Key Questions for Understanding US Travel’s Uneven Recovery

The US travel industry saw significant growth in the summer of 2021. Full recovery is still a far-off goal, however, leading many to wonder, when will the industry recover? To answer that, we need to understand how the pandemic has changed travel in the US, and how long those changes will last. In this article, we will explore three impacts COVID-19 has had on US travel. While each may challenge parts of the industry, they are ultimately opportunities for travel providers to shape their business for the post-pandemic travel landscape.

Will business travel recover?

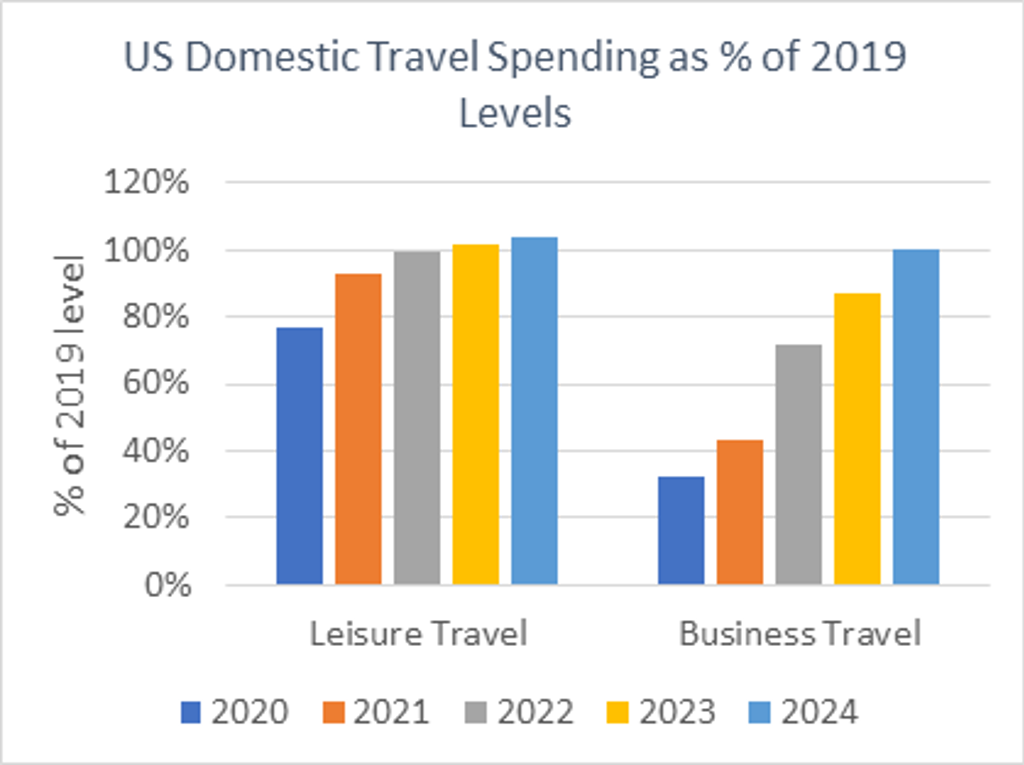

Yes, but it will trail leisure travel for several years. Two factors are critical for business travel to regain its share of the domestic travel market: US companies’ return to work plans and leisure travel’s growth. Many companies expected to bring employees back to the office in the fall of 2021, but the Delta variant caused many companies to delay their plans. Any future waves of COVID-19 in the US could further delay return to office plans. The timeline of these plans is key, as return to the office is a precursor to the resumption of business travel.

Domestic leisure travel had a banner recovery in the summer of 2021, surpassing 2019 travel levels across much of the country.

Leisure travel’s recovery has upended what was a relatively stable balance between domestic business and leisure travel. Growth of domestic leisure travel will wane in 2022, as international travel’s recovery will likely accelerate. The slowing growth of leisure travel will allow business travel to regain its share of the US domestic travel market, especially as the return of conferences and other events help spur business travel’s growth in 2022.

How has consumer behaviour changed?

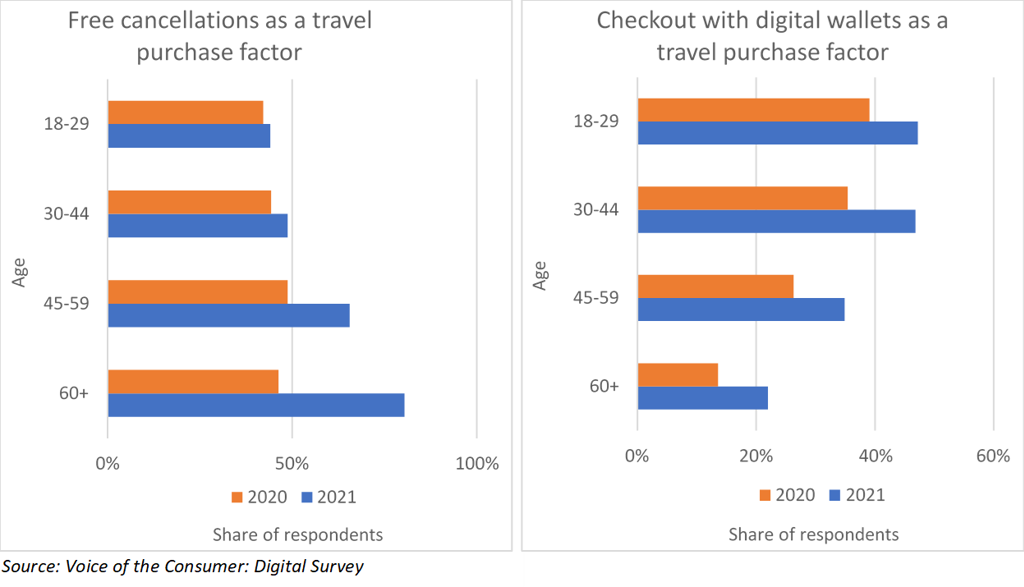

The pandemic has impacted how travellers book their trips just as much as what types of trips they take. Free cancellations surged as a purchase factor during the pandemic, as consumers sought insurance against COVID-related complications. Consumers’ interest in digital wallets also grew, indicating travellers want flexibility in how they pay for travel. The pandemic’s impact on booking behaviour varies significantly between age groups. These differences offer travel providers an opportunity to sharpen their consumer targeting.

Before the pandemic, free cancellations influenced the purchasing factors of different age groups at roughly the same rate. While all age groups became more interested in free cancellations over the pandemic, older travellers are now much likelier to be swayed by free cancellations than younger travellers. Those aged 60 and up saw the greatest shift, with 80% of consumers in this group citing free cancellations as a purchase factor in travel decisions in Euromonitor’s 2021 Voice of the Consumer: Digital Survey.

While free cancellations are the most influential purchase factor for American travellers, convenient digital wallet checkout options are a more persuasive factor for travellers aged 18-29. 44% percent of 18-29 year-olds reported being interested in digital wallet options in 2021, as opposed to 44% by free cancellations. Topline trends in purchase factors belie important variance among age groups. To have the most impactful messages, travel providers need to account for these differences in their marketing.

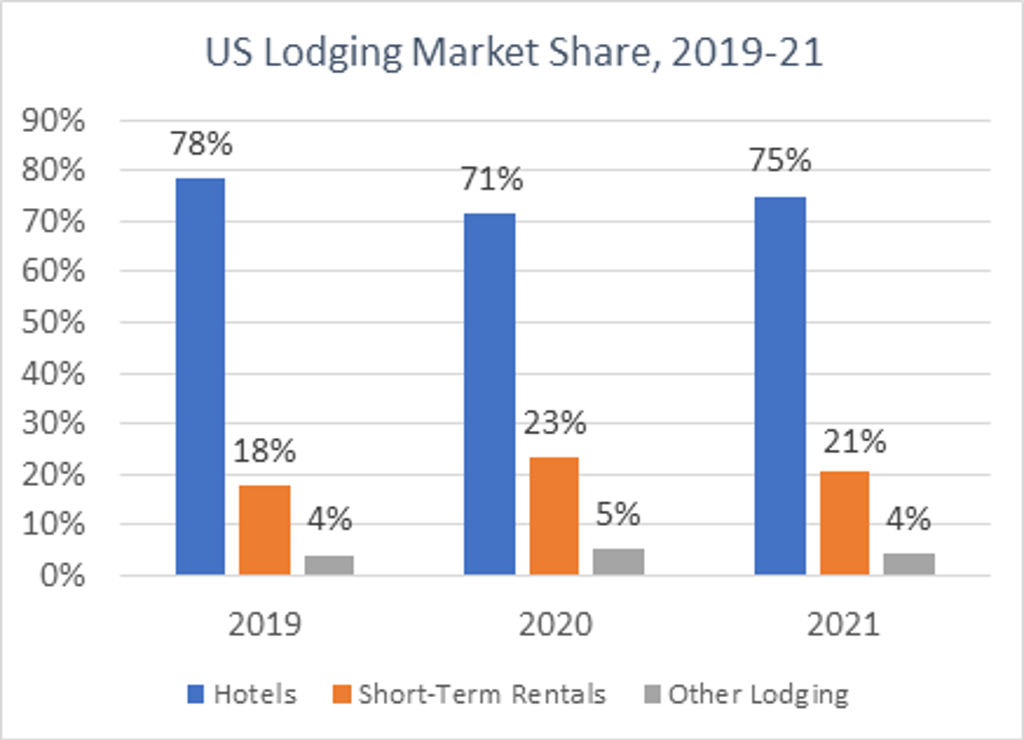

How long will the short-term rentals boom last?

Expect the short-term rental boom to level off beginning in 2022 due to several trends that could slow growth.

As demand has risen, so have short-term rentals’ prices. Short-term rentals’ price advantage over hotels was a major factor in their early growth. If prices rise further, US travellers may become more likely to book more stays at hotels.

Furthermore, several cities, including Chicago and New York, introduced restrictions on short-term rentals operations over the past several years. For the moment, these issues are headwinds and not serious issues for the short-term rental sector. If short-term rental providers want to continue increasing market share, however, they will need to focus on recruiting more hosts. Having more properties on their platforms will address the supply crunch and help keep short-term rentals’ price competitive compared to hotels.

Conclusion

Key trends are emerging that answer what the long-term impact of the pandemic on US travel will be. Some sectors, such as business travel, continue to struggle but have a potential road to recovery. Other sectors, such as short-term rentals, have permanently increased their position in the market, even if their growth will level off over the coming five years. Consumers’ attitudes toward travel saw some of the largest changes from the pandemic, especially as differences between age group became more pronounced. Instead of being challenges for the industry, trends established during the pandemic are an opportunity for travel providers to personalise their messaging. In doing so, travel providers will prepare themselves well for the industry’s eventual recovery.