The post-Covid world will see unequal economic recoveries, disparate category growths and new consumer preferences, presenting both challenges and opportunities for diversification and growth.

At the Australian Food & Grocery Council (AFGC) Symposium 2021, the panellists explored the markets which present new frontiers for growth, ways to succeed in these markets and what government support is available to help them succeed.

The themes leading the panel discussion highlighted the top performing markets in food & beverage, key shifts in megatrends and recommendations of how businesses can apply these to untapped opportunities.

Top performing markets in food and beverage

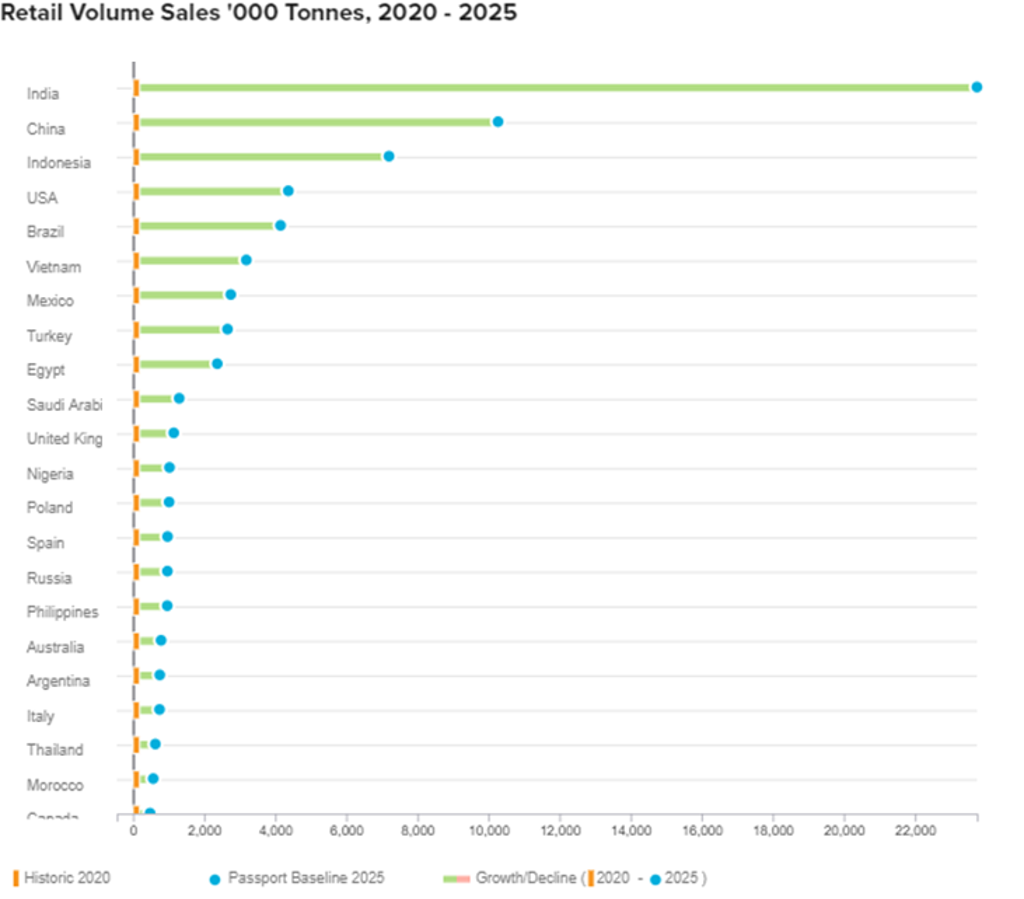

Source: Euromonitor Industry Forecast Model

Euromonitor International predicts that the impact of COVID-19 will dissipate from 2022, leading to a favorable long-term outlook for both retail value and volume growth from 2022 to 2025. India, Brazil, Mexico, Indonesia and Vietnam are among the top markets expected to grow in terms of absolute retail value growth. This forecast is mainly driven by its sheer size of population, a strong economic performance, an increasing number of middle-class consumers and higher consumer demand for staple food and dairy.

There is polarisation between high-potential markets like India and Indonesia with continuing income growth, and Western European and North American markets with modest, flat (or in some cases negative) income growth. While this trend is constraining the ability of consumers to trade up to premium food and beverage options in the latter regions, it brings opportunities for branded and trusted products in emerging markets.

Key shifts in megatrends

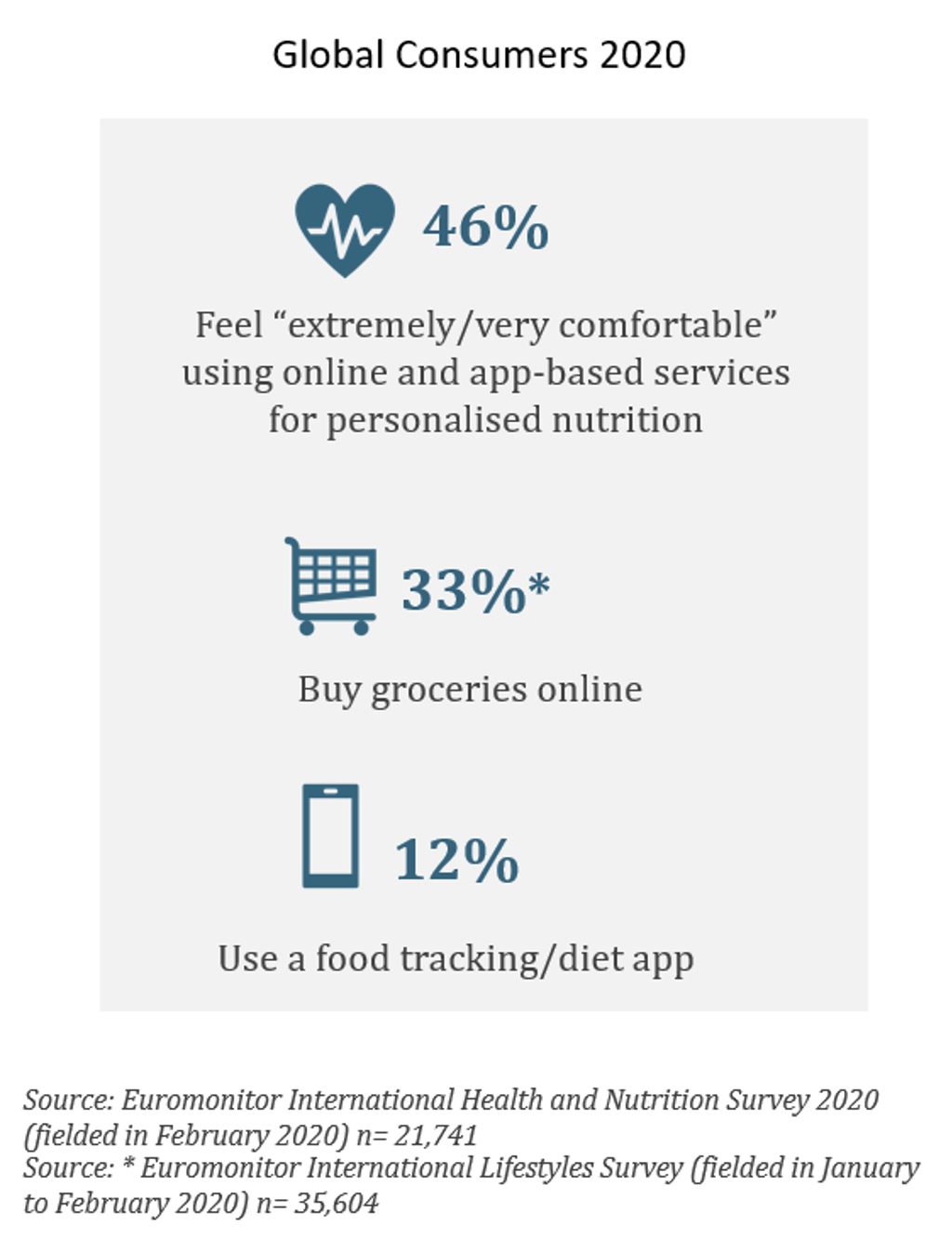

1. As pandemic waves continue to surge across different markets, the home seclusion trend is expected to persist. In addition to e-commerce, this has created sustained demand for convenient solutions to dining occasions, such as ready meals and home-cooking ingredients.

2. Consumption occasions will evolve moving forward and although impulse occasions are set to return, the rise of e-commerce and the increase of working from home could lead to a fundamental shift on impulse consumption.

3. Growing demand for healthy living has contributed to “soft” attitudinal shifts among consumers, who are moving towards mindful eating and functional foods. In line with a more holistic diet, this will result in a long-term impact on consumers’ baskets, with this set to be a key innovation area.

4. This shift in consumption has forced manufacturers to focus on value-added products and sustain demand through price-engineering such as raising prices and scaling down pack sizes for products like bottled water.

Key recommendations for businesses

1. Tangible, accessible and relevant propositions

Businesses should invest in the right pockets of opportunities such as functional food and beverages. As the concept of the home evolves to a wellness hub, businesses need to fulfil the increasing need to mimic out-of-home experiences.

Businesses can reach a more diverse pool of digital consumers and address the needs of underserved and more vulnerable communities by diversifying the range of technologies and support tactics.

2. Maximise exposure through a wider lens

Businesses should leverage opportunities for e-commerce and ensure a balance between a physical and online presence to optimise the consumer purchasing journey.

Further, businesses should effectively cater to the surge in order volumes as government SOPs and the safety of delivery agents remains a top priority.

Adopting an innovative culture through product launches is vital to tailor to local consumers.

3. Raise awareness of your brand through a consumer-led approach

It is essential to understand shifting demographics in export markets and focus resources to reach younger and more urban consumers in new markets, with online-focused initiatives such as subscription models.

Lastly, businesses should utilise technology and local know-how to address new priorities around innovative products, supply chain transparency and safety.