Plant-Based Chicken Sets Sail in Hong Kong

The ongoing global Coronavirus (COVID-19) pandemic has not only caused a severe impact on almost all fmcg industries across markets, it has also caused companies and consumers to consider and prioritise sustainable ways to pursue their goals.

Hong Kong sees alternative proteins accelerate

Consumer foodservice sales in Hong Kong recorded a 35% decline in value in 2020, and was one of the industries most severely impacted by COVID-19. But this has also provided an opportunity to step back and transform menus, which has seen the growing introduction of plant-based cuisine through outlets. This development has stimulated interest in flexitarianism and sustainable eating, now echoed in neighbouring markets.

In 2020, sales of meat substitutes in Hong Kong reached USD30 million, while Malaysia and Singapore recorded sales of USD85 million and USD72 million respectively. Significantly, the ratio of retail to foodservice volume of meat substitutes in Hong Kong is now 1:5.

“Covid has definitely accelerated the growth of the alternative protein industry. For example, a food delivery giant has recorded a 160% growth in plant-based orders, and that is only from 2020 to 2021. It continues to grow. The fast growth is also driven by the rise of flexitarianism; more and more people are looking into eating more healthy and more plant-based alternatives.” This is according to Eunice Ng, Brand Manager for Alternative Protein at Classic Fine Foods Hong Kong & Macau - a premium food specialist operating in 12 different countries across Europe, the Middle East and Asia.

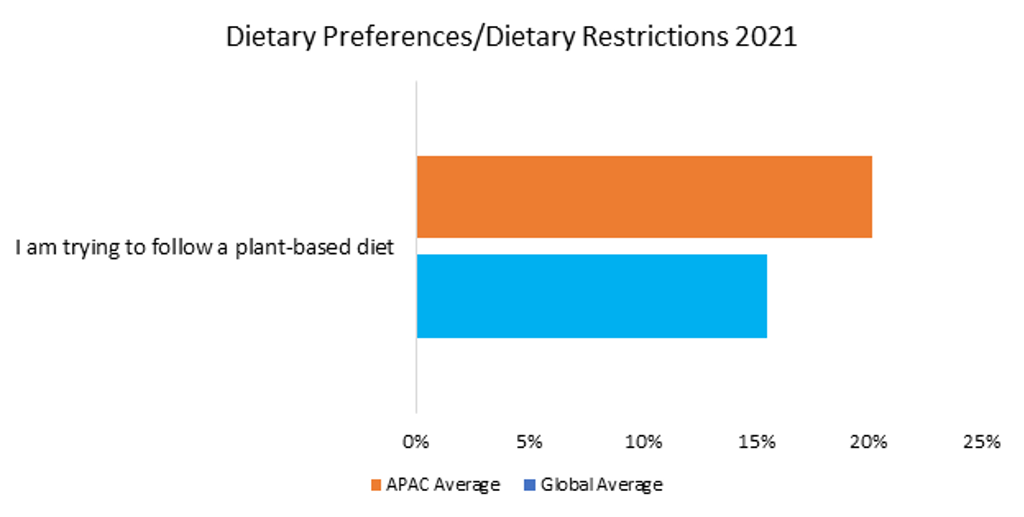

According to Euromonitor’s Health and Nutrition Survey result in 2021, 20% of respondents in Asia Pacific are trying to follow a plant-based diet, four percentage points higher than the global average of 16%. Consumers not only equate plant-based alternatives to digestive health and immunity-boosting qualities, but are also turning to these options as a response to environmental concerns and animal rights.

Besides the long-term vision of sustainable eating, the COVID-19 pandemic has also driven practical issues, which have accelerated the adaption of meat substitutes by foodservice industries in Hong Kong. As Eunice Ng points out, “During the pandemic, restaurants have experienced fluctuation in demand and animal-based products have a shorter shelf life compared to plant-based meat. The pandemic has driven restaurants to look for products with longer shelf life and plant-based meat has been a solution for them.”

Sustainability concerns indicate opportunity

Having spotted the market opportunity, TiNDLE, a global plant-based chicken brand based in Singapore debuted in Hong Kong and Macau in mid-2021, and is now available at 25 restaurants across the two special administrative regions. The brand not only eyes the business opportunity of the plant-based eating trend but also the longer-term vision of sustainable eating.

“TIDNLE is made from nine non-GMO ingredients and delivers the mouth-watering taste, texture and aroma that we all love about chicken. For a small 100g of TiNDLE, we use 75% to 90% less land, greenhouse gas emissions or water consumption according to data from Blue Horizon” said Marc Jolly, the Growth Director APAC from Next Gen Food, the food technology company that created the chicken alternative. “Many governments, globally widespread, support green initiatives, such as reduced water consumption and greenhouse gas emissions. That in turn has led to greater consumer awareness of issues like sustainability, which is very important for us”

Expressing similar thoughts on the sustainable food trend, Patrick Lesieur, the Managing Director of Classic Fine Food Hong Kong & Macau, said “Overall, we are in the food distribution sector. We are very cautious; by 2050, the planet will have around 9.7 billion people - that means we will need to produce more than 50% of what is currently produced to feed the planet. Is it feasible? Is it viable? Is it reliable? Is it sustainable? We believe that it is not. We’re engaged in a new journey, a new venture into innovative solutions which we basically believe that TiNDLE can answer as part of the demand of the future”.

Despite the lag in the market size of Hong Kong compared to Singapore and Malaysia, Classic Fine Food is optimistic about the future prospects of local meat substitute consumption, especially the demand from younger adults who are the core consumers in many markets where plant-based meat has trended in recent years. “TiNDLE approached us for the Hong Kong and Macau market. Since then, we have already seen positive responses from both the younger generations and innovative chefs in Hong Kong.” adds Patrick Lesieur.

Future growth looks bright

Since the outbreak of the COVID-19 pandemic in early 2020, consumers in Hong Kong are becoming aware that sustainable food is no longer just a long-term vision for 2050, but an issue that could link back to indulgence and impact on society. It is expected that Hong Kong’s meat substitute market will continue to grow at a CAGR of 8% from 2021 to 2025, surpassing the forecast CAGR of Singapore and Malaysia.

To watch the interview with TiNDLE and Classic Fine Food, please click here.