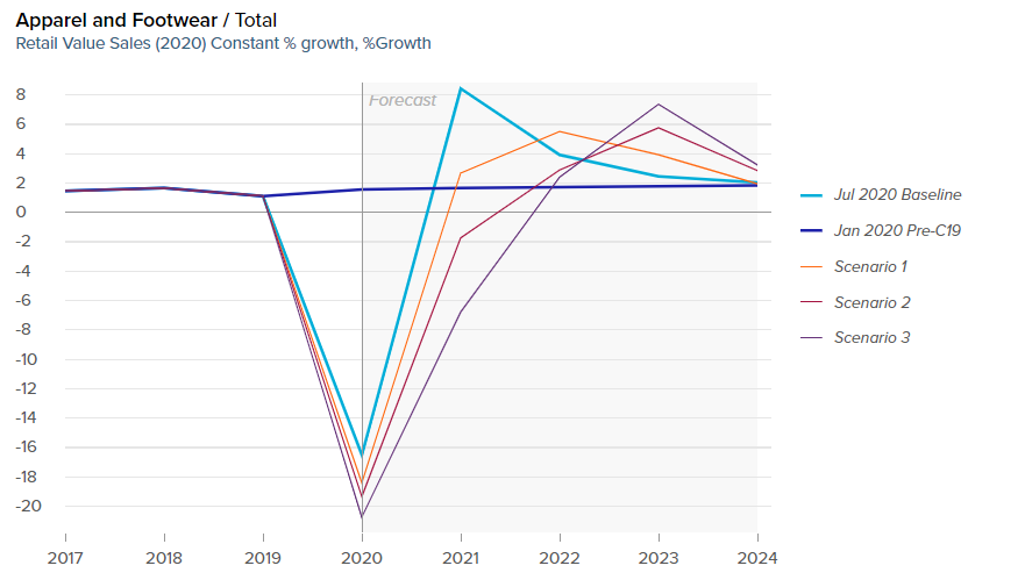

Euromonitor International projects that the global fashion industry will decline by 17% at constant prices in 2020, in contrast to 2% originally forecast prior to the pandemic. An industry already suffering from structural problems, such as the rise in online shopping and high business rates, high street fashion retail has been badly hit by the Coronavirus (COVID-19) crisis, with store closures across fashion. What is occurring in the fashion retail industry is profound and unprecedented.

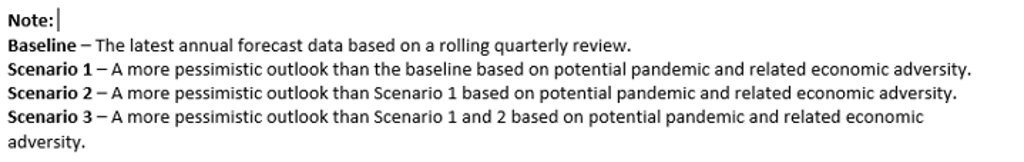

Euromonitor’s Voice of the Industry survey, which was conducted in July 2020 among apparel and personal accessories industry players around the world, reveals that nearly 40% of respondents globally think that there will be a permanent change in the reduction of in-store shopping as a result of COVID-19. However, perhaps most telling is that 81% of industry respondents expect the COVID-19 crisis to provide a permanent boost to e-commerce.

The crisis has provided a real opportunity for companies to rethink strategies in the face of the reopening of retail stores after continued lockdowns. With a second lockdown in place in several Western European markets, including the UK, France and Germany, Euromonitor has identified six strategies for fashion retail players necessary for innovation and success in the current terrain.

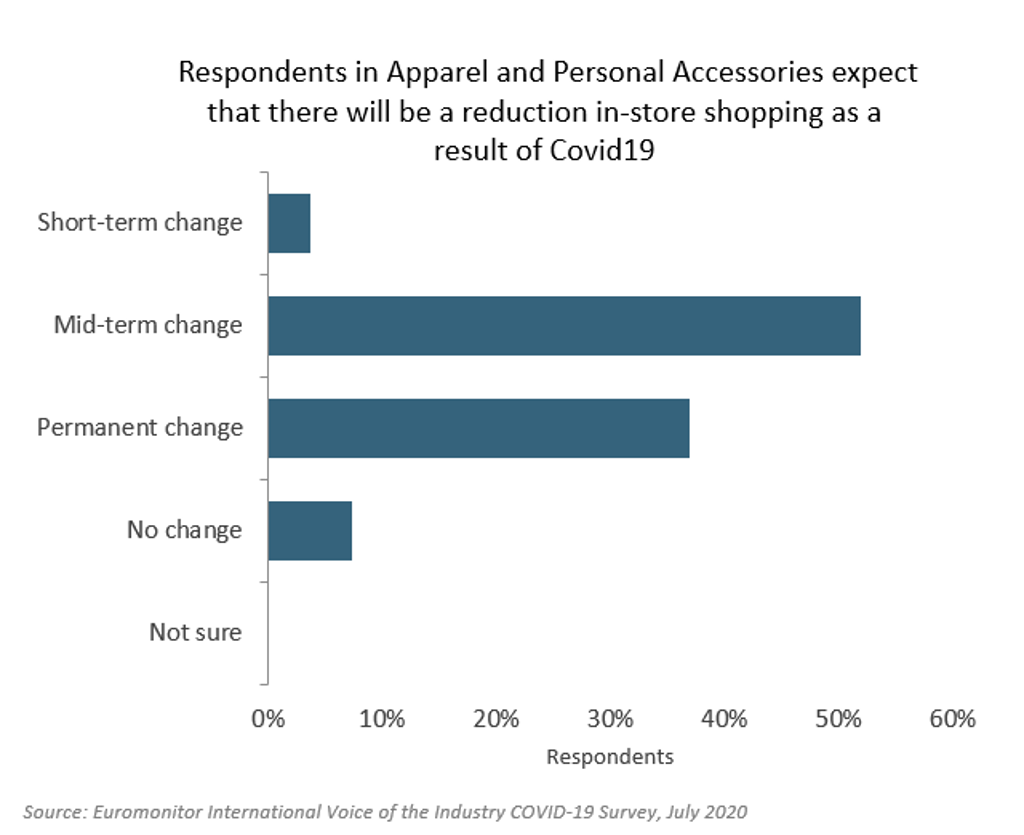

Touch-free technology

Many consumers remain apprehensive at the prospect of shopping in a physical environment, given persistently high infection rates from COVID-19. Euromonitor’s Digital Consumer Survey fielded from March to April 2020, revealed that 35% of respondents prefer the option of scan-as-you-go and walk-in, walk-out technologies, as the top two options that would improve their in-store experience.

Many contactless mechanisms have already been successfully deployed by store-based retailers, with an overall push to minimise stress among consumers with heightened health and safety concerns. In Singapore, sports retailer Decathlon is using a combination of Radio Frequency Identification (RFID), smart tags and mobile payments to enable customers to use self-checkout kiosks at its newest stores without needing to scan the barcodes on the items they have placed in their shopping basket. Japanese retail brand UNIQLO also uses self-checkouts, where customers put in items in self-checkout machines and each machine calculates the total amount.

Engaging the queue

Customers in the queue will likely accept that this is now part of shopping, but there are ways to make waiting more enjoyable. Retailers such as John Lewis in the UK are trialling “virtual queue” technology so customers do not have to wait outside the store. They text to reserve a place and then get a notification when their wait is over. Taking technology further with interactive shop windows, Lone Design Club in London has launched a “shoppable window” where customers can scan and purchase each of the items displayed. Brands can create interactive content to help people pass the waiting time; videos, games, and even virtual tours allowing customers to browse the stores pre-entry.

The pop-up

A rise in store vacancies is leading to a wave in pop-ups post-COVID-19. This will be an opportunity for brands to evolve and experiment. It is a sustainable solution that enables brands to inject a start-up mentality in the retail experience, while also allowing the retailer to connect with a different consumer base. We have already seen signs of activity in Europe, with Primark opening its new Wellness pop-up in London in February 2020, while in Asia, a multinational conglomerate, Landmark Group, has launched a community centre pop-up store initiative in the centres of residential societies in Thailand, taking place over the weekend.

Hybrid events

Increasingly retailers are using their stores to host events highly relevant to their customer base. Hybrid events are hosted from a physical venue but also include an audience online and will be a way to engage with customers who cannot fit in the store or would rather stay home. In 2020, these will need to be adapted to limit crowds and allow for enough space for social distancing. John Lewis launched its first virtual Beauty Festival in May 2020 in the UK and is also hosting virtual fitness events. Partnered with Dior, Elemis and MAC, John Lewis hosted thought-provoking panel talks from leading brands and industry insiders and discussions with celebrities such as English TV presenter Claudia Winkelman. Independent menswear retailer Burrows and Hare in the UK are also trailing combination branding with local businesses.

Diversification in new categories

Diversification will unquestionably be a key strategy for retailers post-COVID-19. Whether they are a small or large fashion player, retailers will look at how they can diversify their product categories as a means to protect against further declining sales. During lockdown, UK independent menswear retailer Hotspur 1364 moved branding from Weddings to Work from Home overnight, driving a 900% uplift in online sales.

Sustainable and green

COVID-19 is accelerating sustainable and green retail concepts as a business strategy. More people, especially younger generations, are worried about the future of the planet. For example, MQ Holdings in Sweden is focusing more on second hand and online retail, post COVID-19. Social commitments could also be a key differentiator as consumers reassess their priorities, shifting from green credentials to an interest in the way companies are treating their staff and suppliers. For example, the Boohoo scandal, where the online retailer was recently embroiled in controversy over allegations that its Leicester factory paid garment workers as little as £3.50 an hour. Some experts argue that such accusations could permanently damage a brand’s reputation.

Shopping for clothes in-store to take on new meaning

COVID-19 has been forcing store retailers to swiftly rethink how they reach their customers. Although health and social distancing will no doubt one day disappear, shopping for clothes in a physical sense will take on a whole new meaning, as consumer apprehension and lingering reluctance to shop in a physical environment remain significant, a result of the pandemic. Once dominated by flagships to attract tourists in key city centres, fashion retail stores are instead soon expected to become the showroom for the brand, and retailers will push forward technology innovations and strategies quicker than ever previously imagined.