While effects vary considerably across different retail channels, the global fashion and luxury goods retail industry has been hugely affected by the Coronavirus (COVID-19) pandemic. In recent years the industry has faced looming threats of a trade war, increased global economic uncertainty, shifts in consumer behaviour and values, and huge advances in digital technology. Together these have led to significant challenges across the luxury and fashion landscape; however, nothing in the modern evolution of the luxury industry compares to the global disruption that we are now seeing caused by the pandemic. The COVID-19 outbreak has highlighted the importance of e-commerce, however, a physical store-based environment will still dominate luxury goods retail.

Outbreak poses a huge threat to US$355 billion personal luxury goods market

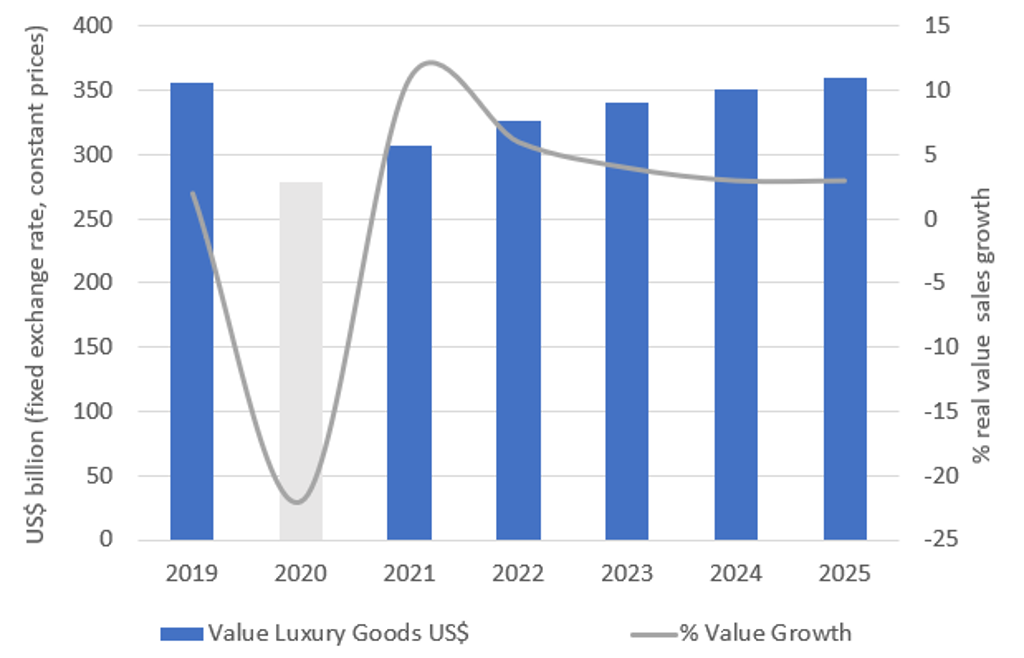

By the end of 2019, global sales of personal luxury goods exceeded the US$355 billion mark (real terms - fixed exchange rates), with additional growth of 3% originally forecast for 2020. However, our latest data reveals that sales of personal luxury goods are expected to decline by 22% by the end of 2020.

Consumer confidence has been hit severely, and many fear contagion in the retail space, whilst others see little or even no point in buying luxury in the present circumstances. Whilst the HNWIs (High Net Worth Individuals) of the world may not be feeling as squeezed as those in lower-income groups, with prolonged lockdowns in many countries, big spends on all discretionary items have diminished and become out of sync with current consumer sentiment.

Whilst some categories within personal luxury have weathered the storm better than others, the pandemic has caused a massive shock to all global demand. Flexibility, resources, capital and a healthy supply chain play a huge role in safeguarding against this impact. Brands with significant equity in digital retail and a strong online presence have been better placed to serve the homebound consumer.

Source: Euromonitor International

Designer fashion set to be hit hardest

It has long been noted that the personal luxury industry is over-reliant on store-based operations and with limited e-commerce capabilities many retailers have had to accelerate their digitalisation strategies. These strategies - both transactional and in terms of engagement - will be essential, considering the far-reaching penetration of e-commerce post-COVID-19, and the shift of marketing budgets to digital platforms and social media.

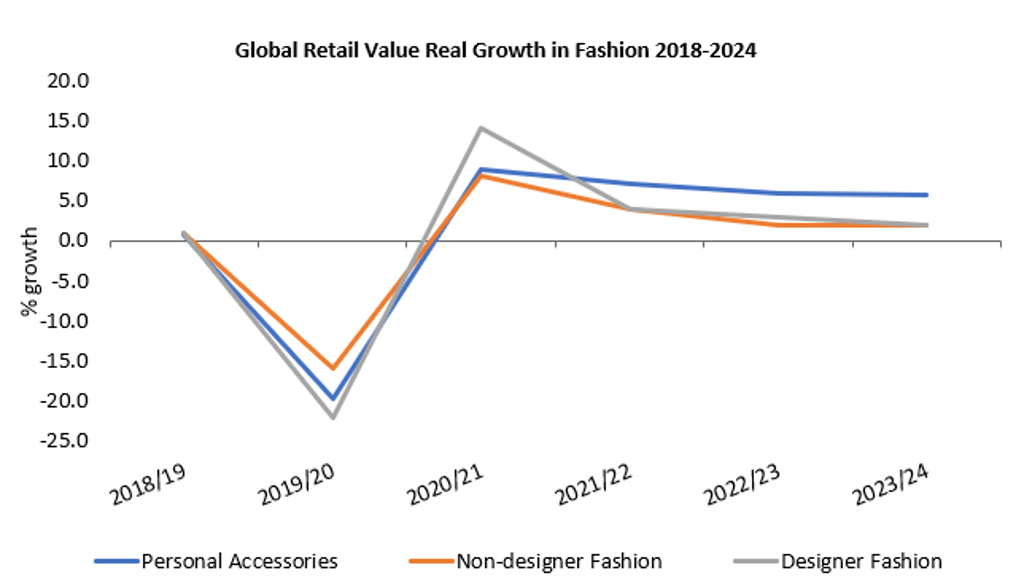

Due to store closures, the conspicuous nature of designer fashion, and the fact that more consumers are choosing to stay at home, sales of designer fashion are set to be hit harder than in the lower-priced fashion segment. Designer clothing and footwear retail value is predicted to see a 22% decline in real terms over 2020, compared to 16% for non-designer fashion and 20% for personal accessories.

That said, designer fashion is expected to see a much sharper rebound in sales in 2021. In fact, luxury and fashion overall are expected to see a considerable uptick in sales and are actually set to lead in growth across our key FMCG markets as more consumers return to stores and start spending again, and we also expect to see some level of normality returning to life, in terms of events, travel, seasonal gifting, social engagements and above all consumer confidence, following the roll-out of vaccines.

Source: Euromonitor International

The full potential of omnichannel is unlocked

Global sales of apparel and footwear, designer apparel and footwear and personal accessories via digital platforms are set to account for 28%, 20% and 16% of all sales, respectively, in 2020. The most rapid increase is expected to be in South Korea, where Euromonitor predicts e-commerce will increase from 28% of total retail in 2019 to 36% by the end of 2020. Similar numbers are expected for China with both markets already having a strong culture of online shopping and high levels of connectivity. With China set to remain at the helm of retail sales in both the luxury goods and fashion industries, this will play a huge role for brands and retailers moving forward.

We were already seeing a huge shift to e-commerce before the pandemic. COVID-19 has highlighted the need for brands to unlock the full potential of the omnichannel and to master digital marketing. According to our latest data, online sales of personal luxury goods accounted for just 12% of the global market in 2019. However, as more consumers are forced to stay at home and retailers move further online, we believe that this number could increase by 20% in 2020.

Brick-and-mortar outlets still vital in personal luxury and fashion

Whilst there is no denying that digital sales are expected to continue growing fast, a clear majority of sales in personal luxury goods will still take place in a physical store-based environment. Consequently, getting the store-based operations right is paramount to the success of luxury brands and no amount of innovation in digital and technology will make up the difference in the short to medium term.

That said, well-thought-out strategies and innovation by retailers are necessary for success in the current environment. Physical retailers will need to go above and beyond to create new bonds and build loyalty with customers who will be looking to be entertained, rewarded and valued. Moving forward, establishing and maintaining empathy will increase in importance.