Regional companies are leveraging their intuitive knowledge about local tastes and preferences and are catering to local needs more effectively. Their stronger relationships with local vendors, understanding of the local distribution landscape and know-how of the regulatory environment put them in an advantageous position to compete with multinational companies.

Interestingly, regional companies are more prominent in tier two and three cities and as these cities become lucrative pockets for further growth, regional companies are becoming a natural competition to the multinationals. Besides, regional companies are starting to expand their nationwide presence, after securing a presence in local regions and are going to threaten the expansion of MNCs especially in tier two and three cities.

V-Mart’s focus on affordable fashion benefits its expansion strategy

Source: Euromonitor International

Source: Euromonitor International

V-mart Retail Ltd’s focus on offering affordable fashion, along with providing a modern retail experience is helping it win in Real Bharat. It is strategically present only in tier two and tier three cities across northern and eastern states of India, which have high population density.

The price points offered by V-Mart are at least 30%-50% cheaper compared to some of the affordable national department store chains. This strategy connected well with consumers in tier two and tier three cities whose disposable income is almost half that of consumers in tier-one cities. Furthermore, with the penetration of modern retail being very low in these areas, V-Mart was able to provide a modern shopping experience with larger stores and improved merchandising.

With national retail chains focusing more on tier two and tier three cities for expansion, the competition is expected to intensify in the affordable fashion space in the coming years.

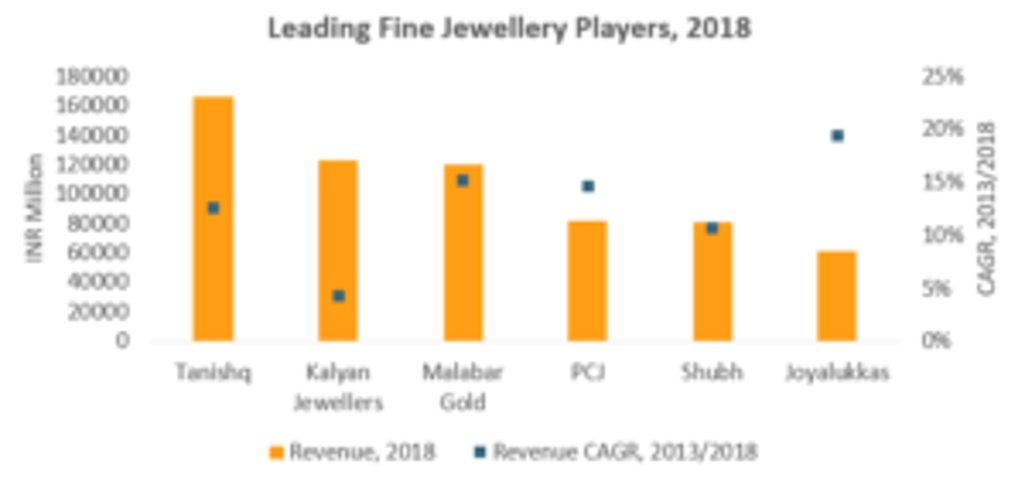

Regional jewellers tap smaller towns on the promise of purity

Fine jewellery in India is predominantly gold jewellery, which continues to be dominated by regional brands. Knowledge of local tastes in terms of designs and patterns have benefitted these companies. Consumers however faced issues with regards to the purity of gold when it comes to unorganised independent local players. To tap into this opportunity, regional players such as Kalyan Jewellers and Malabar Gold announced a nationwide expansion with the promise of a standard purity of gold.

These companies also offered several loyalty schemes, discounts on making charges, etc. which allowed them to acquire new clientele. As smaller cities lack the presence of organised players, these regional jewellers are tapping into this opportunity and expanding their presence in tier two and three cities.

Source: Euromonitor International

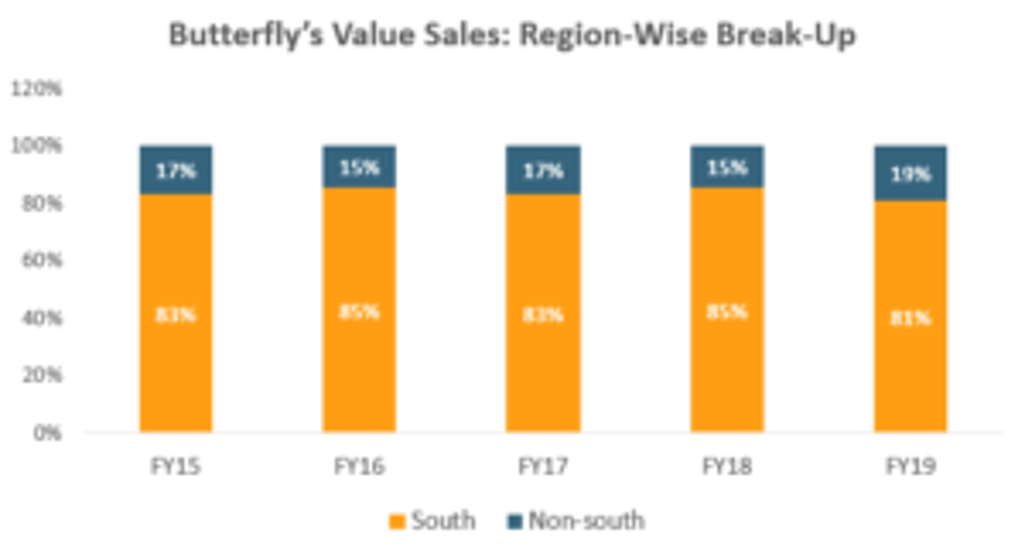

Butterfly Gandhimathi Appliances Ltd challenges bigger players

In the Indian small appliances industry, Butterfly Gandhimathi Appliances Ltd, headquartered in Tamil Nadu, has been consistently growing over the last five years in retail volume.

The company has a strong presence in South India. It has gained this position by expanding in various product categories, often catering to regional need in appliances like wet grinders. But with the plan to make a mark on the national map, as can be seen from new launches year after year, Butterfly has entered over 20+ product categories.

Source: Euromonitor International

Pan India distribution network of 25,000+ retail touchpoints and 500+ exclusive distributors and marketing efforts, like growing the sales workforce and promotional spend, have made it possible for Butterfly to secure significant sales in the small appliances industry. For example, in freestanding hobs, a category that is highly fragmented due to the presence of numerous national, local/regional and unorganised players, Butterfly continues to hold second place and grows faster than the category.

The company is preparing to be a strong challenger against the nationally dominant brands in the small appliances space by strategically continuing to grow and focus on its distributor network, launching more SKUs and investing in marketing.