As we enter another year marked by COVID-19 as a persistent reality, brands will need to adjust to a more streamlined consumer mindset when it comes to consumption, through simplification and the adoption of a ‘back to basics’ approach in terms of marketing, product innovation and portfolio realignment. The crisis has highlighted a collective increased appreciation of personal health and the health of the planet, and has demonstrated our capability of being content with less. While the consumer desire for product and service experimentation remains intact, the pursuit of simpler lives is marginally stronger and has seen an uptick compared with pre-pandemic years, with 69% of global consumers looking for ways to simplify their lives in 2021, according to Euromonitor International’s Lifestyles Survey.

Value reassessment in health, wellness and beauty in particular will manifest in more targeted solutions, simpler brand messaging, enhanced transparency and efficacy, alongside stronger projections of economic, ethnic and geographic inclusivity, price point accessibility, as well as social and ethical purpose, which have become wellness pursuits in their own right.

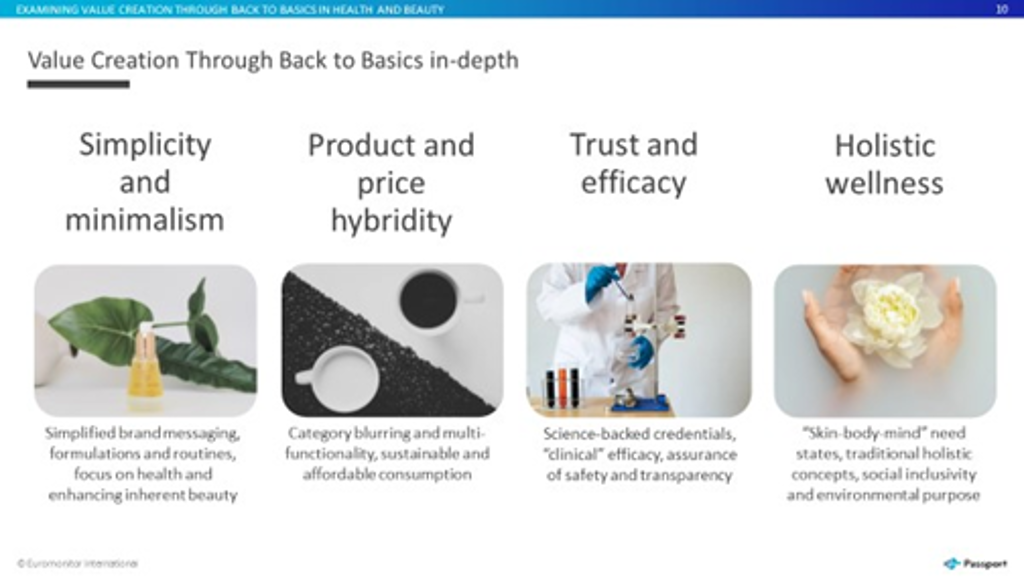

Simplicity and minimalism

The concept of back to basics is rooted in a drive toward simplicity and minimalism in all phases of product development, from marketing and ingredients to understated packaging design.

Alongside an increased tendency towards routine simplification, other factors to consider are more simplified branding around need states and advocating the theory of boosting the skin’s natural resilience to avoid over-sensitised skin conditions which multiple product layering can create.

From a formulation perspective, with many beauty brands already adopting the strategy of singling out signature “hero” ingredients or touting fewer and less processed ingredients, a next natural progression would be a greater focus on education around safety, personalised benefits and results, as well as the potency of actives.

Brands embracing a minimalist ethos are also able to reinforce higher purpose-driven credentials and resonate well with more ethically-minded consumers, a tactic which applies across a wide range of categories, including colour cosmetics and fragrances, which do not have traditional associations with minimalism.

Product and price hybridity

With a strong polarisation between the impact on premium and mass beauty, the masstige segment is gaining further traction. As reported by Euromonitor International’s Voice of the Consumer Beauty Survey, 50% of global consumers spend on average USD6-20 on anti-agers, vs 25% who spend USD30 or more. With so-called ‘skintelectuals’ coming to the fore, challenges around higher price point justification will persist.

Taking cues from beauty, further price tier segmentation and blurring is also taking place in the dietary supplements space, with growing product proliferation and sophistication in personalised solutions being more evident.

The desire for a more holistic approach to beauty and wellness and wider-encompassing psycho-physical need state solutions (eg, gut health, immunity, emotional wellbeing) will result in further benefit blurring across both stand-alone and adjacent categories, not strictly within hybrid skin care and colour cosmetics items, but also in the areas of functional fragrances and ingestibles, and all wellness-centred propositions in food, beauty and health.

In tandem with simplicity and minimalism, harnessing the power of combination and multi-tasking products also bodes well for elevated sustainability commitments, price sensitivity and affordability.

Trust and efficacy

Higher value perceptions are also led by expectations of proven and clinical efficacy, and certainly post-pandemic, we will see an increase in clinical, science-backed brands that can evidence claims and are backed up by medical expertise – something that the crisis has elevated.

Doctors’ brands and dermocosmetics stand to benefit, and so do offerings that involve clinicians, scientists and medical professionals as part of guidance, recommendations and the development of new product concepts.

The progression around science education and efficacy lends itself well to the evolution of personalisation and the much sought-after assurance of safety, trust and biocompatibility of both topical and ingestible products. It also opens up opportunities for novel traceability methods, including on-pack labelling, digitally-enabled formulation transparency and more advanced blockchain technologies.

Holistic wellness

The pandemic shift has elevated the prioritisation of wellness across all product segments and consumer groups and has strengthened certain components around social and environmental sustainability, as well as financial and mental wellbeing.

Key wellness and health and beauty expressions include the rising demand for more botanical/herbal ingredients, the exploration of traditional holistic concepts and self-care rituals such as Ayurveda, and most importantly, solutions that target all-encompassing “skin-body-mind” need states. There is further scope for bringing innovation along the skin-gut-brain health axis through bridging specific psycho-physical outcomes and consequently adapting formulations, education and marketing, for example in the area of psychodermatology and exploring neuroscience as part of skin health solutions.

Aligned with this more pronounced holistic view comes the continued expansion of beauty into less explored concepts, such as hormonal health and sexual wellness, alongside multiple lifestyle components, from beauty snacking and collagen coffee to healing scents and home ambience candles.

As wellness ceases to be a purely individual indulgence and advances towards a more community-centred and environmentally-conscious endeavour, embedding social purpose, emotional resilience, community support and environmental credentials will be as important as the functional benefits of the product to the end-consumer.

Key business recommendations

Source: Euromonitor International

Euromonitor International has identified Value Creation Through Back to Basics as one of the key strategic themes impacting consumer markets. To find out more, see the report Value Creation Through Back to Basics in Health and Beauty.