The past two years have seen a shift towards social purpose and inclusion, with the 2020 Black Lives Matter protests heightening not only awareness of racial inequalities but also placing pressure on beauty and personal care companies to widen and showcase non-Eurocentric perceptions of beauty. Hair care has played a significant role in this conversation, a segment in which the concerns of textured hair and complex styling processes have been historically overlooked by key players.

Understanding is first step toward inclusion

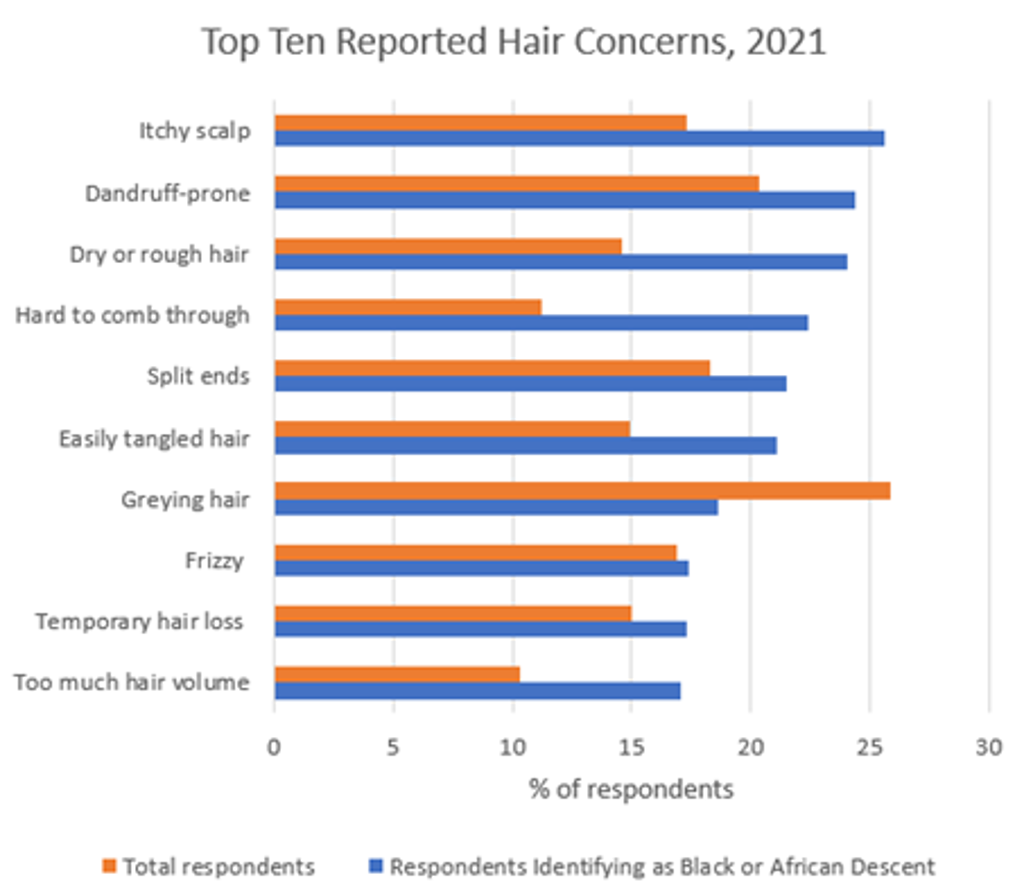

Source: Euromonitor International Beauty Survey, 2021

According to Euromonitor International’s Beauty Survey, greying hair ranked as the leading concern among total respondents, but only seventh among black and African descent respondents. The top hair concerns among respondents of all races and ethnicities in 2021 were greying hair, dandruff-prone hair, thinning hair, split ends, and greasy or oily hair. However, among respondents identifying as black or African descent, the top five concerns in 2021 were itchy scalp, dandruff-prone, dry or rough hair, hard to comb through, and split ends. Hair that was hard to comb through ranked ninth as a top hair concern among total respondents, but fourth among black and African descent respondents.

Although identifying the unique needs of black consumers is a crucial first step for companies to better understand and cater for specific consumer segments, empowered consumers are demanding more, strengthened in particular by social media platforms. The debut of beauty brands in recent years owned by BIPOC (black, indigenous, people of colour) and BAME (black, Asian, minority, ethnic) entrepreneurs has also created a culturally significant space for innovation that comes directly from the community of target consumers.

Greater product availability for different hair types

The momentum for inclusivity has also driven beauty and personal care players to widen their product offerings for different hair types, reagrdless of consumers’ racial or ethnic origin. Drunk Elephant and Function of Beauty launched co-wash products, typically used for curly and textured hair, in August 2020, with Drunk Elephant specifically stating a desire to accommodate everyone. In 2021, Kérastase and Living Proof introduced dedicated lines for curly hair, catering for a range of curl patterns from waves to coils, while Procter & Gamble recently partnered with Walmart to launch the brand Nou, recognising the increasingly diverse population of the US, stating that more than 50% of Generation Z are non-white. The latter range caters for 3A-4C curl patterns and provides information to consumers on hair porosity via scanning a QR code. Walmart strengthened its investment in textured hair care in 2022 by launching Madam by Madam C.J Walker, following the 2020 Netflix series about the eponymous owner in “Self Made: Inspired by the Life of Madam C.J. Walker”.

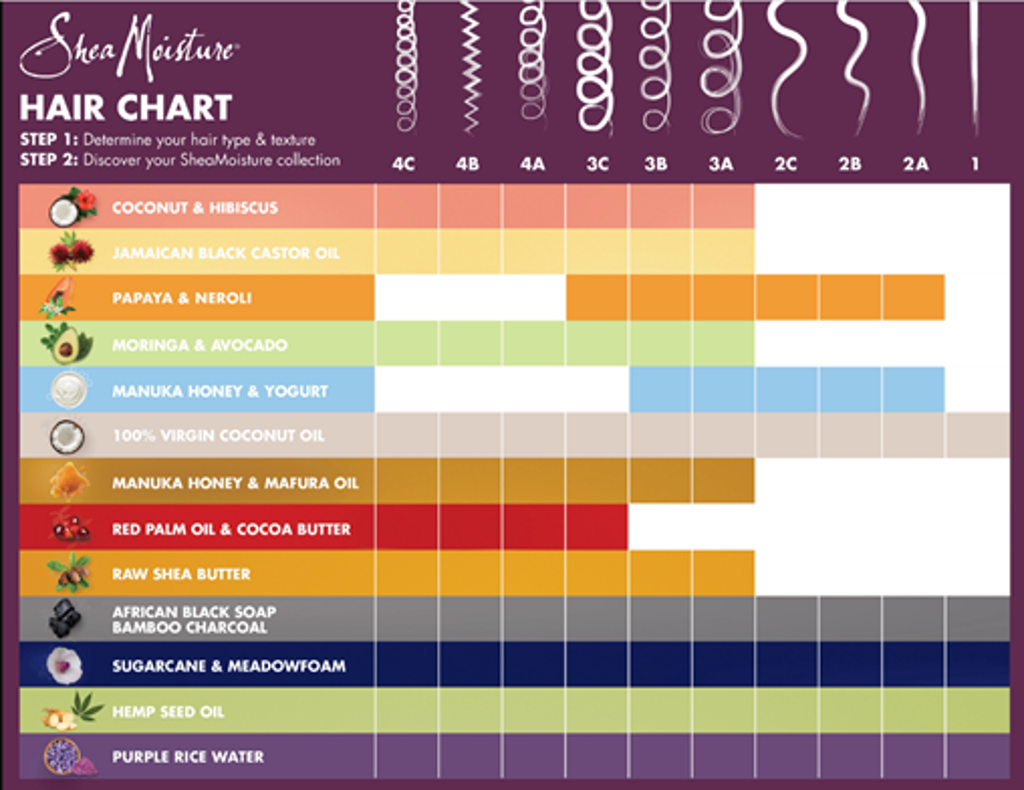

Unilever-owned Shea Moisture, a US-based hair care brand known for ingredient-based treatments, provides a visual guide that matches hair type by line. Source: Shea Moisture

Ingredients companies are further looking to expand their expertise in “textured hair”, a broad term to which the beauty industry has gravitated that better captures the wide spectrum of hair types than other terms such as “ethnic hair”, which indicates a sense of otherness. Dow’s partnership with The Most to understand and solve pain points of multicultural consumers signifies a pivot from ingredient companies to proactively understand the needs of the end-consumer, rather than reactively relying on requests from brands. Meanwhile, Symrise has invested in Sunday II Sunday owner Infinite Looks. Symrise hopes the brand, which develops athleisure hair care for textured hair, will expand its insight into the hair and scalp segment for active consumers.

Meanwhile, retailer Superdrug is prioritising its ranges for black and mixed-race consumers, by launching four exclusive brands; Nylahs Naturals, Afrocenchix, Mielle Organics, and Flora & Curl. As ingredient formulations and retailer accessibility improve, so too will the choice and quality of products available on the market.

Brands are expected to further their inclusive efforts in other areas, such as hijab hair care, with hijab wearers often seeing hair care needs such as dandruff, oily scalp and loss of freshness rarely catered for. Sunsilk and Pantene are defining this trend in Asia Pacific, with opportunities to expand this to Western markets.

Social sustainability key to brand equity

While formulation and product offer drive inclusive hair care, consumers are increasingly demanding more of the brands they purchase from, with community and purpose being key to this.

Brands engaged with consumers throughout Black Lives Matter protests in 2020, with Unilever’s Shea Moisture hosting virtual events and launching a grant programme for black female beauty creators, with 2021’s programme offering USD150,000 to 12 founders. The brand continues to support social and racial issues, such as ending hair discrimination in the US through support of the Crown Act (an acronym for “Creating a Respectful and Open World for Natural Hair”) alongside Dove. Shea Moisture’s success in social sustainability highlights the importance of supporting causes that are key to a brand’s identity and that build on already established online communities.

Meanwhile, online activists called out retailers such as Walmart in June 2021 for having black hair care products locked away in glass cases. While Walmart has since rectified this, and has invested in product development for black consumers in partnership with the likes of Unilever and Procter & Gamble, empowered consumers continue to take advantage of a fragmented retail landscape to seek out retailers that are in stronger alignment with their values.onsumers now expect authenticity, inclusivity, and social purpose to not only guide beauty brands’ product innovations but also their operations, hiring practices and support of local communities.

Opportunities beyond hair care

While hair care has dominated innovation in beauty targeting multicultural consumers, beauty players should be attentive to how to better serve black and POC consumers in other product categories. Colour cosmetics has long seen demand for more inclusive ranges to match all skin tones, with Fenty Beauty pioneering 40-shade foundation ranges in 2017. Launched in September 2020, and supported by Sephora’s 2022 Accelerate Program, Mango People aims to be inclusive of all skin tones, while drawing on inspiration from the South Asian roots of the brand by utilising plant-based adaptogens.

Skin care brand Melyon, with origins in Scandinavia and West Africa, launched in 2020, and aims to be an inclusive force in an exclusive industry while changing the ideal of beauty. Unilever launched melanin-focused skin care brand Melé the same year with products addressing dark spots, uneven skin tone, moisture imbalance and sun damage, while is Dove Baby Melanin-Rich range focuses on nourishment and moisture.

Further opportunity remains in sun care, where demand for products with no white cast remains high. While brands such as Black Girl Sunscreen have existed since 2016, few mainstay brands market their invisible credentials to black and POC consumers. In turn, brands can continue to maximise their consumer base by formulating products suitable for melanated skin tones and marketing these benefits effectively.

For further insight, see our report, Maximising Prospects in Hair Care