2021 was a year that closely mirrored 2020 demand patterns. Demand was high at the beginning of the year due to spill over demand from the last two quarters of 2020. However, demand gradually tapered down towards the end of 2021 as price increases due to raw material and supply chain constraints weighed down both supply and consumer demand.

Despite these challenges, we expect global demand in 2021 to not only recover but exceed pre-pandemic levels of 2019. Both major and small appliance categories are expected to grow by approximately 3% in terms of unit sales.

As the world continues its recovery from the disruptions of 2020 and a ramping up of production, companies are discovering that they are competing for the same limited commodities.

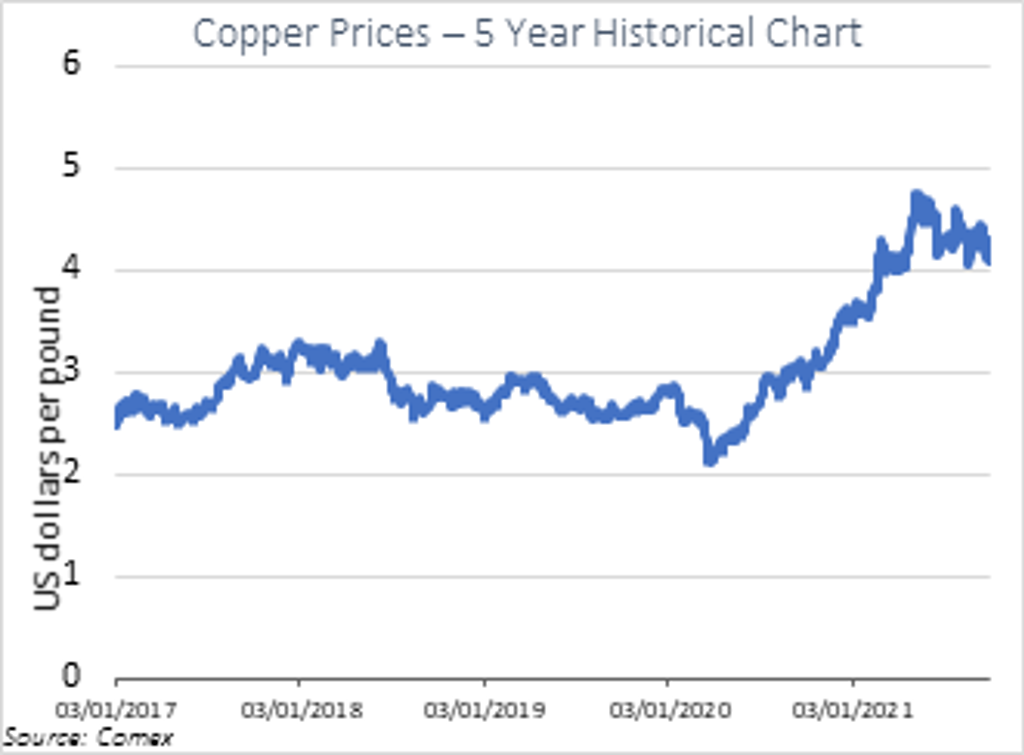

Inflationary pressures are everywhere: steel prices have more than tripled from 2020, copper prices have doubled, freight prices have quadrupled, and there is an ongoing semiconductor shortage affecting almost every industry from electric vehicles to consumer appliances.

We therefore expect continued inflationary pressures from the semiconductor and raw material shortages in addition to container freight shortages to depress demand well into 2022.

Companies involved in air conditioning are especially affected as copper accounts for approximately 20-30% of the costs of manufacturing an air conditioner. With the air conditioning industry being an extremely competitive landscape and consumers focused on pricing, companies are unable to pass on this increase to the end consumer. This has led to companies considering a switch to aluminium for producing heat exchangers. In Daikin’s May 2021 conference call with investors, it announced plans to halve its copper usage in its products by fiscal year 2024.

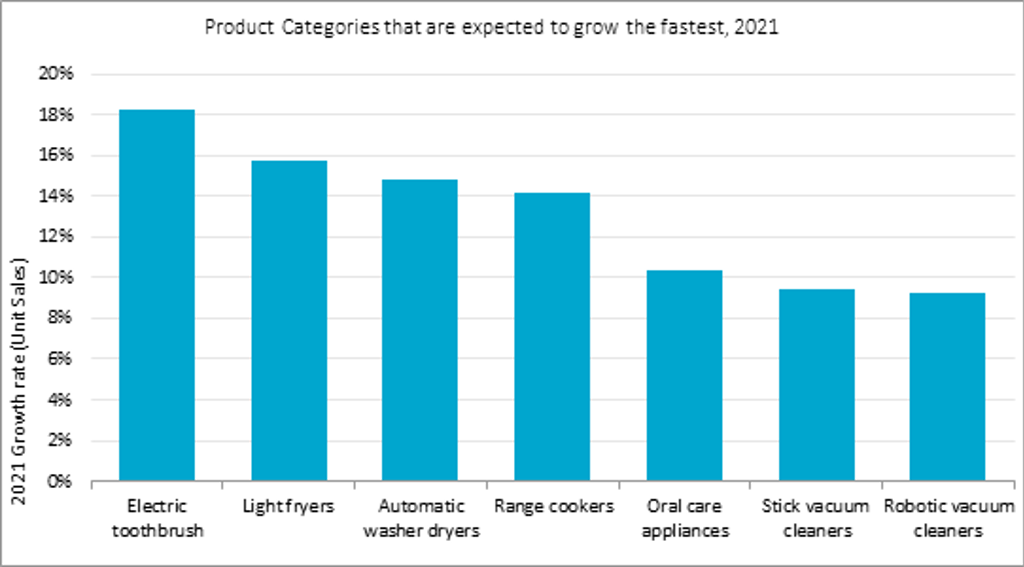

On a brighter note, as a significant number of consumers continue to spend greater time at home, the “everything from home trend” has continued. We expect 2021 growth categories to be focused on hygiene, large and small cooking appliances, and personal care appliances.

High growth categories in 2021 are expected to stem from products such as automatic washer dryers (15%), electric toothbrushes (18%), light fryers (16%), oral care appliances (10%), and stick (9%) and robotic vacuum cleaners (9%).

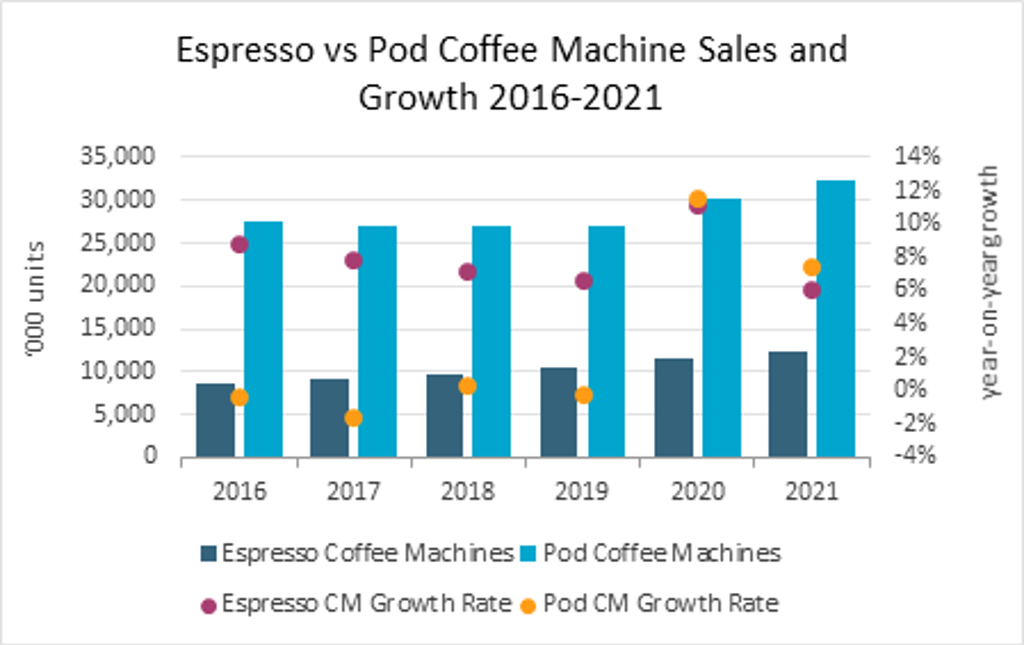

An interesting trend of note is the evolution of coffee machines used at home. Pod coffee machines such as Nespresso, was a revolutionary machine when initially launched. Removing the inconvenience of preparing a gourmet cup of coffee at home, consumers were able to pop in a pod and a gourmet cup of coffee would be ready in less than a few minutes. This has changed the entire at-home coffee experience and enabled Nestlé to develop a new business model around selling premium, single-use pod coffee instead of simply coffee machines and instant powder. Brewing coffee this way is also perceived by consumers as convenient and fast.

Sales of pod coffee machines surged in 2020, with home-bound consumers buying these appliances in droves. However, we expect this trend to peak in 2022 as consumers continue their switch to espresso coffee machines instead. One main factor driving this trend is that surveys have also indicated that consumers find disposable plastic coffee pods to be environmentally unfriendly.

In South Korea, an interesting trend is evident within air conditioners. From a negligible share of only 0.4% of the market in 2018, window air conditioners now hold a 12% share, recording a CAGR of 146% over 2018-2021. Traditionally, window air conditioners are not popular for many reasons, among them being their loud noise, inefficient electricity usage and clumsy design.

However, Paseco saw this as a business opportunity and developed a new window air conditioner that was relatively quiet and included smart features. The latter is not normally associated with window air conditioners due to their low-cost perception.

Paseco’s window air conditioner targets single-person households and the DIY segment. The latter took off during the pandemic in 2020, as consumers were wary of allowing technicians into their homes to install split air conditioners. In 2021, Paseco launched a model with inverter technology, a first in the market. Seeing this potential, Samsung has re-entered the market, along with 10 other brands.

2021 has been an interesting year indeed, with companies mostly concerned about supply rather than demand. We expect supply issues to persist into 2022 and it will be interesting to observe how different companies react to supply and price inflation challenges.

Reach out to me at tim.chuah@euromonitor.com or your account manager to find out more.