A version of this article originally appeared in the Fats and Oils digital issue of Food & Beverage Insider.

Clean label is one of the hottest topics in the food industry, alongside functional food and sustainability. These trends are driving strategic themes Euromonitor International identified that will shape and influence food innovation over the next three to five years.

In light of the global COVID-19 pandemic, health and wellness have become more pertinent in the world of food, and the importance of healthier edible oils will gain traction. Consumers are preparing food at home for the entire household and are more conscious of the nutritional benefits of their dishes that will cater to various health needs and preferences.

Consciousness of food safety is also expected to accelerate as consumers strive toward a lifestyle that reduces the possibility of falling ill. Hence, food product safety and hygiene are also expected to be of utmost importance. Manufacturers will likely use claims, labels and certifications to assure consumers that their products are of good quality.

Clean Positioning Assures Consumers of Food Safety and Wellness

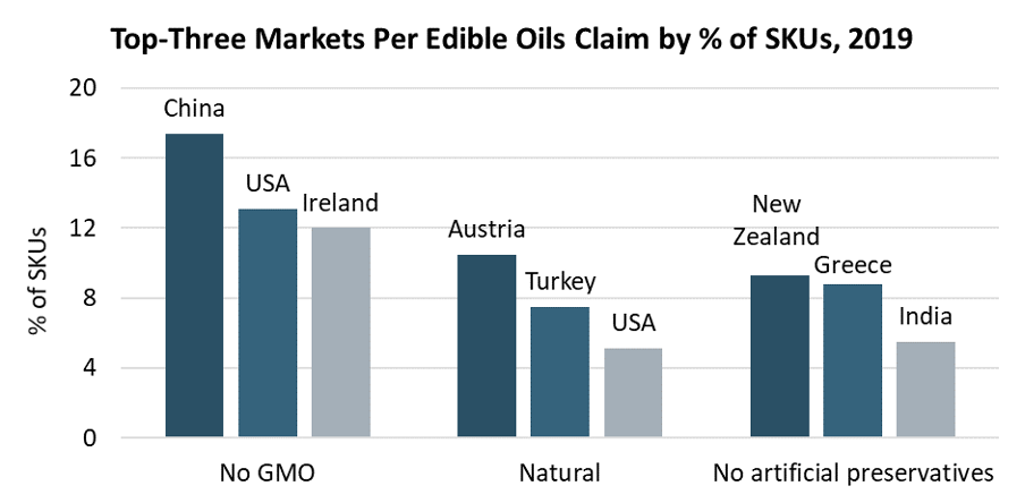

Euromonitor International’s latest product claims and positioning data, which extracts from more than 1,500 e-commerce sites across 40 markets globally, highlights the digital share of shelf for products with certain claims. No GMO stands out among the top-three claims for edible oils; such labelling may help raise awareness for products like sunflower oil that are naturally GMO-free, whose potential consumers are not familiar with crop processing techniques and averse to heavily processed cooking ingredients.

Aside from no GMO, other claims that also promote purity of ingredients include no artificial preservatives and natural, which are already common in edible oils across certain markets.

Source: Euromonitor International

Note: SKUs stands for stock-keeping units.

The core focus of these claims overlaps with organic certification, which excludes the use of pesticides and other chemicals. These characteristics align with clean eating values.

In fact, 10% of edible oil SKUs online globally had an organic claim in 2019, according to Euromonitor International. The top two reasons consumers seek organic labelling in packaged food, according to Euromonitor International’s 2020 Health and Nutrition Survey, are to “[feel] healthier” and “better for me,” which indicates that an organic label appeals to perceptions of wellness rather than a specific health benefit.

What’s next? Blended oil might be a healthy alternative

Despite the optimistic performance of natural and organic edible oils, a key challenge ahead lies in possible recessionary factors causing price sensitivity to suppress consumer spending. Products that are certified organic, as well as artisanal brands with a niche positioning, tend to have higher unit prices compared to mass and standard products, which points to the need of affordable pricing despite consumer preference for value-added variants.

In emerging markets within Asia Pacific, blended oil is growing in popularity as a healthier alternative. Blended oils typically combine several types of oil, such as sunflower, soy or rapeseed, among others. Although considered less premium than pure oil like coconut and olive oils, consumers are typically more familiar with the individual vegetable and seed oil in local dishes and would likely be more receptive toward blended oils incorporating their local ingredients

As meal occasions shift to the home and may remain there due to new habits of eating in, the consumption of edible oils is set to have accelerated in 2020. Health consciousness and price sensitivity will be major influencing factors for trends within the category, which will affect the type of edible oils purchased and shape product development. Preference for certain brands is likely determined by consumer trust for health and food safety benefits communicated through product claims and labelling. As edible oils is a less dynamic category compared to other cooking ingredients like sauces, clear description on packaging will help to attract consumers seeking products aligned to their perception of wellness.