The Coronavirus (COVID-19) pandemic has seen a newly heightened value attributed to consumer packaging, related to that of its most basic role, of protector, providing hygiene and safety security, now a lead priority for consumers. While sustainability has certainly been the primary influencer for packaging evolution in recent years, with pressure centred on plastic and its polluting presence as waste, COVID-19 saw this pressure paused. Sustainability is, however, by no means off the packaging agenda.

The circular economy remains critical and is even being expanded upon in the pandemic, as industries, governments and consumers demonstrate, following the initial health shock, a strong will to recover better from COVID-19 for a healthier future.

Packaging shows resilience and provides touch-free security to consumers

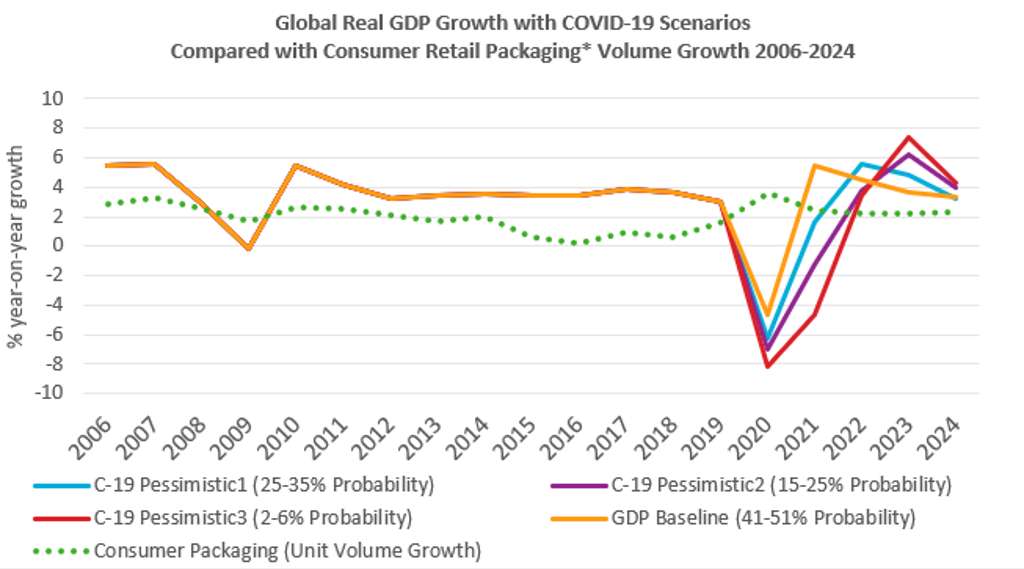

Global retail grocery packaging demand is showing resilience and positive growth, in 2020 in sharp contrast to the falls in real GDP, as COVID-19 factors of stockpiling and home seclusion for population health and safety place even greater reliance on the purchase of retail packaged groceries that are suitable for at-home consumption.

Source: GDP growth and C-19 scenarios from Economic Scenario Model, Euromonitor International; last updated on 28 August 2020. Note: *Refers to global retail packaging unit volume consumption, aggregated across food, beverages, beauty and personal care, home care and dog and cat food industries.

Touch-free/contact-free shopping: Specific to COVID-19, packaging provides a touch-free grocery solution. The protective packaging material helps to minimise the number of human touchpoints on food and beverages purchased; it also helps to expedite the in-store shopping experience and reduce the risk of contracting COVID-19. The surge in online shopping in 2020 is also intrinsically linked to the touch-free/contact-free purchase priority, as consumers have adapted their everyday shopping behaviour, on safety grounds. The e-commerce shift is expected to last; Euromonitor International’s Voice of the Industry survey – COVID-19 (fielded in July 2020, 4,812 respondents) reveals that 64% of respondents believe that there will be a permanent shift to online as a direct consequence of COVID-19.

A bigger grocery shop helps offset out-of-home declines: The hospitality sector and impulse channels has been severely hit by widespread restrictions, continuing even as measures are eased, with a significant decline in consumer mobility. Some out-of-home sales have been recouped in retail grocery sales, as consumers opt to shop bigger (in terms of transaction spend and pack size) but less frequently, for home consumption. For beverages, COVID-19 home seclusion has translated into adjusted pack size preferences in many countries, favouring the bigger, multi-serve format, eg for PET bottles in soft drinks, as pack portability is now a lower priority. Value for money pack offerings may well become more important and support the bigger value buy, amid the financial fall-out from the health crisis.

Continuing COVID-19 clean need: In-demand cleaning products and sanitisers/soaps for personal use will create additional and ongoing demand for packaging and dispensing closures, in the medium term, both for personal at-home use and for on-the-go use, extending to commercial premises that are working to ensure clean, Covid-secure, safe environments for employees and consumers’ alike.

Commitment to a green recovery

Sustainability, the core influencer for the packaging industry in recent years, saw a pause during the acute initial phase of the COVID-19 health emergency, with immediate attention necessarily turned to business continuity and secure supply of goods to consumers, alongside a notable rise in social sustainability action and purpose from brands, retailers and packagers - from establishing employee safety measures to repurposing production to meet a new pandemic need for sanitisers and personal protective equipment (PPE).

Some sustainable packaging delays: COVID-19 has meant delays to some plastic packaging sustainability initiatives, including that of the consultation on levying plastic packaging taxation in the UK, delayed from May to August 2020, to the implementation of plastic taxation in Italy, delayed from summer 2020 to January 2021. However, corporate pledges and government packaging targets largely remain intact. In Europe, the EU Single-Use Plastic Directive targets plastic bottles and closures recyclability and minimum recycling rates, timelines for which remain in place and have not been delayed.

Widespread commitment to advance on sustainability path: Headway on sustainability is coming through from corporates, on packaging waste and recovery even amid the COVID-19 economic pressures faced by many businesses. In April 2020, leading food manufacturer Nestlé SA demonstrated a continued commitment to sustainable packaging and to reducing waste, dedicating investment to sustainable packaging solutions, including a CHF1.5bn fund for suppliers, and has pledged to use food-grade recycled plastics over virgin, at a time of record-low oil prices, to help advance recovery and recycling and minimise plastic waste.

Similarly, announcements and financial commitments on sustainability have come from other major brand manufacturers during the pandemic; from Groupe Danone formally becoming a mission company at end-June 2020 and brands in its family-like Volvic in Europe gaining BCorp status, while Coca-Cola European Partners continues to address plastic waste, in summer 2020 investing in chemical recycling start-up CuRE Technology and by substituting the difficult-to-recycle plastic rim-applied multipack carriers for beverage cans for a recyclable paper-based alternative, initial launch is to be in Spain, in November 2020.

Packagers too are exerting action with glass players and associations in Europe collaborating on a “Close the Glass Loop” bottle-to-bottle recovery initiative, launched in June 2020, by twelve European associations including FEVE (European container glass federation that represents glass packaging manufacturers) with the goal to increase EU rates of glass recovery for recycling to 90% by 2030; currently 76%. Meanwhile for rigid plastics, PET, a hub of recycled activity, witnessing record demand for rPET pre-coronavirus, continues to be in demand, necessitating improved recovery to fulfil onward brand need. Recent 2020 launches include Seagram whiskey (Diageo, US) that has converted to rPET bottles.

US joins Plastic Pact countries to action plastic waste: In August 2020, the US (third largest country in terms of plastic packaging consumption, after China and India) joined the list of countries supporting the Ellen MacArthur Foundation’s Plastic Pact. With 60+ members in the US Plastics Pact to advance plastic circularity, this is an important step, in a country where recycling rates have historically been low, at 29% for PET bottles in 2018 compared to circa 58% in Europe.

Global Planned Sustainability Investments over the Next Five Years

Source: Euromonitor International Voice of the Industry: Sustainability Survey (fielded in June 2020); Voice of the Industry: Sustainability Survey (fielded in May 2019)

The mounting activities to support sustainable packaging progress, in the pandemic, point to an understanding of the importance to advance on sustainability across the whole supply chain, from sustainable ingredients sourcing, renewable energy and water use through to packaging. Also that investment and collaboration are required to improve, for packaging, its recovery, recyclability and re-use, as part of a wider global action to mitigate carbon impact.

There are also new challenges in the pandemic, beyond packaging to consider, such as the surge in use of PPE (masks, gloves) that require addressing so that these do not end up amassing as waste, polluting the environment.