The Coronavirus (COVID-19) pandemic is impacting consumption and consumers around the world. Quarantines and strict sanitary measures mean that consumers are reassessing their time and re-evaluating their priorities. Prevention and personal care, and a search for a mental-physical-spiritual balance, have dominated the minds of consumers.

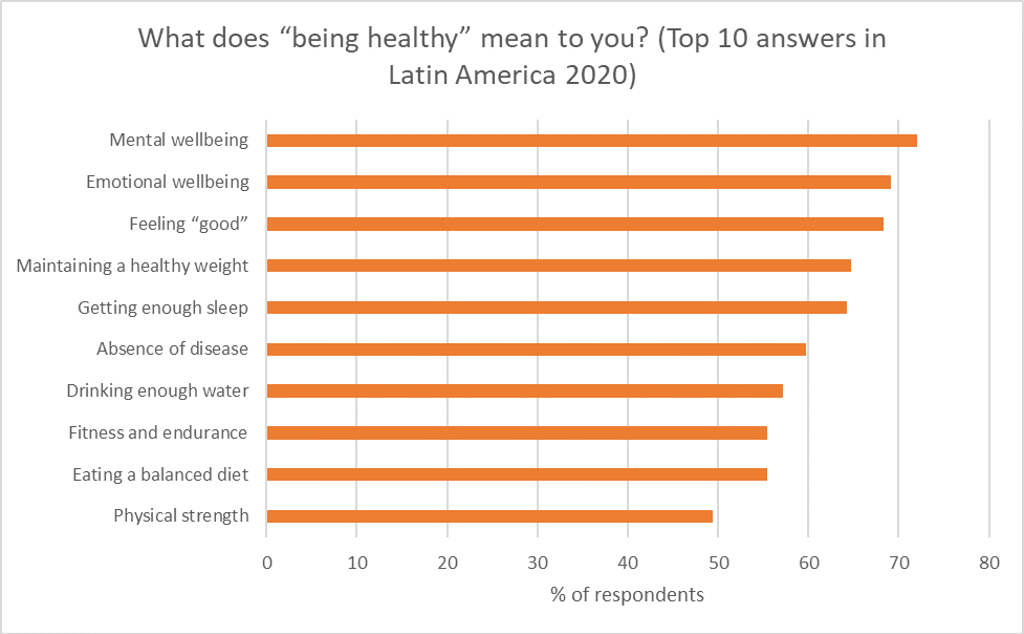

Source: Euromonitor International Health & Nutrition Survey, fielded in February 2020

Latin America has been disproportionally affected by the pandemic, in terms of cases as well as the economic reverberations. Euromonitor’s estimates, updated in October 2020, shows an 8% regional drop for this year and a 4% regional recovery in 2021 in real GDP. Unemployment rates, meanwhile, are around 12% in both years, considering forecast estimates. Income from wages in Latin America has fallen by 19.3%, compared with a global average of 10.7%. The biggest losers will be among the region’s lower-middle classes.

Performance over aesthetics accelerates with Covid-19

The apparel and footwear industry reflects how performance over aesthetics, otherwise known as “post-athleisure”, has defined the Latin American market in 2020.

Casual fashion is already a global trend. Brands offer a combination of technical, elastic, and street attributes to obtain a more relaxed look. But the influence of COVID-19 in Latin America is increasing interest in sports brands such as Nike, adidas and Puma, as confinement, diminished social occasions and the accelerated adoption of the home office are promoting the transition towards a more “carefree” look for daily life.

In a challenging scenario for the apparel and footwear industry in the region, with estimated sales drops of between 25% and 50% depending on the country, the performance of sportswear has suffered the smallest declines so far this year. The versatility and excellent price-quality ratio of these products position them at the top of mind of consumers looking to take advantage of aggressive offers.

At the same time, the explosive incorporation of the main sportswear brands as official stores in marketplaces such as Dafiti, Mercado Libre and Linio is helping the category to keep gaining share despite the negative overall industry performance.

The multifunctional role of the home

The post-athleisure trend is accelerated by the new multifunctional role of the home. Mobility restrictions, store lines and capacity limits, and the continued threat of contagion mean that consumers have adapted to their new reality via multifunctional homes.

Consumers have adapted to better meet their needs from within the safety and confines of their homes. Whether through digital platforms, delivery services or social networks, households are replacing offices, gyms, schools, malls, restaurants, and even social centres.

For example, Gympass, the Brazilian fitness unicorn (worth over $1 billion), is a web platform which offers meditation classes and various types of trainings 100% from home. This practical and fast-growing solution allows consumers an easy and cost-effective way to stay active in lockdown. However, competition is heating up. Apple plans to launch Fitness+ at the end of 2020.

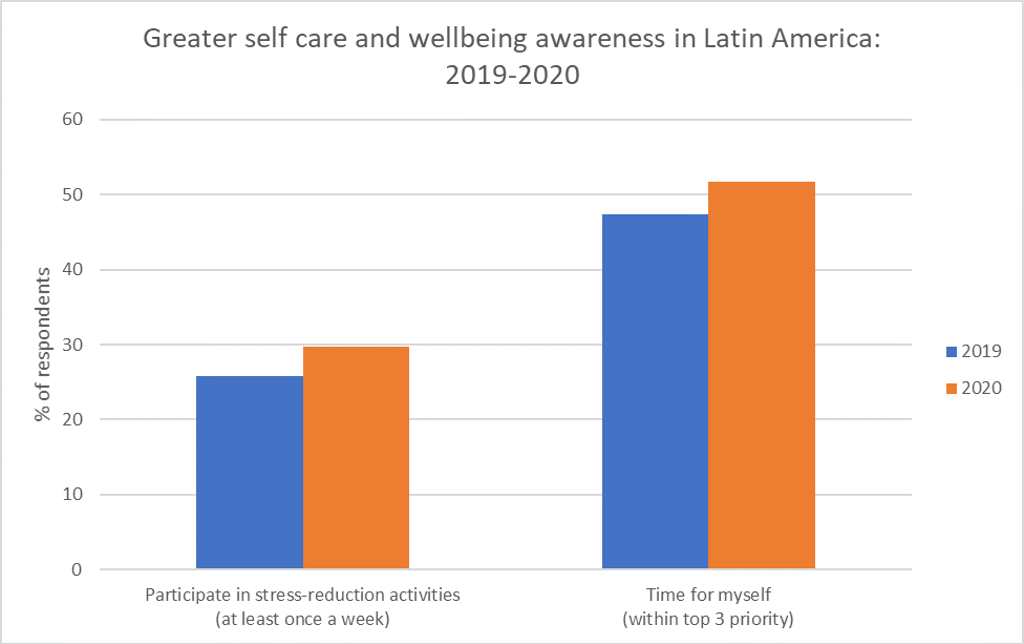

Beyond just apparel

The search for holistic wellbeing and preventive health have accelerated in 2020 and are strongly boosting at-home consumption. From healthier menus to exercise routines and products to reduce stress and/or improve sleep quality, they are all part of how Latin Americans are coping with anxiety related to the political-economic-sanitary situation in the region. Smart home appliances, sport equipment and training machines, along with telemedicine, will continue to grow within the Latin American market, all aided by the forced adaption to e-commerce and digitisation.

Source: Euromonitor International Lifestyles Survey, fielded in January-February 2020

Consumers perception changed

The pandemic has opened Latin American consumers’ eyes to dress codes and the perception of wellbeing being associated with appearance, which is most likely here to stay. Smart casual will continue to displace suits, except in more traditional businesses, such as finance companies and/or law firms, boosted by the increase in working from home, but especially by younger segments, Millennials and Centennials primarily.

At the same time, the increasing relevance of comfort and the search for cost-benefit in the region will continue to drive demand for functional and technical attributes over aesthetics, translating into more simple, versatile and casual looks for daily life.