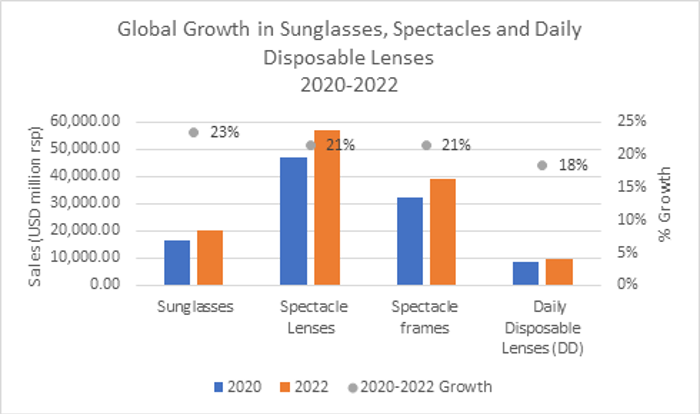

After undergoing a tumultuous period from the impact of COVID-19 in 2020, which resulted in sales plummeting by 14%, the global eyewear industry has been clawing its way back to growth, driven by consumers’ return to travel and socialising, and the inescapable momentum of e-commerce. According to Euromonitor International’s latest research, eyewear globally is set to reach USD142 billion in 2022, a rise of 20% compared with 2020, and is set to post a 5.9% CAGR over 2022-2027, regaining its pre-pandemic level of sales by the end of 2022.

Consumers are ready to travel again

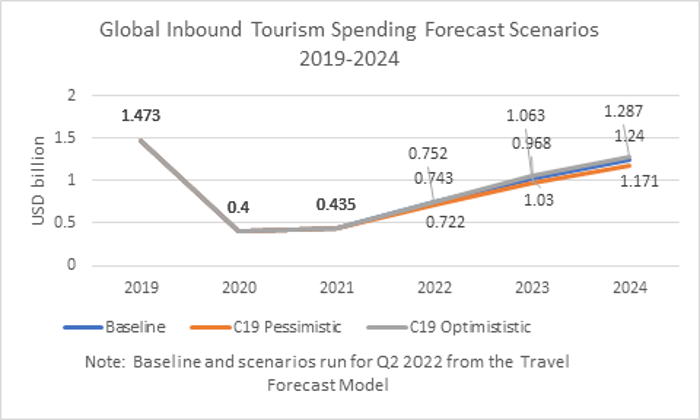

Slowly but surely, destinations around the world are reopening fully following the outbreak of COVID-19, when travel restrictions were in place in countries worldwide. Countries such as the UK, New Zealand, Singapore and several Caribbean and Nordic countries are opening their doors, marking a turning point thanks to mass vaccinations. Despite the uncertainty caused by recent geopolitical events in Europe and the rising cost of living, consumers are therefore starting to travel once again.

The return of tourists is benefiting the eyewear industry, and in particular sunglasses, as consumers are focused less on style and fashion accessories and more on health and wellbeing. Sunglasses was the worst-hit category in eyewear during the COVID-19 pandemic, with global value sales falling 23% to USD16 billion in 2020. Wearing face masks also discouraged consumers from investing in a new pair of sunglasses, because when wearing a mask, glasses tend to get steamed up. However, a return to consumer travel is expected to lead to dynamic growth in 2022, particularly for sales of luxury sunglasses. Sunglasses is set to be the fastest moving category in eyewear in 2022, with global sales reaching USD20 billion, a rise of 23% compared with 2020. Recovery in sunglasses is also linked to the lifting of the obligation to wear face masks.

Consumers are returning to their previous social lives

After a period of health fears, consumers have been quick to return to more normal social lives in 2022, with sports activities, festivals and theatre trips resuming in many countries, such as Italy, the UK and the US. Following the outbreak of the COVID-19 pandemic in 2020, contact lenses and solutions registered a considerable decline in sales (-9%), as consumers’ lifestyles were shaken up by the health crisis. Many switched to spectacles during lockdowns, as they were more comfortable, and were also considered more hygienic in terms of avoiding contracting COVID-19. However, sales of contact lenses have started to make a comeback in 2022, set to report single-digit growth, as consumers’ social lives are resuming, with many therefore turning back to contact lenses once again.

Daily habits have been impacted by hybrid working

However, one threat to contact lenses is new hybrid working patterns. Working in the office has taken on a whole new meaning in 2022. After a year of working from home as a result of the pandemic, the hybrid working model came into full play by the end of 2021. According to Euromonitor’s COVID-19 Voice of the Industry survey, almost 70% of businesses surveyed globally in April 2021 said that their company will expand remote working, with North America and Western Europe the regions with the highest number of people expected to be expanding home working to prevent similar risks in the future. The trend towards a more hybrid working pattern will result in more consumers buying daily disposable contact lenses, thanks to their greater convenience for wearers of contact lenses than frequent replacement and conventional lenses.

However, with disposable incomes under pressure from rising inflation, many consumers may not be able to pay the premium for daily disposable lenses, and as a result they may return to frequent replacement lenses if they do not want to wear spectacles.

Fluctuating comfort levels challenge re-entry

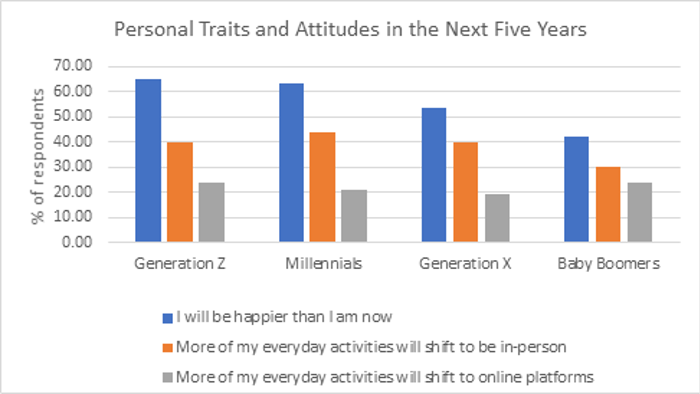

Another threat to the recovery of global eyewear sales is the so-called ‘Socialisation Paradox’, whereby consumers are returning to their usual routines in many different ways. While some consumers were restless during the pandemic and are ready to participate in society once again, others have acclimatised to life in lockdown, and continue to make purchases from home. This is confusing and difficult for businesses, which need to cater to everyone’s needs.

The answer from the eyewear industry has been to offer consumers multiple ways in which to order spectacle frames, sunglasses and contact lenses, to ensure their comfort and safety. E-commerce, historically undeveloped in eyewear, became more relevant and continued to gain share, rising from a 9% share of sales in 2019 to 13% in 2021, as consumers of all ages began shopping online more than ever before. Eyewear players have shown resilience, offering digital solutions to compensate for the loss of physical visits to optical goods stores. One example is UK eyewear brand Cubitts, which partnered with HERU technology for its 3D scan face app, that allows nervous consumers to try on glasses from the comfort of their own home.

Future growth

As the world becomes steadily acclimatised to the virus, consumers are now craving a return to their pre-pandemic lives once again. With international travel set to rebound as countries reopen their borders, and as consumers return to their previous social lives, the severity of the impact of the virus on eyewear categories such as sunglasses and contact lenses is expected to loosen its grip. While hybrid working threatens growth in contact lenses as a whole, in categories such as daily disposables sales will profit. Going forward, the rapid evolution of e-commerce in eyewear will facilitate new growth opportunities.

For further insight, read our report, Where Consumers Shop for Eyewear.