the next three years, starting from fiscal year 2021. These corporate initiatives will further increase consumer interest in sustainability. Furthermore, the new Courses of Study, the standard for curricula for all schools in Japan, that will be fully implemented from the 2020 academic year clearly states "Education for Sustainable Development", which will further increase the interest of Japanese people in sustainability, starting with their children.

Consumers Who Try to Have a Positive Impact on the Environment through their Everyday Actions: 2020/2021

Source: Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January to February 2020, 2021 (2020 N=41,231, 2021 N=40,732)

Home and Technology: Evolving living spaces as work and life integrate

Influence of home seclusion and working from home: Within the home and technology realms, some categories saw significant growth between 2019 and 2020, as more people stayed away from offices and other workplaces and worked from home. According to Euromonitor data, those categories include home office furniture for working at home (+18% in terms of retail sales value) and gardening tools such as fertilisers and seeds for growing plants at home (+11% in terms of retail sales value). While some of these categories will see a downturn in reaction to sudden growth in 2020, in the longer term, working from home is expected to be more normal, increasing the significance of the home in both their professional and personal lives. For example, consumer appliances are expected to be more naturally and ubiquitously connected to the home, other appliances, and people. Sony's Multifunctional Light 2, a ceiling light with speakers, sensors, Wi-Fi, infrared remote control and more, is one of the products that captures this trend well.

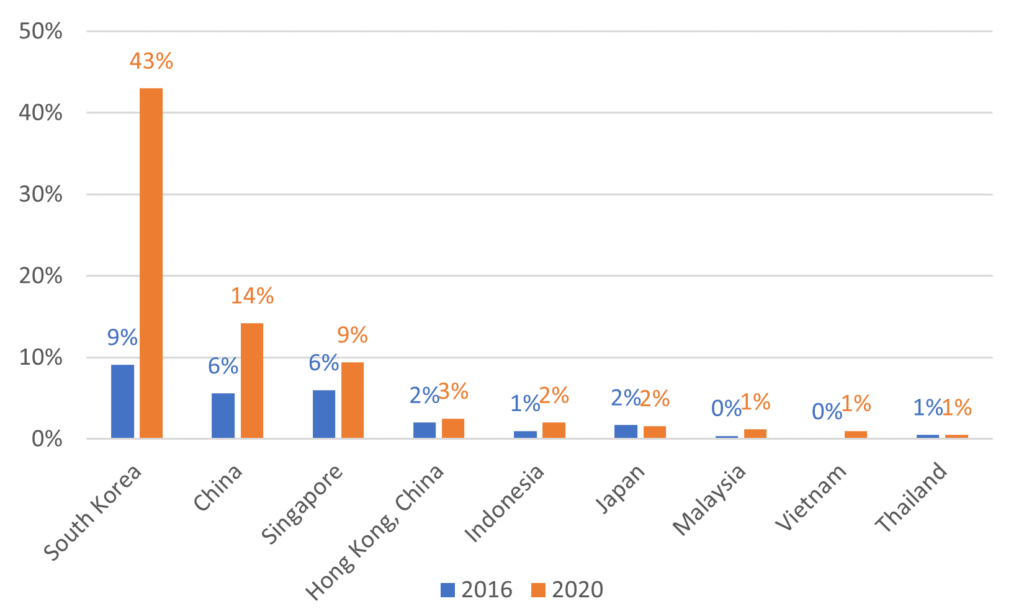

Percentage of Connected Fridge Freezers in Selected Countries: 2016/2020

Source: Euromonitor International, Consumer Appliances

Heightened awareness of indoor air quality: Indoor air quality (IAQ) has been a hot topic whenever there was an outbreak of a virus or increase of yellow dust in the atmosphere which flew from the Asian Continent and caused economic and health problems, but never has there been more awareness than in 2020. According to Euromonitor data, the air purifier market in Japan grew by +19% year-on-year in 2020 in terms of retail sales value. Looking ahead, discussion to improve IAQ will require a more holistic perspective. In addition to the products such as air purifiers and air conditioners, IAQ needs can be considered more broadly to include 24-hour house ventilation system, cooker hoods in the kitchen, (robotic) cleaners, wallpaper, air fresheners, and home insecticides. To provide higher value and more comprehensive solutions, it is essential to use various sensors and collaborate among companies or products/services.

Services and Payments: Strategies for offline stores

Making consumers physically visit shops: COVID-19 has generated unprecedented demand in domestic e-commerce sales. Conversely, offline channels offering non-essentials (as opposed to essentials such as food and beverages) have become difficult to secure high profitability, particularly in well-located stores in downtown areas. The rapid channel shift from offline to online in the wake of the spread of COVID-19 is expected to continue to impact the sales of offline stores, even as more of the public has been vaccinated and people start returning to shopping districts. While many services offer convenient yet fun shopping experiences though online, such as AR and live commerce, offline channels should strengthen strategies to bring consumers to physically visit shops. In-store-only, limited products and marketing campaigns with popular brands and subcultures are effective in drawing attention among Japanese consumers.

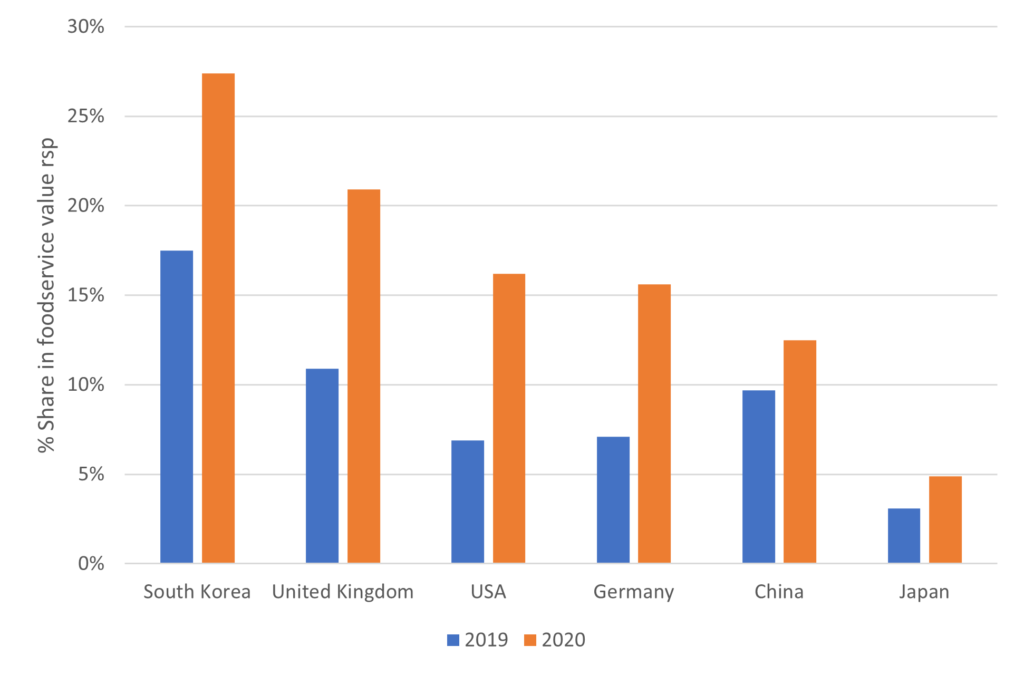

Flexibility to respond to changes in consumption locations: Food delivery services such as Uber Eats and Demaecan have been rapidly expanding their coverage since the COVID-19 outbreak and are changing the way people source meals in Japan. Some restaurants, particularly those that have been forced to close temporarily or shorten their opening hours, are now offering delivery and takeaway services to survive, while some players have embarked on a major business transformation. Izakaya and family restaurant chains such as Gusto and Watami have opened restaurants specialising in karaage, Japanese-style fried chicken, that offer delivery and takeaway services. Although the proportion of delivery sales in Japan is rising, there is still significant room for growth in geographical coverage and affiliated stores compared to major countries worldwide, and this will continue to expand. Furthermore, foodservice giants have been actively developing products that can be consumed outside their stores such as Mos Burger’s pre-order-only bread and its collaboration with a food manufacturer to sell Teriyaki burger-flavoured potato snacks. A flexible business model is crucial to survive in these uncertain social conditions.

Delivery Sales in the Consumer Foodservice Industry: 2019/2020

Source: Euromonitor International, Consumer Foodservice

Summary: Adaptability is the key for businesses

The threat of COVID-19 has persisted for over a year and had a major impact across Japanese consumer markets. However, in a society with a declining birthrate and ageing population, most of the changes brought by the pandemic are the challenges that Japan had to face in the future. The digital shift that has taken place, under the restrictions imposed to slow infection, is one of the changes that has been required for some time, and will continue to escalate, irreversible, to tackle labour shortages and to improve productivity in response to population decline. The expansion of working from home and the increased time spent at home have also marked a turning point in consumer awareness of the need to improve their personal lives, including their living environment and what they intake. Increased awareness of preventative health and stress reduction may have a positive long-term effect on the challenge of extending a healthy life expectancy in an ageing society. In a new normal, people are more likely to seek high-value-added products and services that meet new needs, and businesses need to respond flexibly to these changes as an opportunity to create a better future.

This analysis was prepared by Euromonitor’s Japan team of research specialists:

• Supervised by Sean Kreidler (Head of Research), Tomomi Fujikawa (Senior Analyst)

• Beauty and Fashion: Yuri Gorai (Consultant), Aya Suzuki (Research Analyst)

• Drinks: Tomomi Fujikawa (Senior Analyst)

• Food and Nutrition: Nozomi Hariya (Senior Analyst)

• Home and Technology: Taro Yamato (Research Analyst)

• Services and Payment: Megumi Matsunaga (Consultant)