Since the emergence of the COVID-19 pandemic there have been significant fluctuations in wood demand, starting from a considerable decrease in early 2020 to acute material shortages in 2021 due to soaring post-lockdown demand.

As construction activities and furniture manufacturing picked up in late 2020 so did the lumber prices, recording the highest increase since 2016.

2022 brought new challenges to the wood industry as intensifying disruptions in global supply chains amid the Russian invasion of Ukraine, rising inflationary pressures and declining consumer confidence are already altering the global wood demand and supply landscape. However, long-term changes in forestry management and building practices are expected to sustain the global demand for wood.

Geopolitical tensions exacerbate global wood supply issues

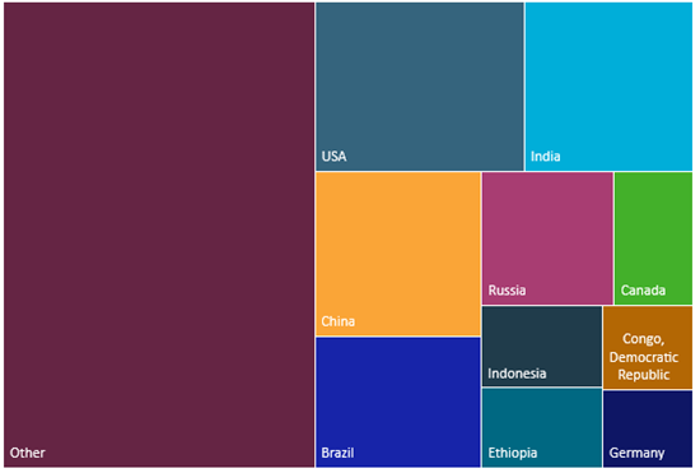

Geopolitical tensions exacerbated by the Russian invasion of Ukraine have significantly affected the global wood supply chains. The cut of wood supplies from Russia and Belarus amid the economic sanctions and the inability to deliver supplies from Ukraine are resulting in reduced wood supplies for major global economies. Together, these three countries account for nearly 7% of global roundwood production in terms of volume, while wood product exports are valued collectively at USD13 billion as of 2021. The slash of wood exports from Russia, Belarus and Ukraine are set to considerably tighten wood supplies in Europe, primarily Germany, the UK and France - countries with large construction and furniture output in a global comparison.

Wood Production Output by Country, 2021

'000 cu m

Cause for optimism despite rising inflation and low consumer confidence

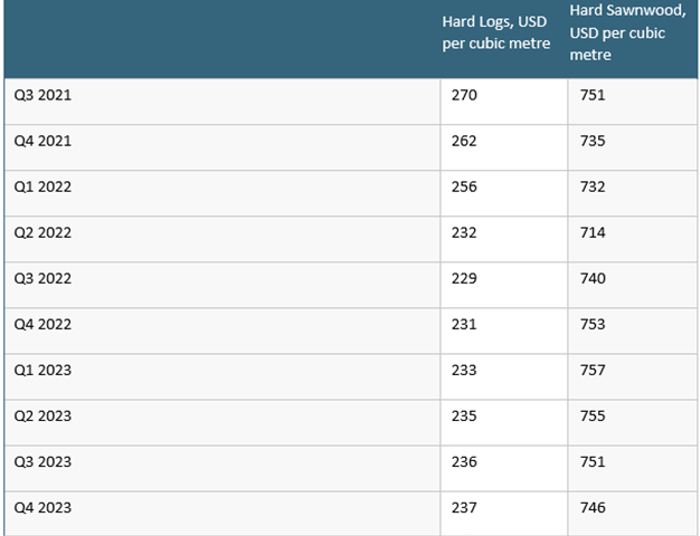

Record-breaking inflation levels across the globe are already diminishing consumer and business confidence which leads to decreasing wood prices. To slow inflation, the US central bank increased its interest rates to a range of 1.5% to 1.75% in June 2022 with further increases anticipated over the year. Meanwhile, the European Central Bank recently announced its plans to raise key interest rates. Inflation and increasing interest rates have been reflected in the rising cost of buying a home, diminishing housing affordability and reducing timber demand from one of the main wood buyers - the construction sector. Yet, construction activities may slow only in the near term as persisting housing shortages globally are set to support long-term industry growth.

New building codes are also expected to support usage of wood in construction projects. Changes adopted by International Building Code (IBC) 2021, a model building code developed by the International Code Council (ICC), assured of the safety of mass timber buildings and allowed construction of tall developments using mass timber that are up to 18 storeys high. The reform is expected to increase the usage of wood in commercial and residential buildings in the US. Meanwhile, mass timber buildings already gained traction in Europe as building decarbonisation stands at the centre of the EU Green Deal, which is actively moving towards the goal of ensuring zero emissions for all new buildings by 2030, by increasing the use of more environmentally-friendly materials such as wood.

Wood Prices, 2021-2023

Source: Euromonitor International from World Bank

Construction and Real Estate Production in Top 20 Countries 2021-2026

Source: Euromonitor from trade sources/national statistics

Changing environment poses further threat to wood supplies, encouraging new strategies

Warming climate and intensifying adverse weather events are anticipated to continue to pose major threats to the world’s forestry resources. Detrimental long-term changes in forestry are already posing a risk of depleting resources. Availability of forestry products has witnessed a decline in a number of countries as aggravating climate change effects considerably damage woodland areas around the globe. According to the Global Forest Watch, from 2002 to 2021, the total area of humid primary forest in the US, the largest wood supplier globally, decreased by 0.7%. Forest disturbances caused by the warming climate, manifesting in wildfires, storms, droughts or pest outbreaks are expected to persist and even intensify in the future, posing severe risks for vital forestry resources.

To address a changing environment, the global community will have to strengthen sustainable forestry management and wood production practices. The use of damaged wood as well as the recycling of wood products are already gaining momentum in wood production. As a result, the industry is set to be more modernised, creating future growth opportunities that are expected to respond to changing regulatory environment.

For further insight, read our report Global Market Overview of Wood