The COVID-19 pandemic and inflationary environment since 2021 have given rise to the Generation Z (Gen Z) beauty consumer’s tendencies towards price sensitivity, individualistic expression, active participation in user-generated content and phygital spaces. The rise of Gen Z-geared brands highlights this cohort’s preference for sustainable features and clean beauty claims. Social media and social commerce are essential to succeed with Gen Z beauty consumers.

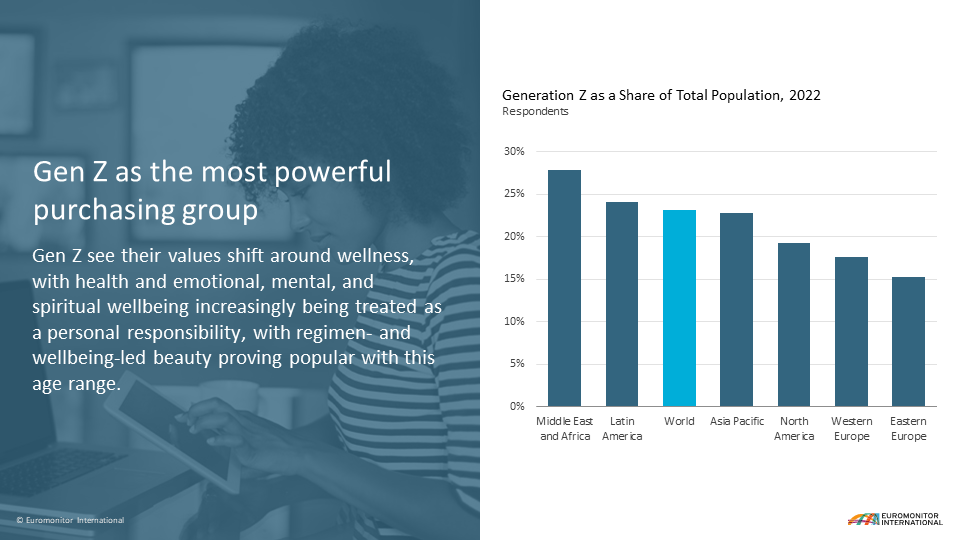

Gen Z’s buying power grows as they account for almost a quarter of the global population

The Gen Z beauty consumer is currently aged between 13 and 27 with a total number exceeding 1.8 billion people. This represents just over 23% of the world’s population in 2022 with varying prevalence rates regionally. Perceptions of beauty for this generation differ from previous generations, to be more centred around expression, identity, and individualism.

23% of the world's population in 2022 are Gen Z beauty consumers

Gen Z see their values shift around wellness, with health and emotional, mental, and spiritual wellbeing increasingly being treated as a personal responsibility, with regimen- and wellbeing-led beauty proving popular with this age range.

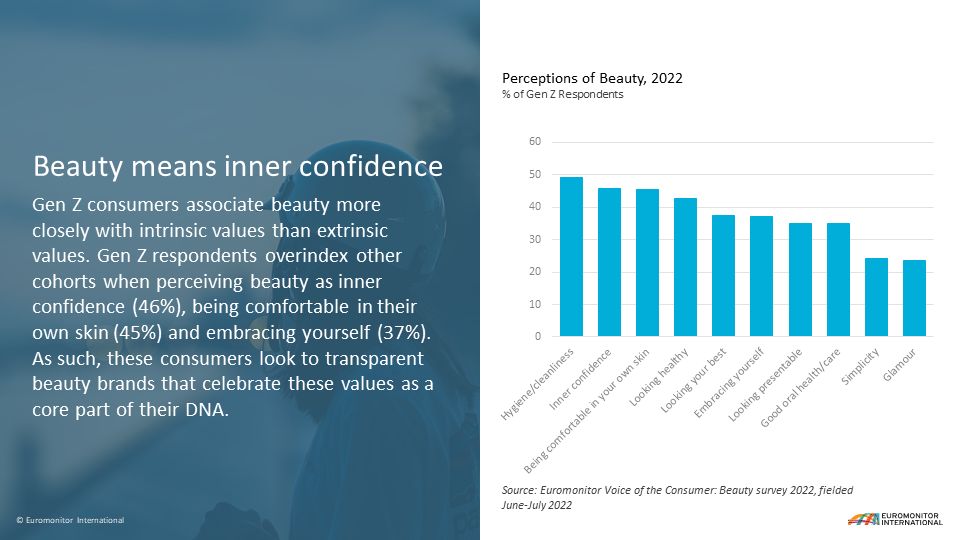

Gen Z links beauty with intrinsic values, holistic health and emotional wellness

Gen Z consumers associate beauty more closely with intrinsic values than extrinsic values. According to Euromonitor’s Voice of the Consumer: Beauty Survey, fielded June-July 2022, Gen Z respondents overindex other cohorts when perceiving beauty as inner confidence (46%), being comfortable in their own skin (45%) and embracing yourself (37%). As such, these consumers look to transparent beauty brands that celebrate these values as a core part of their DNA. While Gen Z across most of Euromonitor’s surveyed markets tend to view beauty through these intrinsic values more acutely than older generations do, there were some market differences, such as South Korea and Japan.

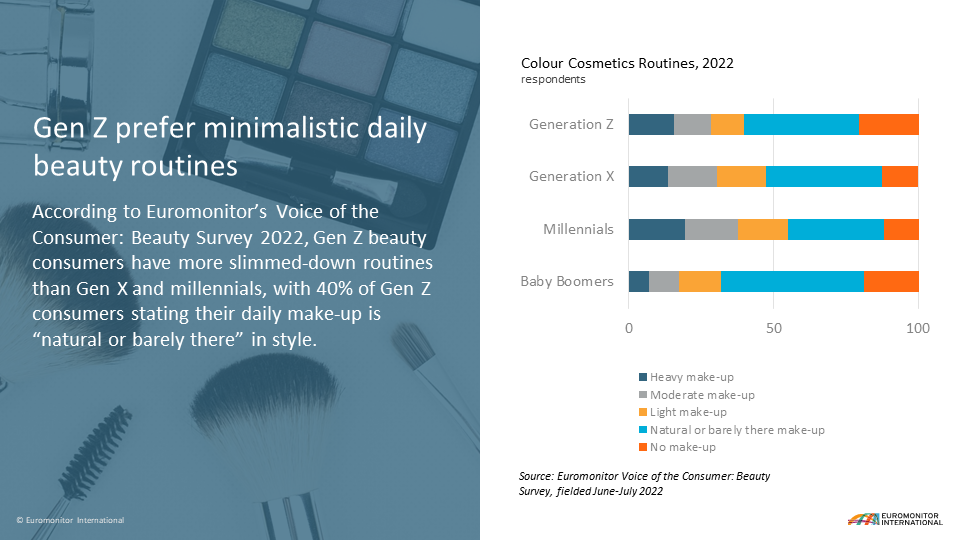

Gen Z prefer minimalistic daily beauty routines, but use expressive make-up occasionally

While expressive make-up is used for special occasions among Gen Z, Euromonitor found that Gen Z’s daily make-up usage routines remain simple. According to Euromonitor’s Voice of the Consumer: Beauty Survey 2022, Gen Z beauty consumers have more slimmed-down routines than Gen X and millennials, with around 40% of Gen Z consumers stating their daily make-up is “natural or barely there” in style. Gen Z’s preference for both expressive “special occasion” make-up and natural aesthetics suggests that beauty and personal care players should look to balance their product portfolios between everyday, skin-first products and products designed for occasion and play.

40% of Gen Z consumers state their daily make-up is “natural or barely there” in style

Source: Euromonitor International's Voice of the Consumer: Beauty Survey 2022

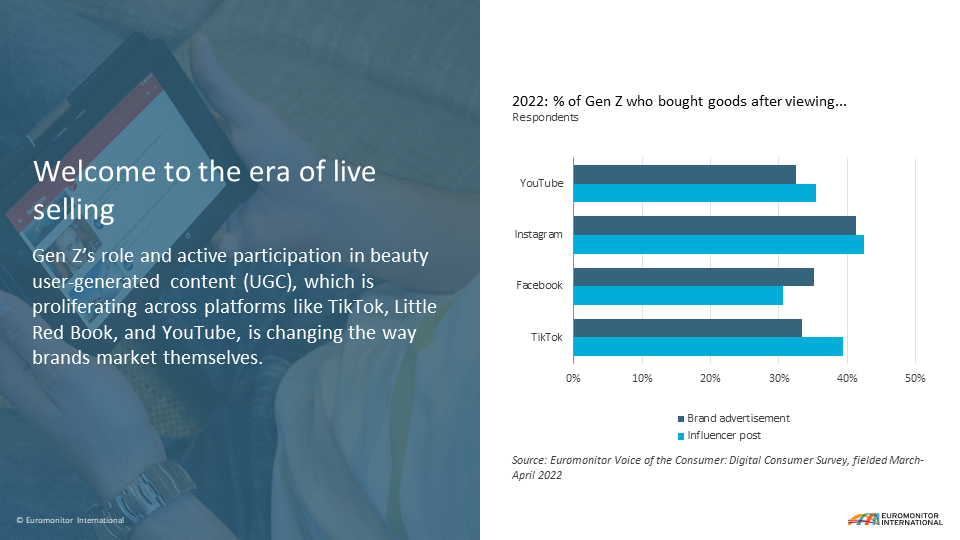

Gen Z leans into digitalisation, especially in creating beauty user-generated content

Gen Z’s role and active participation in beauty user-generated content (UGC), which is proliferating across platforms like TikTok, Little Red Book, and YouTube, is changing the way brands market themselves. In turn, influencers and even avatars are starting to carry more weight.

Shoppable social media and social commerce is another avenue that beauty brands can pivot when attracting this segment

Notably, Gen Z has the highest response rate for using livestreaming for discounts, suggesting a value-driven component is high on their priority list, a nuance from millennials, some of whom have been in the workforce for almost two decades.

How to win with Gen Z

A fast-deteriorating global economic outlook is set to present challenges for both Gen Z and the beauty brands targeting them. Gen Z seeks out beauty to express individualism and achieve wellness in a “back to basics” approach, and also expects digital and physical beauty worlds to work together seamlessly. Building customer loyalty within Gen Z won’t be easy, especially in an oversaturated beauty market. Hence, it is recommend for beauty brands to substantiate efficacy and have a large presence on social media.

For a deeper dive into this topic, read our report, The Gen Z Beauty Consumer