Despite its relative maturity, K-Beauty continues to make its mark on the beauty and personal care industry. Much of the trend’s continued success is owed to K-Beauty’s association with innovation and quality at affordable prices, rather than the initial novelty which introduced the prospect of a relatively cheap but effective skin care routine to the masses.

As a result, more K-Beauty companies such as Soko Glam, YesStyle and Wishtrend are tapping into potential consumer groups outside of South Korea.

K-Beauty's attributes receive global interest

We analysed the distribution of a selection of key K-Beauty brands* online over time under the skin care category. Out of a sample of nearly 1,500 online retailers across 40 geographies, 81 of these were selling K-Beauty brands at the end of 2018, while in 2019, the number increased to 113, a 40% rise, which is a noticeable increase in global availability.

By the end of 2018, there were 6,070 skin care SKUs available of such brands in markets outside South Korea, while up to September 2019 there were almost 13,747 SKUs of the same brands from our sample of retailers being offered worldwide. The increase in retailers stocking K-Beauty products reflects and sustains growing consumer awareness.

More than just awareness of the trend and South Korea’s prominence as an innovative trailblazer in beauty, there’s a growing consciousness towards specific product attributes associated with K-Beauty, unknown to many Western consumers until the trend’s globalisation. These attributes include claims such as skin brightening, exfoliating and soothing.

The sample of retailers analysed reveal that from 2018 to 2019 there was an increase of 56% in skin care products claiming at least one of these benefits. In fact, the preference towards those attributes by South Koreans can explain the industry´s interest in launching products making such claims.

Euromonitor’s Beauty Survey data shows that under acne-treatment, for example, South Koreans opting for products that highlighted skin brightening/luminosity/radiance features jumped from less than 3% of respondents in 2017 to 10% in 2018. Under anti-ageing products, exfoliating/clarifying attributes influenced just 7% of total respondents in 2016, while in 2018 the figure increased to 21%.

Price remains a key differentiator for consumers

Regardless of this, price remains a key differentiator for consumers turning to K-Beauty as the movements bills itself as offering good quality and effective products at affordable prices. But are K-Beauty products cheaper than other brands?

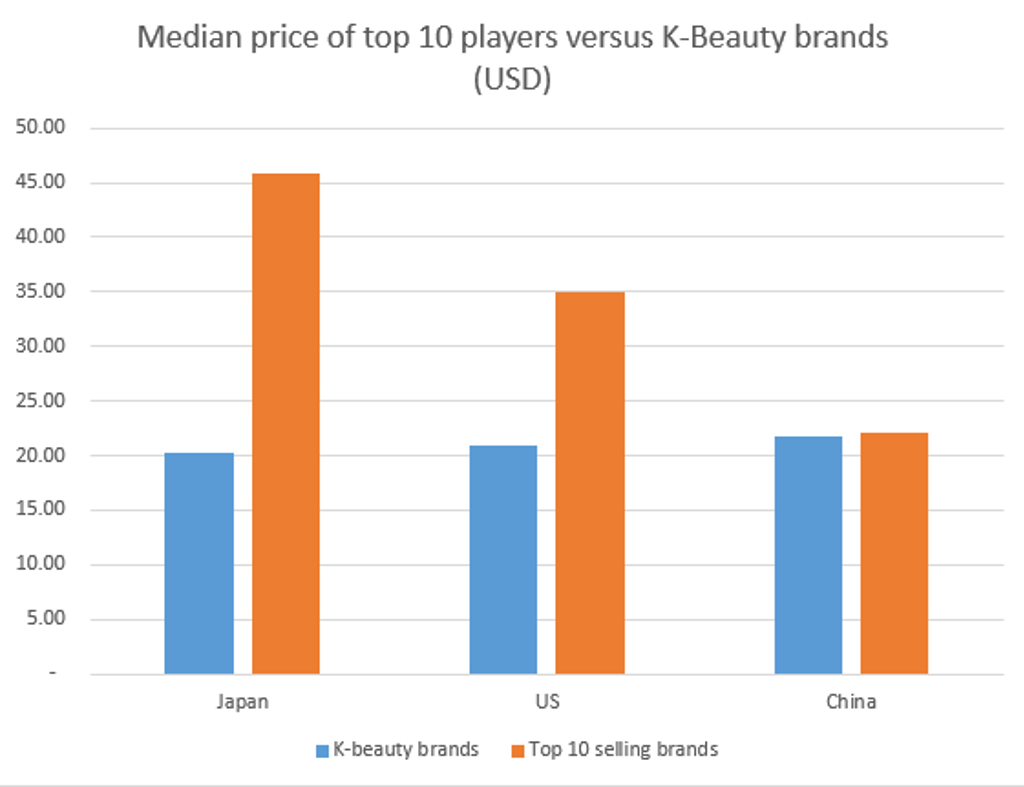

China, the US and Japan are the three largest beauty and personal care markets and in 2018, accounting respectively for 24%, 15% and 13% of the global skin care segment. When analysing pricing strategies, we see that that the sample of K-Beauty brands are cheaper than those of the top 10 selling skin care brands in each country, according to Euromonitor International´s Passport data. K-Beauty brands are priced 38% lower than those of the top 10 bestselling brands in each market.

The US and Japan are more premium-centric markets than China, with Euromonitor´s data showing that the premium segment accounted for 34% of the total market in the US in 2018 and 40% of the market in Japan. However, the Chinese premium segment is posting strong growth rates, showing the appetite of local consumers towards higher value-added products.

The Chinese market posts extra challenges for K-Beauty brands, with local brands such as Pechoin and Chando also investing in delivering innovative products at affordable prices. With C-beauty to be amongst the next BPC trend waves, K-Beauty is challenged to rapidly gain ground in China as to not lose momentum against the rapid growth of local brands.

In all three markets, K-Beauty products are challenged to increase their presence under a scenario where the premium segment continues to post higher growth rates. Consequently, apart from maintaining competitive prices, focus on performance and innovations are set to continue be fundamental for K-Beauty brands to increase their presence worldwide.

Source: Euromonitor International

K-Beauty has been paving the way to grow the masstige segment

More than offering relatively cheaper prices, K-Beauty has been paving the way to grow the burgeoning masstige beauty segment. In Japan, for example, out of the top 10 selling skin care brands, according to Euromonitor´s data, the median unit price was USD46, whilst K-Beauty brands presented a median price of USD20. Meanwhile, top selling premium brands in the country, such as Shiseido, Pola and SK-II, had an average price of USD68.

In the US, the scenario repeats with the top 10 selling brands presenting an average price of USD35 while K-Beauty brands presented a figure of USD21. K-Beauty products seem to be targeting consumers who may not be able to afford to invest in premium items, but desire products with a differentiated value proposition from the mass segment.

Despite maturity, promise remains

Despite the maturity of the K-Beauty trend, promise remains as the gap between price and value widens and the crucial masstige segment is having something of a revival, which could benefit the K-Beauty category. With both mass and premium brands looking to adopt new aspirations for efficacy, ethical, experiential and authentic qualities, the lines between the two segments continue to blur and the ‘masstige’ space is further reinforced.

In 2018 the mass segment rapidly picked up pace to narrow the growth trajectory gap between mass and premium, as the sophistication in the lower price echelons intensified. Beauty brands old and new have been able to reassert their value to consumers with no-frills, results-driven products that deliver, regardless of price and K-Beauty could be at the forefront of this as availability improves outside of South Korea.

* Brands included when referring to K-Beauty brands analysed in the article: Missha, Banila Co, Benton, Neogen/Neogen Dermalogy, Innisfre, COSRX, Etude/Etude House and Klairs/Dear, Klairs.

This analysis was done using Via, Euromonitor International´s latest pricing intelligence tool. To understand the impact of ecommerce data in the pricing strategy process, download our white paper “How to Optimise Your Pricing Strategy Using Ecommerce Data”.