Western Europe was among the most adversely impacted regions globally by Coronavirus (COVID-19), as the implementation of strict social distancing and temporary quarantine measures led to significant economic deterioration during 2020.

As a result of an anticipated regional 8.6% real GDP dip over 2020, Western European countries are exposed to rising unemployment levels, which depend on countries’ abilities to tackle the pandemic, including the effectiveness of government policies in securing jobs within the private sector. Rising unemployment rates will result in deteriorating consumer and business confidence over the medium term, further weighing on economic growth potential.

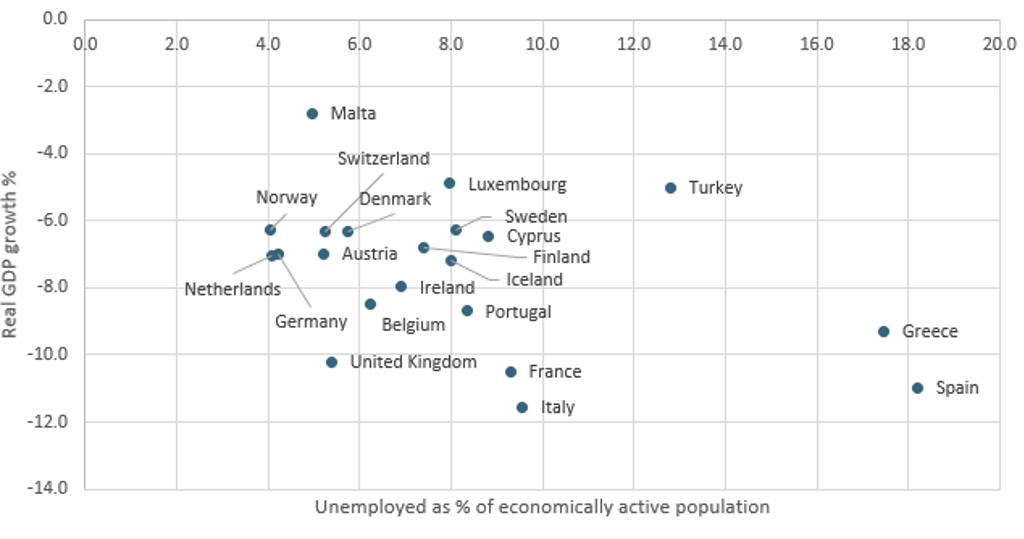

Real GDP Growth vs Unemployment Rate in Western Europe: 2020

Source: Euromonitor International from International Labour Organisation (ILO)/Eurostat/national statistics/OECD/UN/International Monetary Fund (IMF), World Economic Outlook (WEO). Note: 2020 data is forecast.

Spain, Greece and Turkey face the highest unemployment rates in Western Europe

Due to skyrocketing COVID-19 cases, Greece, Spain, Italy and Turkey face the highest unemployment rates in 2020 as their real GDPs are forecast to decline by 9.3%, 11.5%, 11.0% and 5.0%, respectively. High debt to GDP ratios, poor creditworthiness, industrial orientation towards small and medium-sized businesses as well as high dependency on revenue from tourism and some of the lowest shares of population employed in the public sector are all weighing on the ability of these countries to cope with the pandemic, leading to elevated unemployment levels.

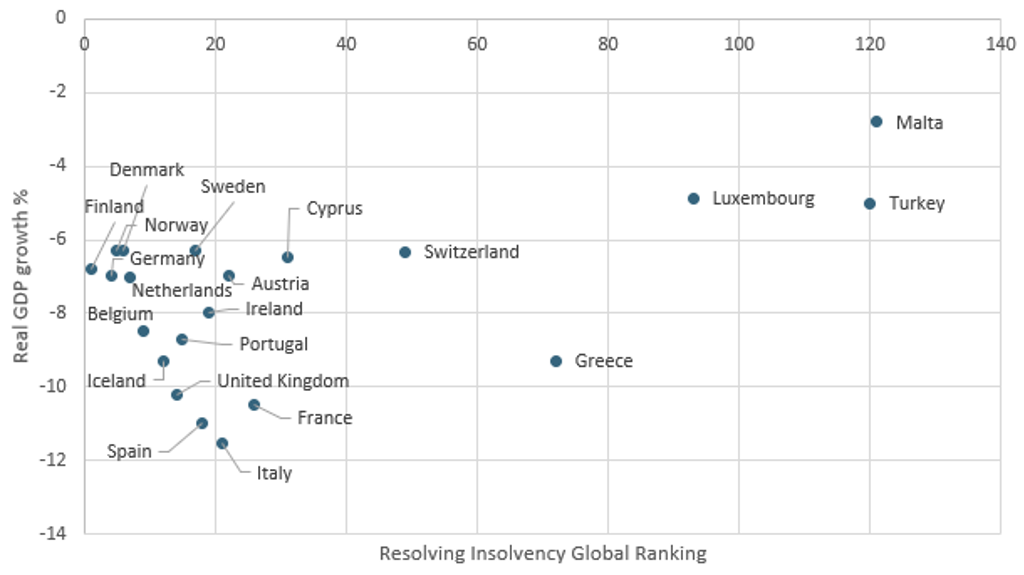

Governments have introduced multiple fiscal as well as monetary and macro-financial measures to tackle rising unemployment. The Spanish government, for example, established changes to corporate resolution frameworks aimed at the reduction of insolvency cases, introduced extensions of government guarantees to companies and the self-employed and improved unemployment protection conditions for workers that are employed under permanent discontinuous contracts.

Real GDP Growth vs Resolving Insolvency Global Ranking in Western Europe: 2020

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF), World Economic Outlook (WEO)/World Bank. Note: 2020 data is forecast; Resolving Insolvency Global Ranking covers 184 countries.

Favourable loan conditions help the UK and Germany tame unemployment

The UK and Germany recorded skyrocketing numbers of COVID-19 cases, but both countries had significantly lower growth in unemployment rates. Lower debt to GDP ratios, coupled with high creditworthiness as well as large fiscal capacity enabled these countries to provide a more effective response to the COVID-19 outbreak.

Some of the most effective measures introduced by the UK Central Bank were cutting the interest rates to all-time lows and introducing a guarantee system of 80% of the loan value for SMEs on lending and overdrafts, a decision which eased loan conditions and boosted the demand for credit. Moreover, the UK government implemented a job retention programme, allowing employees, that would otherwise be laid off, to be placed on “furlough”, leading to a slower rise in the unemployment rate.

Meanwhile, Germany’s economy ministry also introduced an extensive list of instruments, including the extension of credit lines to liquidity guarantees, changes in the short-time working programme and grants for businesses, collectively amounting to EUR750 billion.

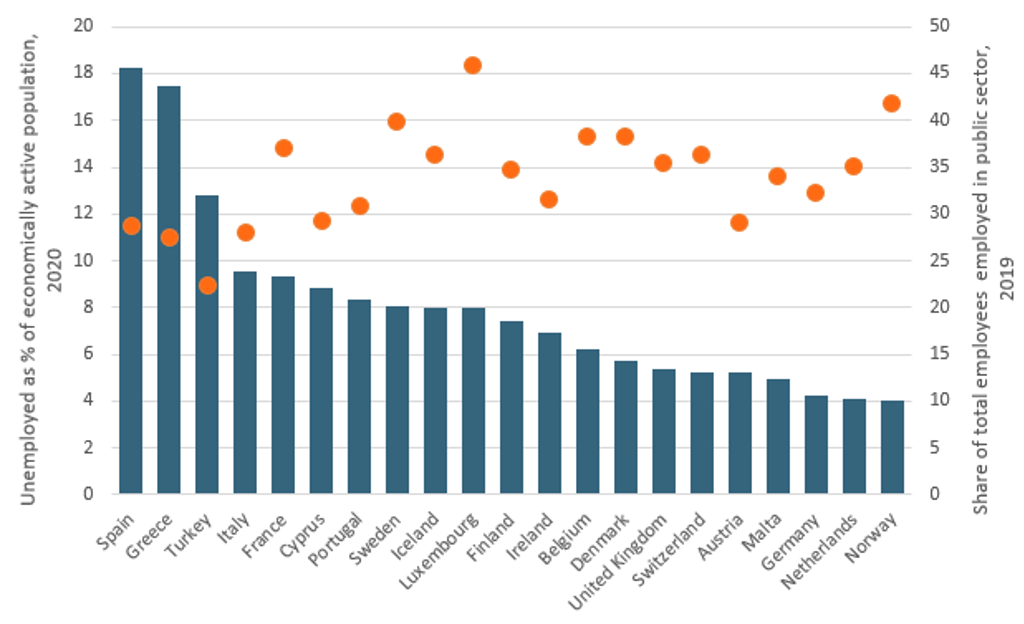

Strong public sector facilitates a lower unemployment level in Norway

Norway and the Netherlands managed to record some of the lowest unemployment rates during the pandemic as they implemented measures that resulted in a relatively low number of COVID-19 infections. In addition, as more than 40% of Norway’s population is employed in the public sector, a significant part of the country’s population was shielded from the job losses seen in other countries.

However, as 12.9% of the country’s workers are employed in the wholesale and retail trade industry, 3.4% in hotels and restaurants, as well as 5.6% in transport, storage and communication services, a substantial proportion of the population, remain vulnerable to job losses in the future as these industries are forecast to contract by 13.3%, 16.3% and 16.0%, respectively, in 2020, based on real GDP figures.

Unemployment Rate vs Share of Employees in the Public Sector: 2019/2020

Source: Euromonitor International from International Labour Organisation (ILO)/Eurostat/national statistics/OECD. Note: 2020 data is forecast.

UK’s labour market outlook to turn downwards

In contrast to Southern European countries, during the COVID-19 outbreak, the UK and Germany managed to keep unemployment rates under control, primarily thanks to furlough and short-time working programmes, while Norway benefited from a large public sector. However, as the UK’s furlough programme is set to expire in October 2020, unemployment rates in the country are expected to rise and reach a peak in the fourth quarter of 2020.

Furthermore, as the risk remains of no trade deal being agreed between the UK and the EU by the end of 2020, while monetary capacity stays limited, with interest rates hanging close to zero and the public debt exceeding the size of the UK’s economy already in 2020, a restricted government response is foreseen, resulting in further expected disruptions to the labour market and consumer and business confidence over the short and medium terms.