The naturals trend continues to expand across beauty and personal care categories, in part because many consumers are increasingly associating beauty with health and hygiene. Consumers are paying closer attention to the potential health risks posed by certain ingredients. Natural ingredient formulations are often perceived as healthier and safer, so natural products are often preferred. According to Euromonitor International’s Beauty Survey, in 2018, 25% of US consumers said they would prefer a facial moisturizer with natural or organic ingredients over a brand they have personal experience with. 21% said they would prefer a facial cleanser with natural or organic ingredients.

The naturals trend is present in categories beyond skincare, such as bath and shower care, baby and childcare and even deodorants. There is no standard definition for natural products as ‘natural’ is a subjective concept that can touch upon ideas like non-toxic, plant-based and vegan. Still, ingredients are one of the most important lenses that consumers associate with ‘natural’.

Health concerns create an opportunity for natural deodorants

Health concerns regarding the ingredient formulations of deodorants and antiperspirants have paved the way for natural deodorants to successfully penetrate the US market.

U.S based institutions, including the National Cancer Institute, the American Cancer Society, and the Susan G. Komen Cancer agree that deodorants appear to be safe. However, some scientific research to date has proven a link between certain ingredients in antiperspirants and health problems, ranging from developmental or reproductive issues to cancer and Alzheimer’s, but has not been conclusive in proving cause and effect.

Consumers are prioritizing ingredient transparency, simplicity, and healthy living, opting for a more natural deodorant and causing manufacturers to rethink deodorant formulations.

Source: Euromonitor International

Indie, mass, drugstore, and premium manufacturers have responded to this trend over the past five years, debuting new lines of natural deodorants to attract health-conscious consumers.

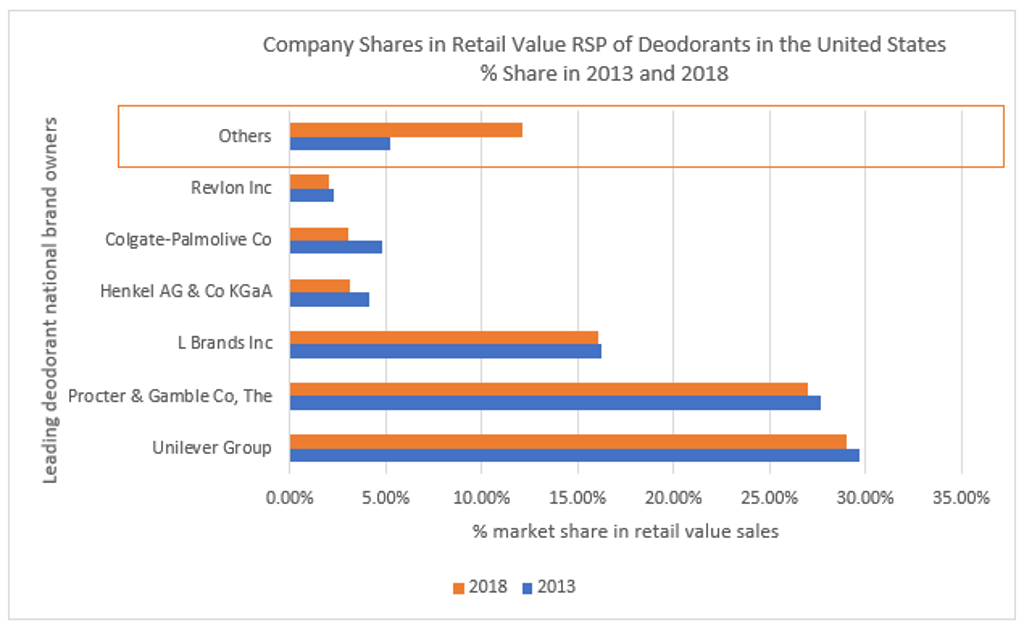

The naturals trend has been a driving factor in the rapid growth of smaller brands, represented by “Others” in the chart above. Their market share in the U.S has dramatically increased within the past five years, from 5.2% in 2013 to 12.1% in 2018, according to Euromonitor International. Although “Others” is not exclusive to natural deodorant brands, many fall within this category. The naturals trend will continue driving the share of these brands and influencing future mergers and acquisitions, product line extensions, and formulations of deodorants over the next five years in the U.S.

Natural deodorant brands focus on safety, effectiveness, and sustainability

Largely in response to health concerns, most of today’s natural deodorant brands position their products as safer alternatives to traditional deodorants. Ingredient-specific benefits like aluminum-free, paraben-free, phthalate-free and blanket buzzwords such as safe and clean are popular.

Some notable examples in the U.S include SmartyPits, whose founder was inspired to create the brand when her mother was battling breast cancer. The brand touts a “super-strength formula” and rejects animal testing. Other examples include Native, which was acquired by Procter & Gamble in 2017 and promotes health consciousness and safety through its “Safe. Simple. Effective.” slogan, and Honestly pHresh Naturals, which is aluminum-free, cruelty-free.

While the naturals trend is changing how deodorants are marketed to consumers, they are still skeptical that deodorants are either natural or effective, but not both. Euromonitor’s Beauty Survey data from 2018 shows that when U.S consumers were asked to choose between skin care products that have natural and organic ingredients and skin care products that are effective, they favoured efficacy, which garnered 48% of respondents, compared to 20% who prefer natural or organic ingredients. The remaining 32% of respondents were neutral to both options.

However, advancements in the development of natural and effective deodorants stemming from skin care studies are merging the gap, meeting the needs of consumers drawn to health and safety claims that are also seeking a balance between natural ingredients and efficacy.

The Power of Probiotics – Can this ‘good-bacteria’ cure underarm odor?

Recent research on the skin’s microbiome has shed light on bacteria’s role in underarm body odour. Contradictory to widespread consumer assumptions, sweat by itself is not what smells. Instead, the bacteria found in the underarm area is the true culprit of body odour.

It seems that certain strains of bacteria tend to smell worse than others, suggesting that the right balance of good bacteria might address the vice of foul-smelling underarms. University of California-San Diego researcher Dr. Chris Callewaert successfully eradicated bad bacteria in foul-smelling armpits by transplanting bacteria from non-foul-smelling armpits. Although this is still an ongoing area of research, certain natural brands have begun experimenting with pre- and probiotic formulas to increase the effectiveness of their deodorants.

In the aim to meet consumers’ expectations for effectiveness in odour elimination or odour control incorporating natural ingredients, emerging US brands SmartyPits, Native, and Honestly pHresh Naturals incorporated some form of prebiotics and/or probiotics into their formulas.

Native deodorant sticks contain Lactobacillus Acidophilus, a type of bacteria believed to support gut health, often found in foods including yogurt and sauerkraut. SmartyPits contains a plant-based prebiotic, and pHresh contains a prebiotic formula that the brand claims “promotes the growth of healthy bacteria on your skin’s surface while attacking any gram negative or positive bacteria that causes body odor.”

Despite the addition of prebiotics and probiotics in these brands’ formulations, the pre- and probiotic claims are highlighted to a lesser extent compared to their aluminum-free and paraben-free claims. The under-emphasis of microbiome content is peculiar, considering skincare brands have been quick to boldly market the pre- and probiotic formulations of their products that contain them.

However, natural deodorant brands may be hesitant to highlight pre- and probiotics since its benefits to odour control or odour elimination effectiveness in deodorants is still in the early research phases. For instance, Dr. Callewaert notes that L. Acidophilus, the probiotic strain found in Native, is typically found in the gut. It is uncertain whether the strain has any significant benefit to reducing underarm odor, although L Acidophilus is, indeed, a probiotic.

Consumer familiarity with the topic of the microbiome may also be a barrier considering that the growth of probiotics for gut health has stagnated immensely. In fact, the U.S. market size for probiotics shrunk 6.4% from 2,993.8 million USD in 2017 to 2,800.3 million USD in 2018. Amid a decline in probiotics for gut health, it will be interesting to see if other natural deodorant brands will introduce pre- and probiotics into their products and what kind of growth the existing pre- and probiotic deodorant products will experience in the next five years.

As the naturals trend continues to evolve in the U.S., the definition of “natural” and natural product positioning will continue to change. As seen with natural deodorants, it is very common for these brands to highlight their products’ absence of certain ingredients consumers are looking to avoid. The current naturals trend is largely centered around clean beauty, containing non-toxic ingredients or as few ingredients as possible.

Plant-based ingredients have also been popular because they meet consumers’ natural preferences along with sustainability preferences. As more research is conducted on the efficacy of different types of natural ingredients, marketing may change from emphasizing the absence of certain ingredients to featuring the addition of specific natural ingredients proven to be effective. For instance, if research demonstrates that pre- and probiotics strongly assist in the functionality of deodorants, more natural deodorant brands may begin incorporating the ingredients and showcasing them via product labels.

Moreover, the market for deodorants in the U.S. is forecasted to grow by 7.6% between 2018 and 2023 (1.5% compounded annual growth rate), according to Euromonitor International. Assuming that the naturals trend in deodorants is a long-term trend contributing to this expected growth, leading national brand owners may consider investing in it. Leading brand owners may either acquire smaller natural deodorant brands, just as P&G acquired Native and Unilever acquired Schmidt’s Naturals, launch their own natural deodorants or tweak their existing formulations. Their decisions and product positioning (probiotic containing vs. free-form claims) will depend on consumers’ perceptions of naturals in the coming years.

For more information download our on-demand webinar: The Role of Microbiome in the Evolution of Skin Care.