Sustainability and Social Purpose in Hair Care

Sustainability is a long-established trend in hair care, particularly in Asia Pacific and Latin America, where consumer demand for environmentally-friendly and/or ethical hair care products is high, at 18% of consumers in each region in 2020 (Euromonitor International Voice of the Consumer: Beauty Survey, n=6,499 and 2,755, respectively). This is likely due to the impact of the climate crisis on these regions, making these issues particularly close to home.

2020 and 2021 saw a renewed interest in climate change globally, following the Australian bushfires between July 2019 and May 2020, extreme cold weather in Texas in February 2021, and extreme flooding throughout 2021, impacting Germany, amongst many other markets. With heightened social media use during home seclusion, widespread footage of these events, and a drive from activists, eco-anxiety is at an all-time high, with consumer behaviour and priorities changing as a result.

Demand shifts from natural and free-from to cruelty-free and sustainable packaging

Hair care has been a natural beneficiary of the renewed focus on sustainability, after skin care, due to high water consumption both in product production and consumer usage, as well as a previous lack of mainstream format innovation, leading to a category ripe for disruption. Demand for environmentally-friendly and/or ethical features in hair care was below skin care in 2020, at 15.5%, in comparison with 16.2% for skin care, while this was as high as 17.5% for conditioners and treatments (Euromonitor International Voice of the Consumer: Beauty Survey, n=19,385, n=19,104 and n=3,208, respectively).

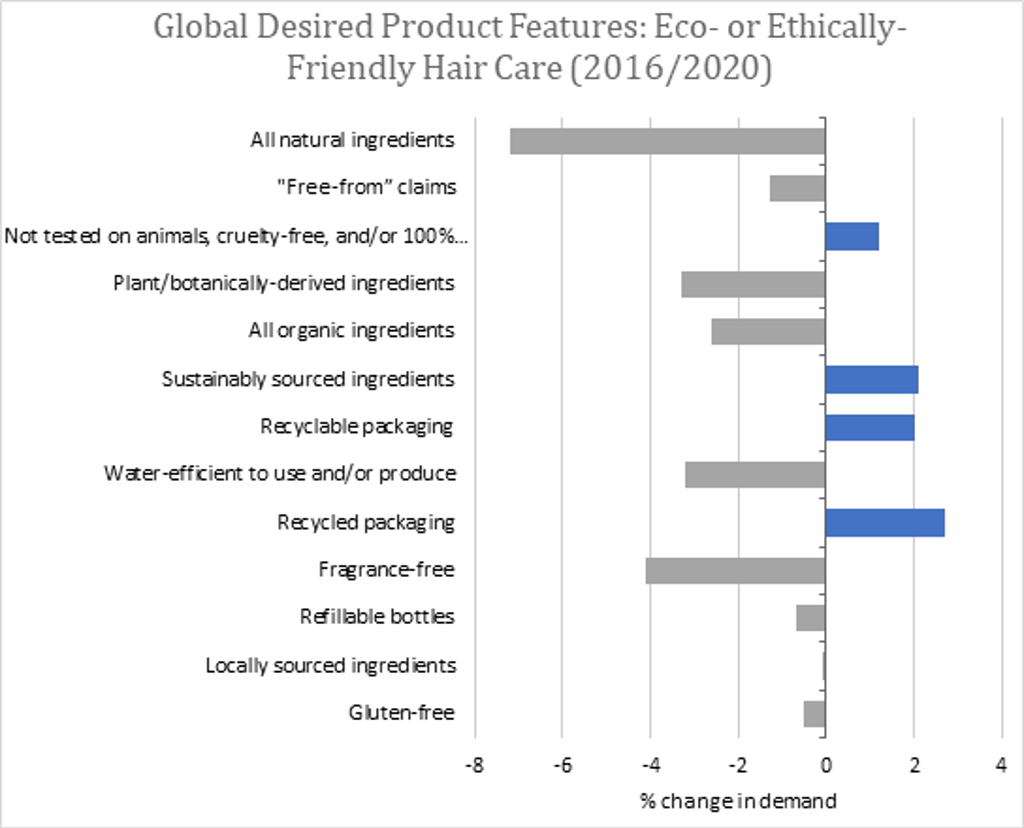

Fielded June to July 2020, n=19,385

While all natural ingredients remains the number one desired eco or ethical feature for hair care in 2020, rising consciousness in hair care is seeing consumers increasingly concerned about animal cruelty, recycled and recyclable packaging and sustainably sourced ingredients. L’Oréal has been well-aligned with this trend, with Pureology reformulated to be 100% vegan in July 2020, while the company is also trialling plastic packaging using captured and recycled carbon emissions, which it hopes will house its shampoos and conditioners from 2024. As water supplies become ever scarcer in the forecast period, water-efficient products are expected to emerge as a priority. Demand for locally supplied ingredients is also projected to rise, as supply chain issues in 2020 and 2021 bring to light the effective mileage and resultant emissions of products purchased.

Brands align with consumer demands through claims, yet fail to cater to sustainable demands in Latin America

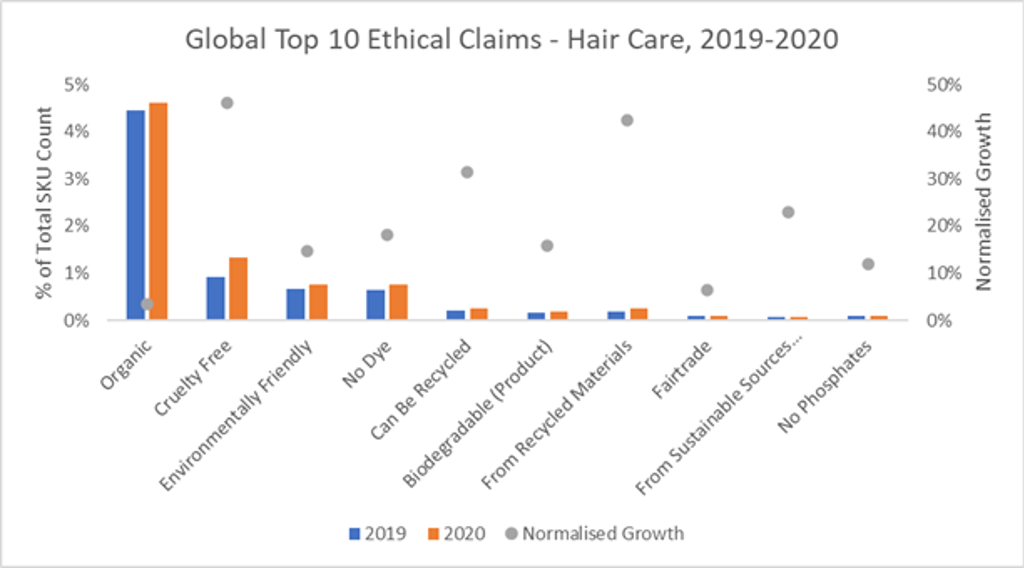

Organic is the top ethical claim in hair care, according to Euromonitor International’s Product Claims and Positioning, with 150,871 SKUs holding this claim in 2020, with a 4.6% share of digital shelf. However, growth in this claim is stagnating in line with consumer demand shifting away from ‘natural’, ‘organic’ and ‘clean’ positionings.

Brand focus is instead shifting towards cruelty-free (which saw normalised growth of share of shelf of 46%), the ability to be recycled, and made from recycled materials (31% and 42% normalised growth, respectively), and for the product itself to be derived from sustainable sources (23% normalised growth), with this aligning with consumer demand.

Western Europe holds the largest number of ethical claims in hair care, followed by Asia Pacific and North America. This highlights the opportunity for brands in Latin America, where consumer demand for ethical hair care is high, at 18%.

Social purpose and greenwashing concerns to lead the future of sustainability in hair care

As consumer consciousness rises, further pressure is being placed on brands to adopt social sustainability offerings, with 2020 and 2021 seeing heightened demand from consumers in this regard.

In hair care, this largely transpired as increased racial consciousness and demand for brands to cater to a wider range of the population through being more inclusive of multicultural and textured hair. Online activists called out retailers such as Walmart and Boots for having black hair care products locked up or available on shelves as ‘display only’, and while Walmart has since rectified this, damage to brand reputation is likely to be sustained. Brands such as Unilever’s Shea Moisture engaged with consumers throughout the Black Lives Matter protests in 2020, hosting virtual events and launching its grant programme for black female beauty founders, with the 2021 programme offering USD150,000 to 12 founders. The success of Shea Moisture in social sustainability highlights the importance of supporting causes that are key to a brand’s identity and that build on already established online communities.

As consumers are becoming sceptical about greenwashing and are increasingly looking for brands that align with a range of conscious values, certification and transparency will be ever more important in verifying the social and sustainable claims made by brands. Brands unwilling to adapt to this social purpose landscape are likely to begin to lose consumer trust in the forecast period.