According to the latest data published by Euromonitor International, global sales of personal accessories are set to increase by just over 4% by the end of 2022. Whilst this represents a marginal slowdown compared to 2021 figures, following the strong pent-up demand on the back of global lockdowns and store closures, growth for 2022 is still hugely impressive against a backdrop of ongoing political and economic instability, major concerns over high and rising inflation, and the cost-of-living crisis, not to mention the continuing effects of the global pandemic. Recovery to pre-pandemic value sales levels is expected by the end of the year, albeit fuelled by inflation and rising prices, which could act as a potential constraint to demand.

The industry overall has clearly benefited from the resumption of social events and key market players pursuing their digital transformation. However, China continues to experience extensive lockdowns driven by its “zero-COVID” policy. This factor, combined with all-time high inflation, ongoing supply chain disruptions, volatility in commodities markets and rising operating costs continues to place pressure on global businesses and manufacturing, in addition to ongoing uncertainty in Ukraine, meaning that recovery in the short to medium term will be uneven and fragile.

The return of weddings and social occasions helps to fuel demand

A major driver behind the recovery of sales, particularly when assessing jewellery, is due to the return of weddings, as well as a small uptick in international sales, linked to a rise in global travel flows and the return of the wealthy tourist in key shopping hotspots around the world. Indeed, according to the latest data published by Euromonitor International, the number of marriages taking place around the world fell by 16% in 2020, followed by an increase of 4% in 2021 and a 6% rise expected by the end of 2022. The outlook for marriages over the short to medium term also remains stable.

Furthermore, overall sales of personal accessories within the luxury category are particularly healthy. This price platform has been somewhat cushioned due to the wealth of global affluent populations but also because many consumers are increasingly looking to luxury jewellery and timepieces as alternative assets and safe investments in times of financial crisis. The shift in women’s purchasing power in North America, Europe and Asia along with evolving gifting occasions, including the rise of self-gifting, is also playing a key role in driving demand for jewellery and watches in general.

Asia Pacific comprises over half of all sales

Overall sales of personal accessories are being driven by North and Latin America, with both regions registering double-digit growth in 2022. Growth in Asia Pacific is being constrained by China’s “zero-COVID” policy, while Europe is being undermined by the triple impact of high inflation, the cost-of-living crises, and ongoing uncertainty regarding the war in Ukraine.

Nevertheless, despite constrained growth in China, Asia Pacific continues to lead overall sales to account for over half of all global spending on personal accessories, with a 57% value share. As international travel continues to be impacted in key markets across the Asia Pacific region, significant spending by local consumers on personal accessories, such as luxury timepieces, bags and jewellery, within domestic markets rather than international markets remains extensive.

Rise in online sales continues as new shopping habits stick

COVID-19 has undeniably served as a catalyst for a stronger move towards digitalisation and direct-to-consumer (D2C) sales. Supported by innovation and rising access to technology, the way that personal accessories businesses, retailers and governments deliver products and services has changed.

Whilst store-based retailing remains the largest distribution channel for personal accessories, accounting for over 80% of all sales in 2022, retailers and brands, especially fine jewellery retailers, have been investing heavily in digitalisation in the hope of creating a stronger and true omnichannel shopping experience. Once again, China and the US are the key markets supporting e-commerce’s success and account for the largest contribution, with the two countries accounting for over half of all global online sales.

As remote working arrangements are set to remain relevant moving forward, and a growing number of consumers want to enjoy the convenience of being able to shop anytime and from anywhere, online sales will continue to grow in the future. However, physical touchpoints remain critical and store-based retailing is set to reinvent itself by focusing on brand and customer experiences. Nevertheless, expanding a digital presence is projected to remain key for retailers in the short to medium term.

Connected watches, driven by smart wearables, continue to shape the competitive landscape

The competitive landscape is further consolidating, with LVMH increasing its lead over its closest competitors in 2022. The ranking of the top five industry players is otherwise unchanged, but Cie Financière Richemont SA is set to record the strongest growth, driven by its iconic Cartier brand, with continued strong appeal to consumers.

Connected watches, driven by smart wearables, continue to shape the competitive landscape in personal accessories. The scale of their impact is visible in the newly-introduced timekeeping devices dataset, as Apple Watch emerged as the fifth largest global personal accessories brand in 2022, trailing marginally behind Rolex. Samsung and Garmin also joined the top 20 industry brands.

Global stagflation could hit personal accessories as tempering of pent-up demand sets in

Global stagflation could severely affect the growth outlook for personal accessories, particularly for those emerging and developing countries which are dependent on external demand and supply. A sharp slowdown or recession in the US and the eurozone would lead to lower demand for exports from China, undermining the country’s economic activities and growth.

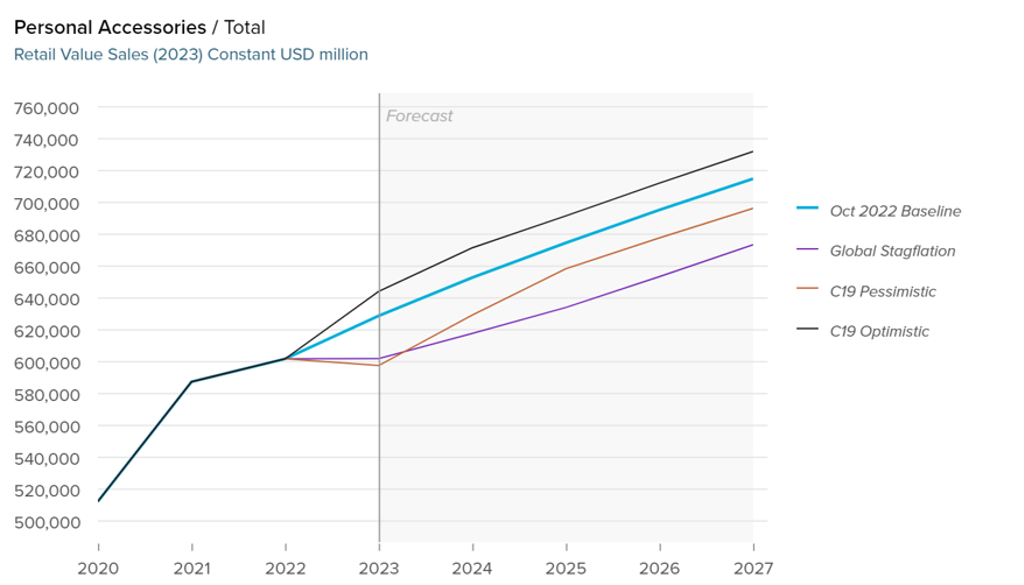

Source: Euromonitor International, Industry Forecast Model

According to Euromonitor International’s latest Industry Forecast Model, in the two worst-case scenarios – C19 Pessimistic and Global Stagflation – global spending on personal accessories could decrease by 0.07% and 0.0% respectively in 2023. However, in the most optimistic scenario – C19 Optimistic – this will see an increase of just over 7% in the year. Either way, the industry has new challenges to face, such as the global surge in inflation. This may lead to a tempering of pent-up consumer demand as belts tighten in the face of soaring energy, food and commodity prices.

Amid such volatility, consumers globally are demanding greater multifunctionality and price hybridity – features that tend to thrive during periods of uncertainty, such as the Global Financial Crisis of 2008-2009. Due to the rising cost of both discretionary and essential items over the past two years, consumers demand brands, especially in the low- to mid-priced platforms, that deliver the best value and optimal benefits.

For further insight, read our reports Global Wealth and Luxury and World Market for Luxury Goods.