IPOs have always been synonymous with a public offering. However, the growing popularity of the SPAC (Special Purpose Acquisition Company) track challenged this in 2020 and the first half of 2021. While recent regulatory activity suggests a surge in demand may be subsiding, through this article we explore why SPACs have experienced such a boom, evaluate their partial slowdown in 2021 and assess the way forward in 2022.

Our article gives insights on key trends driving SPACs globally. Read on to:

- Understand how COVID-19 is impacting global financial markets

- Learn about how key industries have leveraged SPACs to drive their M&A agenda

- Read our view on opportunities SPACs present in 2022 and beyond

SPACs: An overview

A SPAC, or blank cheque company, is a listed company created with the sole purpose of merging with an existing business, usually within a 2-year window after IPO. It is an alternative way for private companies to go public. The global SPAC market has grown considerably in the last decade. Whilst in 2013, there were 10 SPACs with approximately USD144 million in assets, 2020 marked the year of the SPAC with a total of 248 SPAC IPOs going public globally and raising more than USD70 billion – growth of 320% compared to 2019 alone.

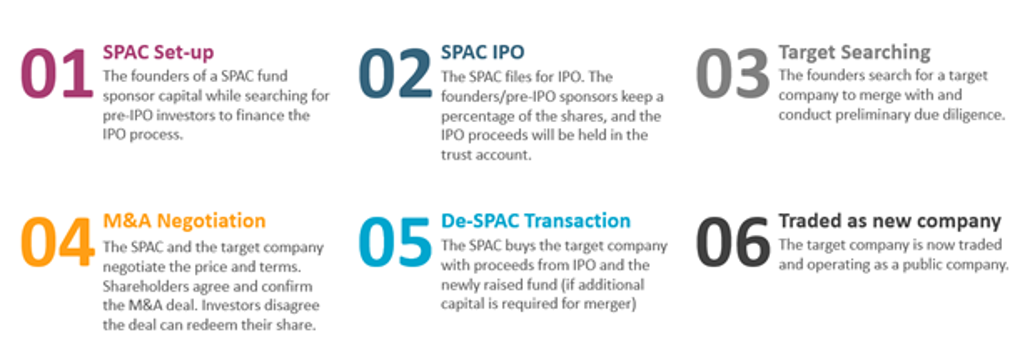

How do SPACs work?

Source: Euromonitor International

The traditional IPO practice is sometimes regarded as a long and tedious process, as it requires companies to provide extensive track records of financial performance and operations. As a result, companies and start-ups, many of which need capital for innovations and investments, are not in the best position to fulfil each requirement.

SPACs enable private companies to go public without such strict scrutiny by regulatory authorities and to raise funds with comparative ease. Led by shorter timelines and cheaper costs for listing, companies also benefit from sponsors (usually experienced financiers) to guide them to where they need to be when initiating a reverse merger. Furthermore, SPACs offer target companies greater certainty on valuation and pricing throughout a negotiation, while in traditional IPOs, company value heavily depends on market trends and is constantly shifting.

Nevertheless, there are downsides to SPACs. While a SPAC might be seen as a shortcut to going public, it still has to be a successful business to perform well as a growth stock. There is also a time compression of two years to find a suitable target to merge with, otherwise the company needs to pay back funds to its investors. SPACs also face the risk of capital shortfall as investors may choose to redeem their shares when a deal is finalised. Moreover, the due diligence performed for the target business tends to be less strict than a traditional IPO, which might present a greater risk to the future performance of the business and returns for investors.

Underlying SPAC market trends in 2020 and 2021

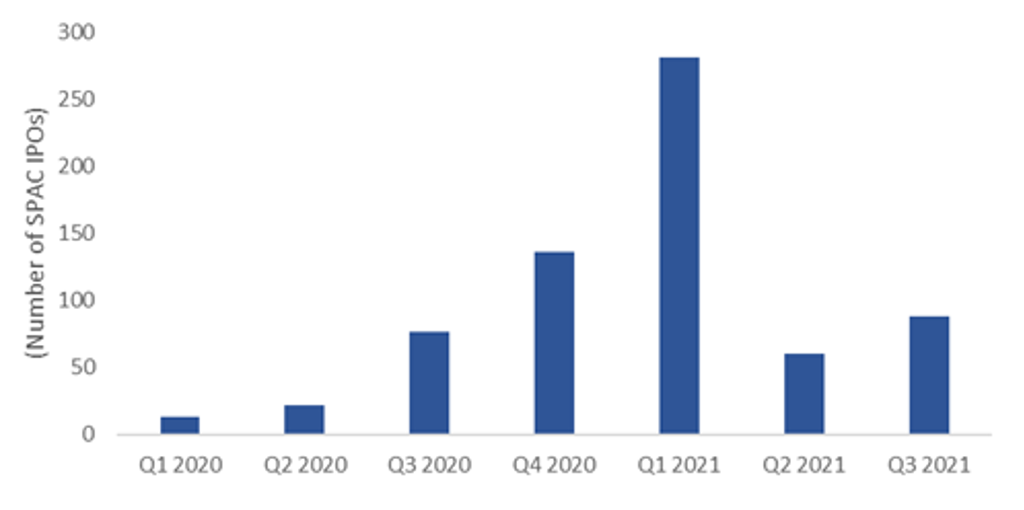

SPACs have experienced an unprecedented boom triggered by the pandemic. As COVID-19 brought massive uncertainty to markets, private companies became less certain of raising large venture/PE funding rounds, while the need for new capital remained high. Governments also introduced monetary policies to ease the negative economic impact and extra volatility in capital markets. This led to a large number of SPAC IPOs in 2020. From 248 SPAC IPOs in 2020, the momentum continued in Q1 2021 with 281 SPAC issuances completed.

The majority of SPACs are still largely US-based. Few Asia-backed stock exchanges allow SPACs, while Europe-based SPACs are tiptoeing amid heightened regulatory scrutiny. One recent exception is Southeast Asia-based ride hailing and food delivery giant, Grab, as its listing on NASDAQ is an exemplar for many potential unicorns looking to similarly list in New York. (Euromonitor International was appointed the Industry Consultant for Grab’s IPO, and the full prospectus can be seen here. )

The booming SPAC market drew the attention of the US Securities and Exchange Commission (SEC), which announced guidance and alerts in December 2020, including requesting a greater level of disclosure on SPAC and target company management teams to avoid potential conflicts of interest. Several months later, the SEC made other statements regarding accounting guidance as well as emphasising the target company’s readiness, including meeting the basic listing requirements of the Securities Exchange Act. The government’s actions brought uncertainties, causing a sharp decline in SPAC IPO numbers in Q2 2021 to just 61. Even though the number increased by 46% in Q3 to reach 88 SPAC IPOs, this is still far from the record of the first quarter.

Global Number of SPAC IPOs by Quarter

Source: Euromonitor International

SPAC trends by industry

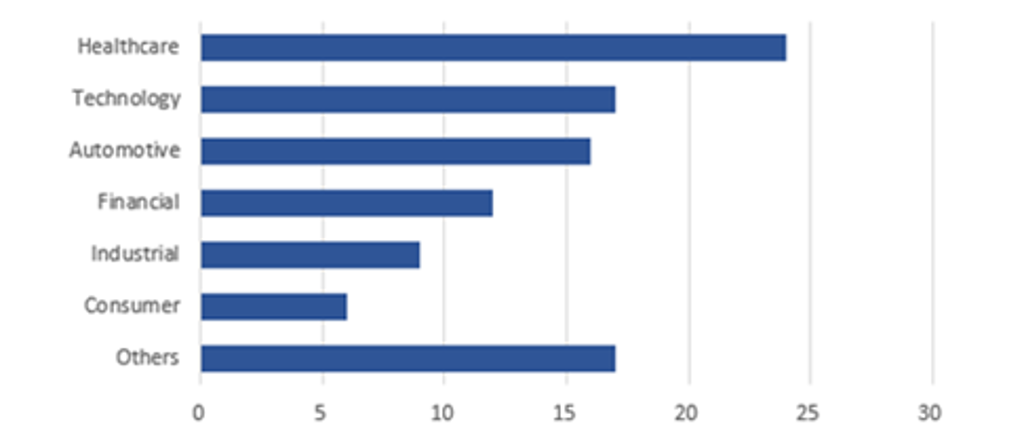

Healthcare, technology and automotive sectors saw the most SPAC merger cases in 2021. Start-ups in these sectors have potential for fast growth, but they might not be profitable yet or are just too young to meet the requirements for traditional IPO. Through SPAC merger, they are able to better market their business with future projections and define a long-term business roadmap to potential investors.

Among healthcare, tech-oriented healthcare businesses and services have attracted the attention of SPAC sponsors (or de-SPAC transactions, which involve the company merger of a SPAC, the buying entity and a target private business). A few examples include the at-home genetic testing company 23andMe, which went public via a merger with Richard Branson, founder of Virgin Group, VG Acquisition Corp. Shecare, a digital health start-up, also completed its merger with a special purpose acquisition company in 2021.

Number of De-SPAC Deals (by Industry) – January to October 2021

Source: Euromonitor International

In terms of technology companies, the Southeast Asian consumer-tech unicorn Grab, took the same road to go public. In December 2021, Grab completed a record USD40 billion merger with Altimeter Growth Corp, which is the biggest SPAC deal globally so far. Other renowned examples include the online real estate buying platform Opendoor and Fintech company SoFi.

For automotive sectors, de-SPAC deals mainly took place in the electronic vehicle (EV) industry, including battery and charging components. Lucid Motors, an American EV manufacturer, merged with a SPAC, Churchill Capital IV Corp. Another electric car company, Polestar, joint venture of Volvo and Chinese car maker Geely, also announced a merger deal with a SPAC in Q3 2021.

Outlook for 2022

Even though increasing governance and surveillance over SPAC activities has dramatically slowed the surge of SPAC IPOs in 2021, it makes SPACs a more mature, promising and better regulated investment instrument for public investors in the long run. In addition, its features of shorter timelines in which to go public, valuation based on projections, and greater pricing certainty, are attractive to many start-ups globally. It is likely that SPACs will stay in the capital market as an alternative for private companies to be listed. In addition, they are becoming increasingly available in regions other than the US. The Singapore Exchange (SGX) introduced a SPAC listing framework in September 2021 allowing for them to be listed on its mainboard. At the same time, the Hong Kong Exchange (HKEX) also published a consultation paper, seeking market opinions on the proposal of a listing regulation for SPACs.

On the other hand, SPAC IPOs are expected to slow down, as is the pace of de-SPAC deals. In the first three quarters of 2021, there were 429 SPAC IPOs and only 93 de-SPAC mergers completed globally. As most SPACs have a 2-year definitive timeframe to complete a merger, there are still over 500 live SPACs actively looking for targets and expecting to complete mergers by 2023. Litigation and regulatory risks present another obstacle in the future of SPACs as reasons for lawsuits include viability of proprietary technology, inadequate financial disclosures, inflated sales figures and supply chain threats.

How can Euromonitor International FIS help?

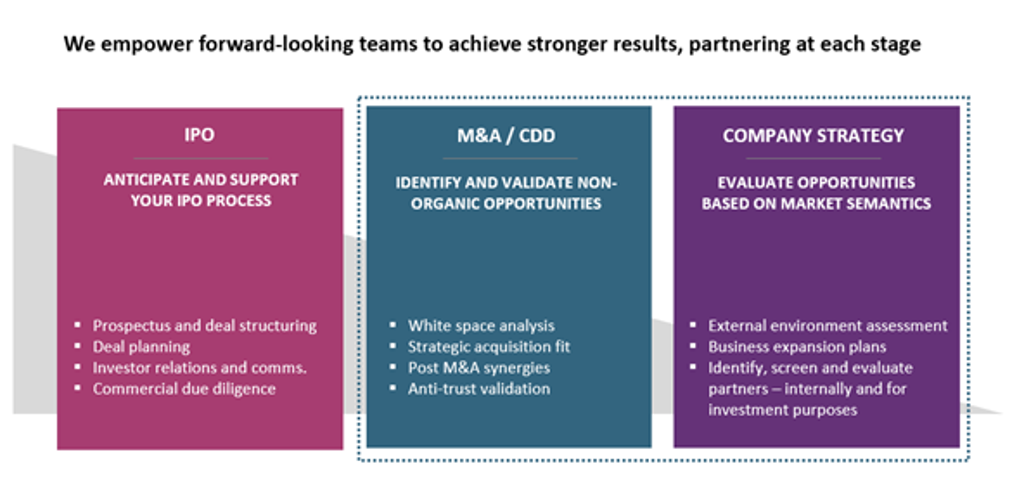

Euromonitor International provides investment-grade research, analysis, and strategies, supporting firms in sourcing, completing and managing transactions and in their relationships with private, public and institutional investors. Our experience includes supporting bank sponsors, lawyers and issuers with SPAC-based IPO transactions.

Contact your local account manager for further details.