Some aspects of beauty personalisation have taken a back seat during the COVID-19 pandemic, such as in-store consultations or consumers experiencing the creation of customised beauty products in-store. On the other hand, personalised beauty brands emphasising the at-home experience and pairing their solutions with virtual consultations with professionals have thrived. Within the beauty space, the growing interest in personalisation, supported by improvements in technology and data collection, translates into a plethora of new products and services and has a transformative impact on how brands operate, drive further value and retain their customers.

Every consumer wants a degree of personalisation in their beauty products

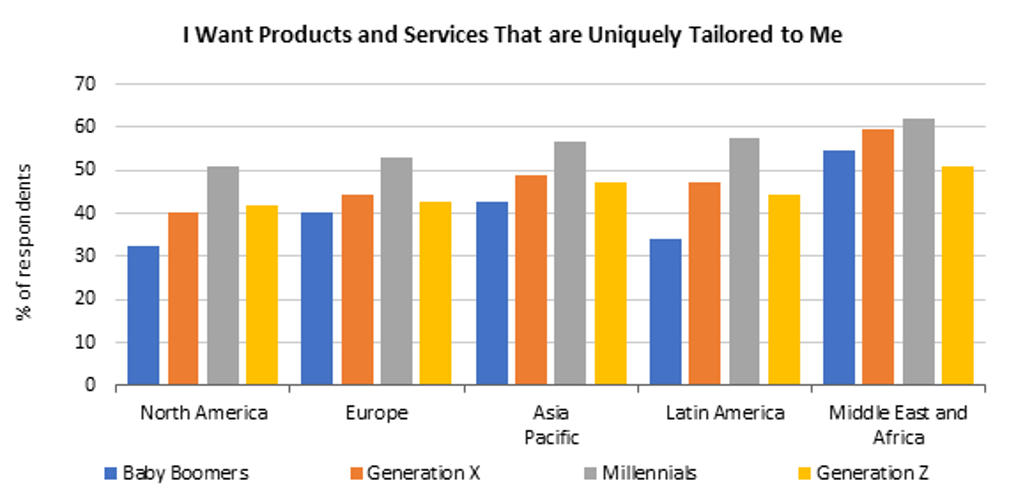

Euromonitor International’s Lifestyles Survey reports that 49% of global respondents want products and services that are uniquely tailored to them. Looking at age groups, personalisation is particularly appealing to millennials and generation X; however, generation Z and baby boomers are not far behind. As every consumer wants a degree of personalisation in their beauty products, every brand can cater to this demand, from mass customisation to hyper-personalised products, to answer consumers’ spectrum of needs and budgets.

A strong driver for personalisation is social purpose, and inclusivity in particular, with personalised beauty helping to answer consumers’ unique needs and traits, considering factors such as ethnicity, skin tone, skin concerns and gender. One example is offering foundation shades that are less widely available, such as Le Teint Particulier, Lancôme’s bespoke foundation service.

Increasingly, consumers unable or unwilling to travel are expected to demand and pay for ever-higher levels of service in the home. The pandemic has also led to changing consumer attitudes towards beauty salons, with many reducing their visits to salons and preferring DIY solutions at home, seeking brands such as hair colourants brand Color&Co by L’Oréal. This product helps users achieve the colour they have in mind thanks to its made-to-order colour creation process led by a professional colourist online.

Meanwhile, AI-based skin care monitoring is becoming more common, with solutions such as Atolla, which offers monthly AI-based monitoring, refining and adapting the skin care regime to the user’s skin behaviour. Each month, the algorithm gets smarter and becomes able to deliver increasingly targeted skin care.

Future personalised beauty will be efficient, holistic and phygital

Beauty products that are efficacy-driven will continue to gain importance, as the pandemic will give rise to price sensitivity, with consumers preferring to avoid spending on products that are not delivering results. Solutions backed by science or offering a professional consultation will also be valued, alongside results monitoring, through efficacy tracking over time. Consumers’ education with regard to results will make a true difference and will also ensure user retention and repeat purchases.

As it becomes more holistic, the personalised beauty proposition needs to consider factors such as internal health, lifestyle, surrounding environment and nutrition, as well as their interaction and evolution over time. Further technological and scientific advancement should also open more doors, with DNA-driven skin care growing in importance, leading more brands to enter the market, such as South African brand Optiphi or Swedish brand Allél, both mapping their users’ skin predisposition for ageing to offer the best-tailored skin care solutions.

Phygital solutions, blending the physical and digital world, will become increasingly relevant as consumers become reliant on virtual experiences such as online try-on. This should translate into digitally connected at-home routines with devices such as Perso by L’Oréal, as well as interactive e-commerce, with virtual consultations and an enhanced consumer experience through at-home real-time guidance and support.

Conclusion

While personalisation will continue to evolve alongside digitalisation, many consumers will continue to seek convenience and safety, and therefore value the digital features of personalised beauty, from skin analysis on a mobile application to virtual consultations with a dermatologist. Greater reliance will also be placed on online beauty communities as consumers will increasingly seek advice and transparency. Moving forward, brands linking personalisation technologies to self-care and preventative health are likely to resonate among beauty consumers, while involving and educating consumers throughout the personalisation process will be key. Finally, brands should embrace phygital solutions to create interactive engagement with their customers through a seamless journey across various physical and digital touchpoints.