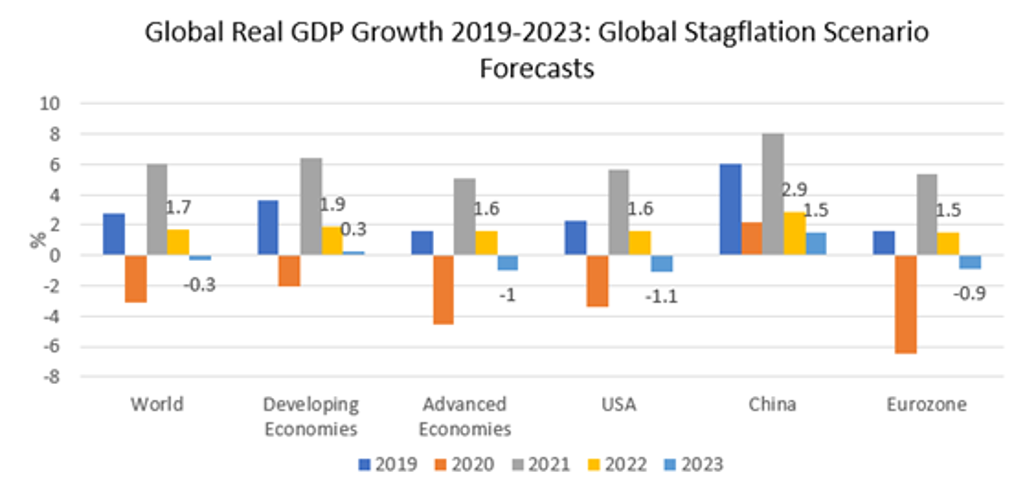

The global economy is expected to see a sharp slowdown in 2022, while the risk of stagflation – a period of economic stagnation and high inflation – looms larger amid high and volatile commodity prices, significant geopolitical tensions and slower growth in China. While the US and the Eurozone economies are facing high stagflation risks, developing and emerging markets could be hit hard if the global economy enters a stagflation era. Euromonitor International’s new Global Stagflation macroeconomic scenario maps out the possible outcome of global stagflation on major economies.

Rising uncertainty, higher energy prices and worsening supply conditions could trigger global stagflation

Euromonitor International’s global stagflation scenario is based on the assumption that worse-than-expected global negative spillovers from the war in Ukraine through uncertainty, confidence and supply constraints lead to stagnant global economic growth combined with high inflation. If cuts in Russian energy exports to advanced economies are stronger and more abrupt, and an energy decoupling from Russia is more difficult than expected, supply constraints will worsen, leading to higher energy price increases. An intensification of the war and geopolitical conflicts would also cause global private sector confidence to decline significantly and financial risk premia increase substantially relative to the baseline forecast.

Under the global stagflation scenario, global real GDP growth would be 0.5-2.0 percentage points below the baseline forecast and fall to 0.7-2.5% in 2022, followed by a figure of between -1.3% and 1.0% in 2023. Global inflation would rise to 7.2-9.4% in 2022 and 5.7-8.3% in 2023. Given its impact on global real GDP growth, global stagflation is now identified as the main downside risk to the global economy, followed by a resurgence of the COVID-19 pandemic. This scenario is assigned a 22-32% probability over a one-year horizon.

Note: (1) Data from 2022 are forecasts; forecasts updated 16 June 2022 (2) Regional real GDP growth using PPP weights

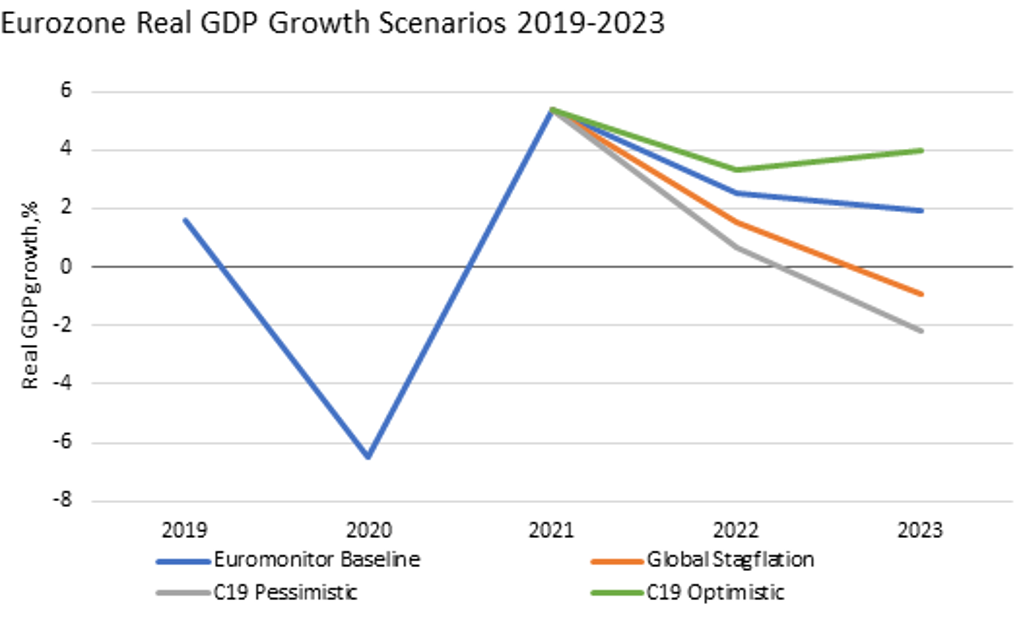

The Eurozone and US threatened by stagflation risk

The Eurozone is highly vulnerable to the negative spillovers from the war in Ukraine, due to its high dependence on Russian energy imports, relatively high exposure to exports to Russia and the greater uncertainty from the risks of the war escalating into a wider European conflict. In 2021, Russia supplied around 40% of Europe’s oil and gas, according to the International Energy Agency. A more abrupt cut-off of Russian energy supplies would force energy rationing in the EU, leading to higher energy price increases and significantly undermining economic activity. In the global stagflation scenario, significantly higher financial risk premia and lower private sector confidence relative to the baseline scenario would reduce Eurozone real GDP growth towards 1.5% in 2022 (1.0 percentage point lower than baseline forecast), followed by an economic contraction of around 0.9% in 2023.

Note: (1) Data from 2022 are forecasts; forecasts updated 16 June 2022 (2) Regional real GDP growth using PPP weights

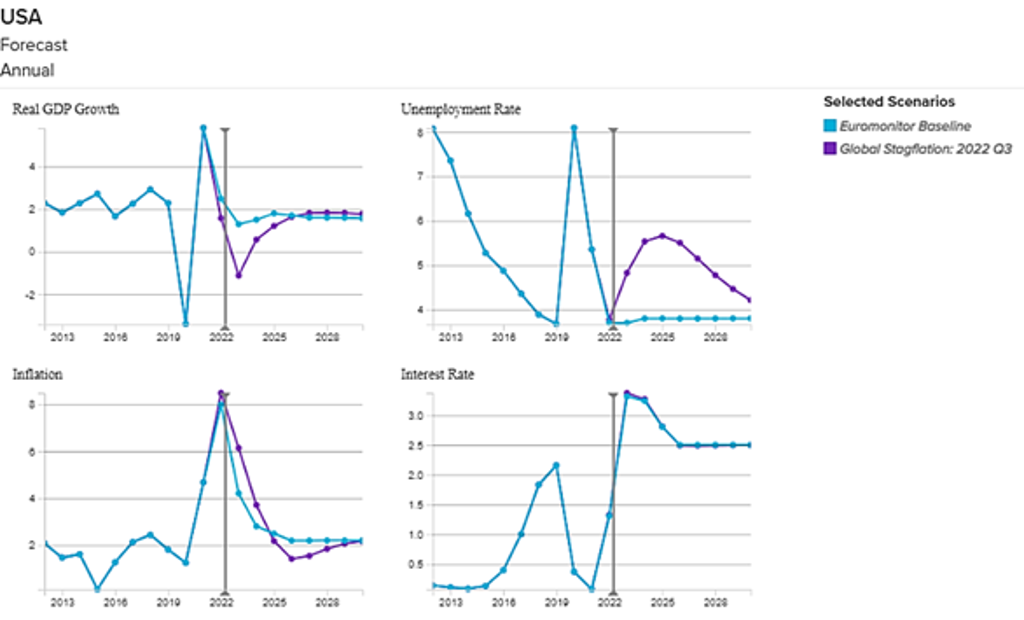

For the US, the risk of stagflation has also increased substantially. Although the US economy continues to be supported by a strong labour market and a large oil and gas sector, lingering supply constraints and negative spillovers from the war in Ukraine continue to send food and energy prices higher, dampening private sector confidence. Growth in US consumer price inflation moderated slightly in April, but rose again in May 2022 to reach 8.6%, the highest level in 40 years. Alongside fading pent-up demand, consumer confidence is declining (US consumer sentiment index in May 2022 was lower than at the beginning of the COVID-19 pandemic). As the US Federal Reserve has speeded up interest rate increases recently, borrowing costs are expected to increase, further constraining consumer spending and business investment.

If uncertainty about the global economic and geopolitical outlook rises and global energy and food supply cuts worsen due to more severe supply chain issues, inflation in the US could accelerate further in 2022-2023 and the economy could experience a contraction in 2023. In the global stagflation scenario, US real GDP growth forecasts could be lower by 1.0 and 2.4 percentage points relative to the baseline forecasts for 2022 and 2023 respectively.

Key Economic Indicators Forecasts USA: Baseline vs Global Stagflation Scenario

Note: Data from 2022 are forecasts

Global stagflation would hit emerging and developing markets hard

Global stagflation could severely affect the growth outlook for emerging and developing countries which are dependent on external demand and supply. A sharp slowdown or recession in the US and the Eurozone would lead to lower demand for exports from China, undermining the country’s economic activities and growth. For commodity-exporting countries like Brazil and Argentina, the impact of weakening global demand and high inflation would more than offset any near-term gain from higher energy and commodities prices. Tightening global financial conditions could have potentially harmful consequences on highly indebted developing and emerging markets across Latin America and Africa. Under the global stagflation scenario, real GDP growth for emerging and developing markets is forecast to fall to 1.9% in 2022 and 0.3% in 2023, compared to 3.1% and 4.0% in the baseline forecasts respectively.

With economic uncertainty on the rise, looking at alternative economic scenarios would help businesses to examine risks and vulnerabilities of economies in order to support critical decision-making. For more analysis on the global economic outlook and stagflation risks, read our full report, Global Economic Forecasts: Q2 2022.