A version of this article originally appeared in the Immune Health digital issue of Natural Products Insider.

Traditionally, sugar has been ubiquitous in soft drinks as a key ingredient used to bring indulgence to consumers. Nevertheless, challenges stemming from the regulatory front as well as changing consumer attitudes about health are disrupting long-successful sugary drinks. Aside from developing healthier alternatives as well as embracing classic flavors, beverage manufacturers in the Asia Pacific (APAC) are offering immunity-boosting beverages. New product variants to support health, including micronutrients like vitamins and probiotics, serve as the new response.

Political and social pressure on sugary drinks in APAC

Governments in APAC have taken tougher measures against sugar amid increasing consumption across the region. APAC is set to witness the fastest growth rate in per capita volume consumption of food and drinks sweeteners amongst all regions in the world between 2019-2024. With a compound annual growth rate (CAGR) of 0.6% during the same period, this figure is predicted to rise from 6.52kg in 2019 to 6.73kg in 2024. Regulators in the region have hence implemented numerous measures to curb surging sugar consumption.

With sugar intake rising, the population of APAC consumers who are obese has also been increasing. Therefore, APAC consumers are turning to healthier food and beverage product offerings for their own wellbeing. Moreover, COVID-19 has led consumers to reinforce their attitudes toward everyday health, nutrition, and hygiene. They are increasingly concerned with health and wellness priorities in their daily life, including a focus on immunity to reduce the risk of illness.

Immune support beverages gain traction

With a pandemic-induced focus on immunity, beverage companies are turning to immune support beverages as the new direction to go beyond their usual approach. According to Euromonitor’s Voice of the Industry: Soft Drinks Survey 2020, more than 54% of professionals recognize the importance of immune support and health and wellness beverages in impacting sales during the pandemic, which is the second most influential factor only behind e-commerce and delivery. Euromonitor also expects fortified and functional soft drinks* to be stably expanding with a retail value CAGR of 2% during 2020-2025.

Juice and vitamins driving immunity-boosting range in APAC

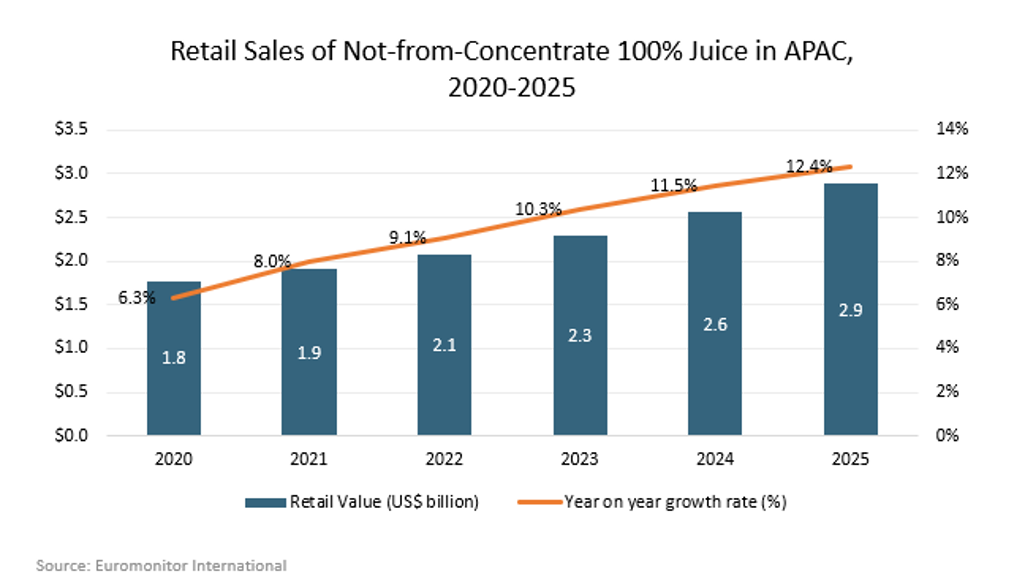

Categories that can boost immunity for consumers have hence been on the rise. Juice remains one of the main core categories positioned to serve consumers for immunity boost, due to its health perception as vitamin containment. Within APAC, retail sales of not-from-concentrate (NFC) 100% juice is projected to hit US$1.8 billion in 2020, growing at an 8% CAGR between 2020 and 2025 to reach US$2.9 billion in 2025.

Source: Euromonitor International

Beverage makers have thus been actively developing new products centered around juice as well as health-focused juice smoothies in order to get a slice of this growing category and draw consumers’ attention, claiming benefits from added vitamins and natural ingredients.

Emerging categories and ingredients for immune support beverages in APAC

Immunity-boosting functionality has now started moving beyond juice. Functional water is one of the prime examples. New and unique ingredients beyond vitamin C or even probiotics have likewise begun to strengthen their association with immune support beverages. In September 2020, PepsiCo announced the launch of Driftwell in the U.S., an unsweetened still canned water containing blackberry, lavender, magnesium, and 200g of the amino acid L-theanine. The launch aims to enhance immunity through sleep aid. Given the traditional impact the U.S. has on beverage trends, APAC will likely follow suit with similar product offerings.

Looking ahead

The rise of immune-support beverages provides a new path for beverage manufacturers to steer towards a more comprehensive product portfolio. Such a trend will continue based on what we have observed during the pandemic. Consequently, it is crucial for beverage companies to understand consumer needs about health and indulgence in order for such beverages to thrive in the long term post-pandemic.

*Note: Immune-support beverages are included in Euromonitor’s “fortified and functional soft drinks” category.